- United States

- /

- Food

- /

- NasdaqGS:KHC

Is Kraft Heinz Stock Attractive After Falling 21.5% and Announcing Product Revamp?

Reviewed by Bailey Pemberton

- Ever wondered if Kraft Heinz’s beaten-down stock is finally selling for less than it’s really worth? There is a lot more to the story than meets the eye.

- Shares have drifted down by 21.5% so far this year and are off 23.7% over the last 12 months. It is fair to say this is not a stock everyone loves right now.

- News that Kraft Heinz is revamping its product lines and doubling efforts to grow international sales has gotten investors talking, even as the stock price remains under pressure. Broader market uncertainty and shifting trends in consumer staples have played a role in recent volatility.

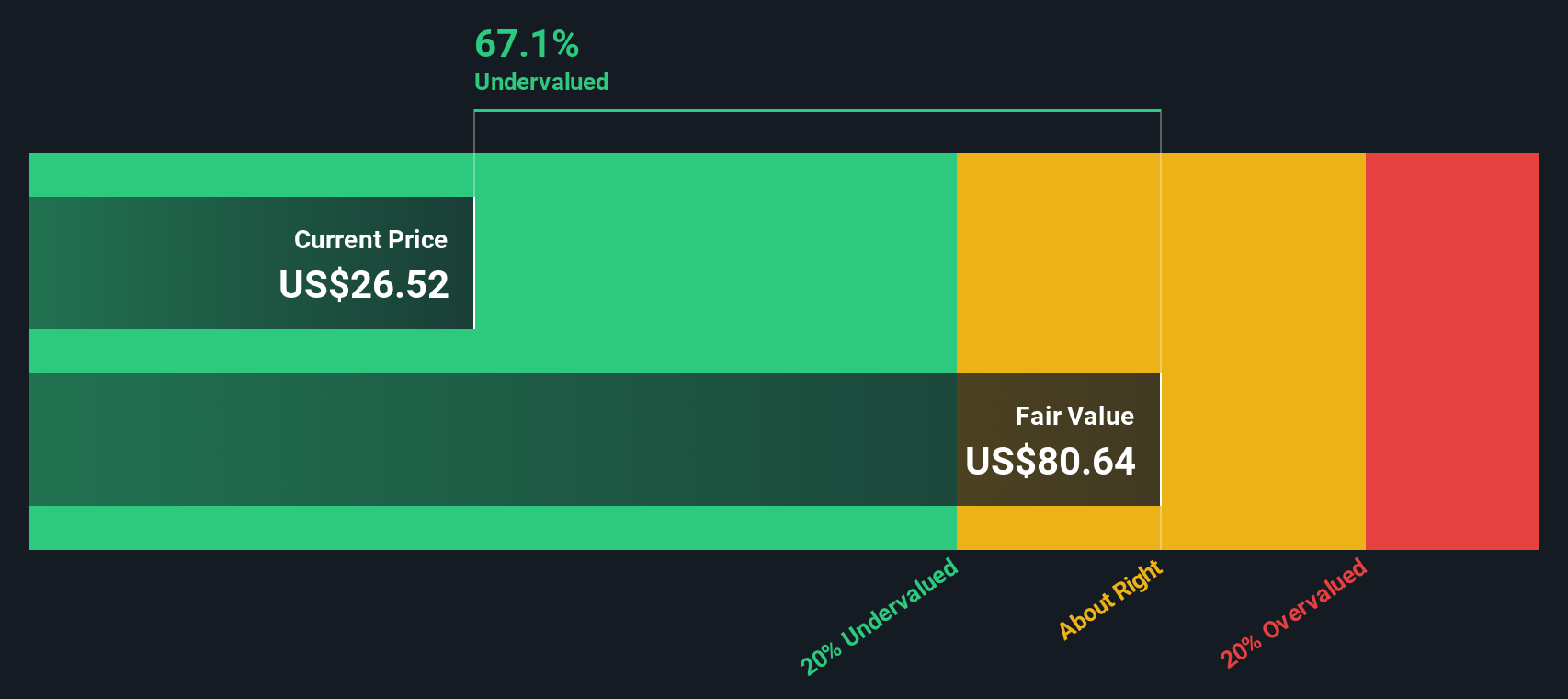

- The company currently gets a valuation score of 4 out of 6, meaning it looks undervalued on several checks but not all. We will break down what those checks mean and explore the traditional approaches, but stick around for a fresh perspective on finding true value you might not have considered yet.

Find out why Kraft Heinz's -23.7% return over the last year is lagging behind its peers.

Approach 1: Kraft Heinz Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true value by forecasting its future cash flows and then discounting those projections back to today’s dollars. This approach helps investors gauge what a business is actually worth based on expected performance rather than just market sentiment.

Kraft Heinz’s most recent Free Cash Flow stands at approximately $3.54 billion. Analyst forecasts expect annual free cash flows to fluctuate but generally remain steady over the next several years, with projections reaching $3.95 billion in ten years. Projections beyond 2028 are extrapolated based on analyst trends and typical industry growth rates.

Utilizing a two-stage Free Cash Flow to Equity model, the DCF analysis currently puts Kraft Heinz’s intrinsic value at $69.23 per share. This represents 65.1% above the present market price and signals a significant potential undervaluation.

Compared to its stock price, Kraft Heinz appears much cheaper than what this DCF analysis suggests the business is really worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kraft Heinz is undervalued by 65.1%. Track this in your watchlist or portfolio, or discover 849 more undervalued stocks based on cash flows.

Approach 2: Kraft Heinz Price vs Sales

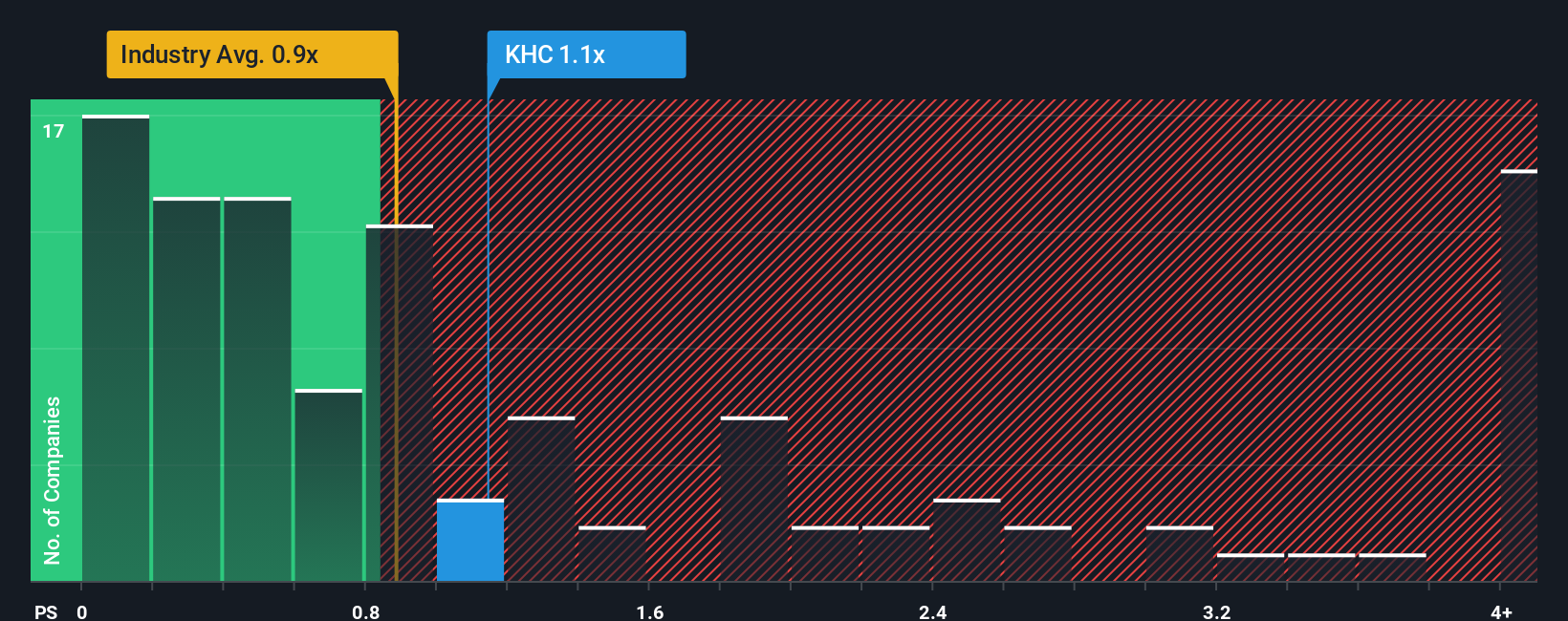

The Price-to-Sales (P/S) ratio is a commonly used metric to value companies in the food industry, especially when profitability may be inconsistent or negative. For established businesses like Kraft Heinz, the P/S ratio cuts through short-term earnings noise and focuses on what investors are willing to pay for each dollar of revenue. This makes it a particularly suitable measure when evaluating steady, mature companies where sales are relatively stable and industry margins are well understood.

Typically, growth expectations and company-specific risks can have a big influence on what is considered a “normal” or fair P/S ratio. Fast-growing firms or those with higher profit margins tend to command a higher P/S, while companies facing uncertainty or slowdowns might trade below the industry average.

Currently, Kraft Heinz trades at a P/S of 1.14x. That is higher than the industry average of 0.87x, but well below the peer average of 1.73x. To provide a more tailored view, Simply Wall St’s proprietary Fair Ratio is a calculation blending Kraft Heinz’s expected growth, profit margin, market cap, industry sector, and company-specific risks. This indicates a fair P/S of 1.36x.

The Fair Ratio delivers greater insight than simply comparing against industry or peers because it adjusts for Kraft Heinz’s particular strengths and challenges. It accounts for nuances like its size, profit profile, and growth outlook, delivering a more realistic benchmark for fair value.

With the Fair Ratio at 1.36x and the actual P/S at 1.14x, Kraft Heinz appears undervalued by this measure, as its stock trades below what would be considered fair based on its fundamentals.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kraft Heinz Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, powerful tool that lets you bring your own story, expectations, and convictions about a company into the investing process. By combining your fair value assumption and future estimates for revenue, earnings, and margins, you create your own explanation behind the numbers.

Narratives work by linking a company’s “story,” the factors you think will shape its future, to a financial forecast, and then to a calculated fair value. On Simply Wall St’s platform, these Narratives are easy to write and update, and can be found in the Community page where millions of investors share and compare their outlooks.

What makes Narratives such a game changer is how they empower you to turn news, earnings, or new information into a quick update to your outlook. This helps you decide whether it is time to buy or sell by comparing updated Fair Value with the current Price.

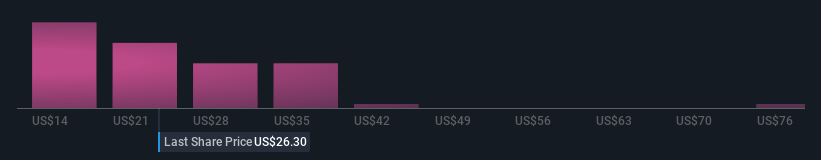

For example, one investor might see Kraft Heinz’s expansion in emerging markets and brand investments as evidence for a $51 fair value. Another investor, worried about weak core market performance and ongoing margin challenges, sees fair value closer to $27. Both are Narratives, and you get to choose (and refine) your own.

Do you think there's more to the story for Kraft Heinz? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kraft Heinz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KHC

Kraft Heinz

Manufactures and markets food and beverage products in North America and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives