- United States

- /

- Food

- /

- NasdaqGS:MDLZ

Mondelez International (MDLZ): Valuation Perspectives as Cocoa Costs Climb and Analyst Outlooks Shift

Reviewed by Simply Wall St

Mondelez International (MDLZ) is navigating a period of uncertainty as cocoa prices rise sharply, driven by tough crop conditions in West Africa. This has led the company to diversify its supply chain and adjust its strategy.

See our latest analysis for Mondelez International.

The past year has been challenging for Mondelez International, with its share price slipping 4.99% year-to-date and the total shareholder return over twelve months down 10.23%. Short-term optimism seems limited, as the 30-day share price return was -6.98% despite some recovery this past week. Momentum has clearly cooled, reflecting heightened risk and investor caution as cocoa prices bite into margins. However, the five-year total return of 9.25% shows Mondelez still has some resilient long-term appeal.

If you’re considering how other consumer-facing companies are weathering similar headwinds, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With analyst targets still predicting upside and short interest on the rise, the question remains: Is Mondelez trading at a bargain in light of recent challenges, or is the market fully pricing in future growth prospects?

Most Popular Narrative: 18.1% Undervalued

The most followed narrative sees Mondelez International’s fair value well above the latest close of $56.53, pointing to potential upside if margin improvements materialize. The argument rests on cost efficiency and market share growth, even as current results weigh on sentiment.

“Mondelez is using a new AI tool developed with Accenture to reduce marketing content production costs by 30 to 50 percent. The company aims to launch AI-generated TV ads for the next holiday season.”

Want to know the quantitative levers behind this valuation? There is a surprisingly ambitious margin expansion forecast, along with an upgrade to profit multiples, driving this fair value. What do analysts see in Mondelez that the market might be missing? Dive into the full narrative to uncover the projections shaping this outlook.

Result: Fair Value of $69.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent consumer demand weakness and ongoing elevated cocoa costs could present real challenges to the bullish outlook for Mondelez in the near term.

Find out about the key risks to this Mondelez International narrative.

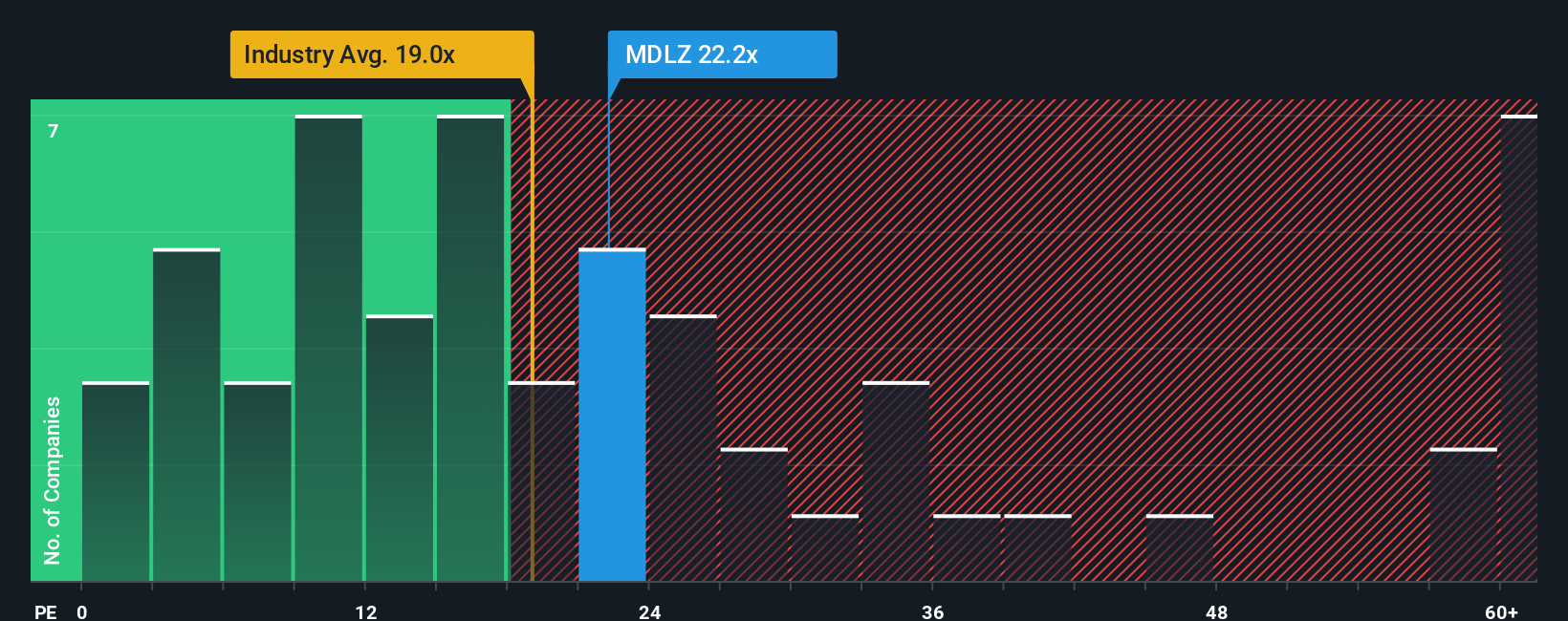

Another View: Market Multiples Tell a Cautious Story

When considering where Mondelez International trades relative to its peers, its price-to-earnings ratio of 20.7x is nearly identical to the peer and US Food industry averages. However, this sits below its fair ratio of 22.1x, which hints there might be a modest opportunity. Yet, with little separation from the pack, are investors pricing in more risk than reward?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mondelez International Narrative

If you have your own perspective or want to dig into the numbers firsthand, you can easily craft a personalized narrative using the available tools in just a few minutes. Do it your way

A great starting point for your Mondelez International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't miss a chance to spot the next big winner. Simply Wall Street’s Screener opens the door to fresh opportunities designed for forward-thinking investors like you.

- Tap into steady income streams by finding high-yield stocks with solid fundamentals in these 14 dividend stocks with yields > 3%. These stocks consistently reward shareholders with strong dividends.

- Stay ahead of market trends by accessing these 26 AI penny stocks, where innovative companies in artificial intelligence are transforming industries and redefining what’s possible.

- Unlock hidden value and seek out stocks trading below their fair price using these 933 undervalued stocks based on cash flows. This tool is tailored for those hunting for compelling bargains with upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MDLZ

Mondelez International

Through its subsidiaries, manufactures, markets, and sells snack food and beverage products in the Latin America, North America, Asia, the Middle East, Africa, and Europe.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success