- United States

- /

- Food

- /

- NasdaqGS:KHC

Kraft Heinz (KHC) Valuation: Is There Hidden Value After Recent Share Price Declines?

Reviewed by Simply Wall St

Kraft Heinz (KHC) stock has drawn investor attention recently as its share price continued to decline. The stock dropped 1% for the day and is down 4% over the past month. The company’s performance has prompted closer scrutiny of its latest financials and market positioning.

See our latest analysis for Kraft Heinz.

Kraft Heinz has seen its share price lose momentum this year, with a 1-day share price return of -1.45% and a year-to-date decline of more than 20%. On a longer timeline, the 1-year total shareholder return sits at -16.72%, reflecting both recent challenges and a cautious investor outlook despite some positive earnings momentum in the last year. The trend points to fading momentum as investors weigh growth prospects against renewed market risks.

If you’re curious about what else is moving in the market, now is a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares trading nearly 11% below analyst targets and at a sizable discount to intrinsic value, the key question for investors is whether Kraft Heinz represents a clear value opportunity or if today's price fully reflects the company's future growth prospects.

Most Popular Narrative: 9.7% Undervalued

With Kraft Heinz’s most-followed narrative assigning a fair value above the current share price, the company is priced at a notable discount. This sets the stage for analysis that focuses on long-term brand moves and evolving global dynamics, which may prompt a re-rating if catalysts materialize.

Sustained investment in emerging markets, where both volume and margins are expanding at a double-digit rate, positions Kraft Heinz to capitalize on the rapid rise of the global middle class and urbanization, driving top line revenue growth and long-term earnings potential.

What’s driving this opportunity? The narrative leans on ambitious underlying growth assumptions, including a profitability turnaround and a future profit multiple that is currently out of reach for many competitors. Curious about the surprises shaping this valuation? The full story reveals the quantitative leap behind this forecast.

Result: Fair Value of $27.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent volume declines in core markets and the risk of continued weak sales trends could quickly challenge even the most optimistic outlook for Kraft Heinz.

Find out about the key risks to this Kraft Heinz narrative.

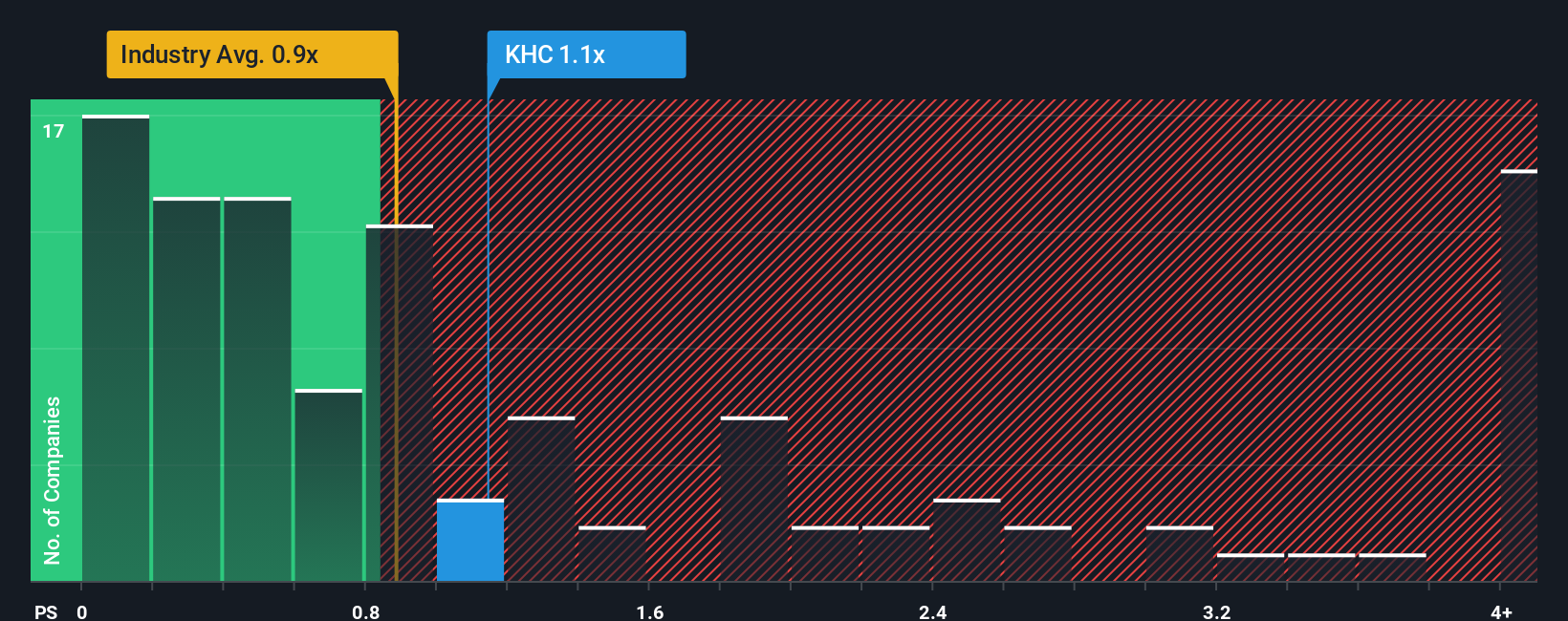

Another View: Multiples Suggest a Mixed Story

Looking at price-to-sales ratios gives a different angle. Kraft Heinz trades at 1.2x sales, which is more expensive than the industry's 0.8x average but cheaper than peers at 1.8x. Interestingly, the fair ratio is 1.4x, showing the market is not in agreement. Does this signal added risk or hidden value?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kraft Heinz Narrative

If you prefer your own perspective or want to dig into the numbers firsthand, you can put together a personal narrative in just a few minutes, Do it your way

A great starting point for your Kraft Heinz research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always cast a wider net. Broaden your opportunities and stay ahead of emerging trends by tapping into curated stock ideas you may have overlooked.

- Supercharge your portfolio with higher yields by jumping into these 18 dividend stocks with yields > 3%, which offers robust returns well above 3%.

- Capitalize on the AI revolution and get ahead of the curve by targeting innovation leaders through these 27 AI penny stocks.

- Catch undervalued potential early and position yourself for outsized gains by zeroing in on these 892 undervalued stocks based on cash flows based on real cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kraft Heinz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KHC

Kraft Heinz

Manufactures and markets food and beverage products in North America and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives