- United States

- /

- Food

- /

- NasdaqGS:JJSF

J&J Snack Foods (JJSF): Revisiting Valuation After Net Income Drop and Impairment Charge

Reviewed by Simply Wall St

J&J Snack Foods (JJSF) recently reported both quarterly and annual declines in net income, along with a drop in sales for the fourth quarter compared to the previous year. An intangible asset impairment highlights some of the operational challenges faced.

See our latest analysis for J&J Snack Foods.

The past year has been a tough ride for J&J Snack Foods, with recent quarterly declines and an impairment charge adding to investor caution. The share price return year-to-date stands at -40.76%, and its 1-year total shareholder return is -45.88%. This suggests sentiment has soured as operating challenges piled up. While the company just affirmed its dividend and adjusted corporate bylaws, the broader stock momentum remains on the back foot. Long-term returns have also lagged, prompting fresh questions about growth prospects versus current valuation.

If you’re keeping an eye out for better market movers, this might be the perfect opportunity to broaden your search and discover fast growing stocks with high insider ownership.

With shares sitting at a steep discount to analyst targets and a sharp year-to-date decline, it begs the question: Is J&J Snack Foods actually undervalued at current levels, or is the market already accounting for any rebound in growth?

Most Popular Narrative: 27.1% Undervalued

J&J Snack Foods is valued by the most widely followed narrative at $125 per share, substantially above its last close of $91.11. This points to a sizable gap to fair value that the market may be missing. The following perspective provides a window into the drivers behind this bullish narrative.

Operational improvements through supply chain optimization, automation, and facility consolidation (for example, shifting handhelds production to a more efficient plant and reducing distribution/freight costs) are expected to drive higher net margins and earnings over time.

Want to know which projections make this price target stand out? The secret sauce in this narrative is a future profit margin expansion and bold revenue assumptions that go far beyond mere market recovery. Think superior operational leverage and growth forecasts typically reserved for rising stars. See what’s fueling analysts’ conviction and how the numbers stack up.

Result: Fair Value of $125 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing ingredient cost inflation and underperformance in key retail segments could quickly dampen the optimistic outlook for J&J Snack Foods.

Find out about the key risks to this J&J Snack Foods narrative.

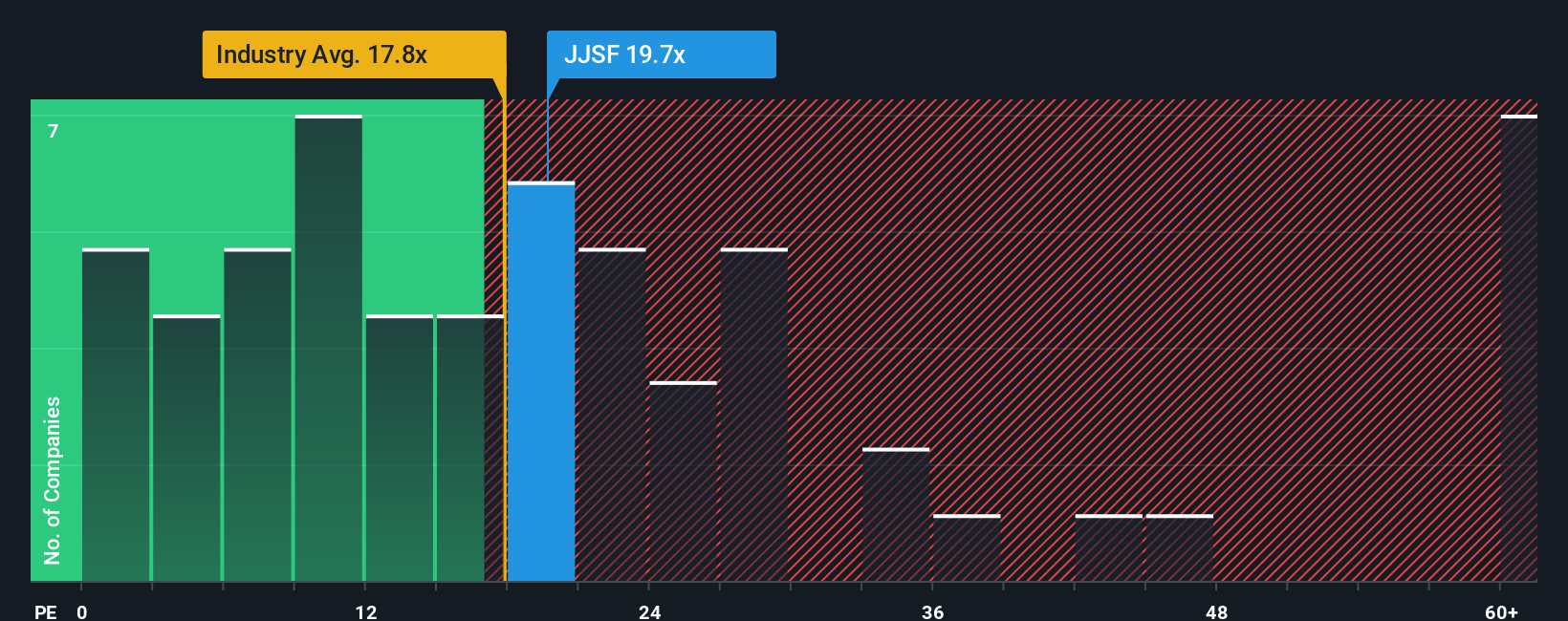

Another View: Multiples Tell a Different Story

Looking at valuation through the lens of earnings, J&J Snack Foods appears pricey at 27 times current earnings, compared to just 19 times for the broader US Food industry and 12.4 for its direct peers. Even the fair ratio for JJSF works out to 15.3, which is far below where shares trade. This sharp gap suggests the stock’s current price reflects high expectations, raising the risk if future growth falls short. Does the market really expect JJSF to perform like a premium outlier?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own J&J Snack Foods Narrative

If you see the story differently or would rather base your view on your own analysis, you can quickly craft your own perspective in under three minutes. Do it your way.

A great starting point for your J&J Snack Foods research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Miss out on these unique opportunities and you could pass up some of tomorrow’s biggest winners. Make your next move count with these hand-picked stock ideas:

- Capture the upside of emerging technologies by exploring these 26 AI penny stocks identified by our algorithm for their advances in artificial intelligence.

- Lock in steady income potential by screening for high-yield opportunities with these 14 dividend stocks with yields > 3%, designed for those seeking reliable dividends above 3%.

- Tap into tomorrow’s undervalued growth stories right now by reviewing these 924 undervalued stocks based on cash flows selections based on solid cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JJSF

J&J Snack Foods

Manufactures, markets, and distributes nutritional snack food and beverages to the food service and retail supermarket industries in the United States, Mexico, and Canada.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success