- United States

- /

- Beverage

- /

- NasdaqGS:FIZZ

A Look at National Beverage (FIZZ) Valuation Following Buyback Decision and Shifting Industry Headwinds

Reviewed by Simply Wall St

National Beverage (FIZZ) has just launched a stock buyback, making a clear statement about how management views the company’s value. Despite recent challenges in the beverage industry, this move highlights their strategic focus.

See our latest analysis for National Beverage.

That buyback news comes after a tough stretch for National Beverage. While share price momentum has faded, its year-to-date share price return is down 21.5% and the one-year total shareholder return sits at -30.2%. The company’s leadership seems ready to bet on a turnaround with this strategic move.

If you’re interested in discovering more market movers beyond the beverage aisle, now’s a smart time to check out fast growing stocks with high insider ownership.

With shares trading notably below analyst targets and management signaling confidence through buybacks, investors may wonder if the market has overlooked National Beverage’s potential or if the current price is already factoring in future growth.

Price-to-Earnings of 16.8x: Is it justified?

National Beverage currently trades at a price-to-earnings (P/E) ratio of 16.8x, which is notably lower than many of its peers and industry rivals, given the company's last close at $33.28.

The P/E ratio is a standard tool for gauging how much investors are willing to pay for a company's earnings. In the beverage sector, this multiple often reflects expectations for steady profits and market share, given the relatively resilient demand for consumer staples like drinks.

A P/E of 16.8x puts National Beverage at a significant value position when measured against two benchmarks. First, its P/E is well below the peer average of 56.4x, suggesting the market may be cautious or underestimating its earnings potential. Second, National Beverage also trades below the global beverage industry average P/E of 17.6x, reinforcing the notion it is undervalued even in a sluggish sector.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 16.8x (UNDERVALUED)

However, slow annual revenue growth and a sharp multi-year stock decline could challenge hopes for a quick turnaround in National Beverage’s market perception.

Find out about the key risks to this National Beverage narrative.

Another View: Discounted Cash Flow Perspective

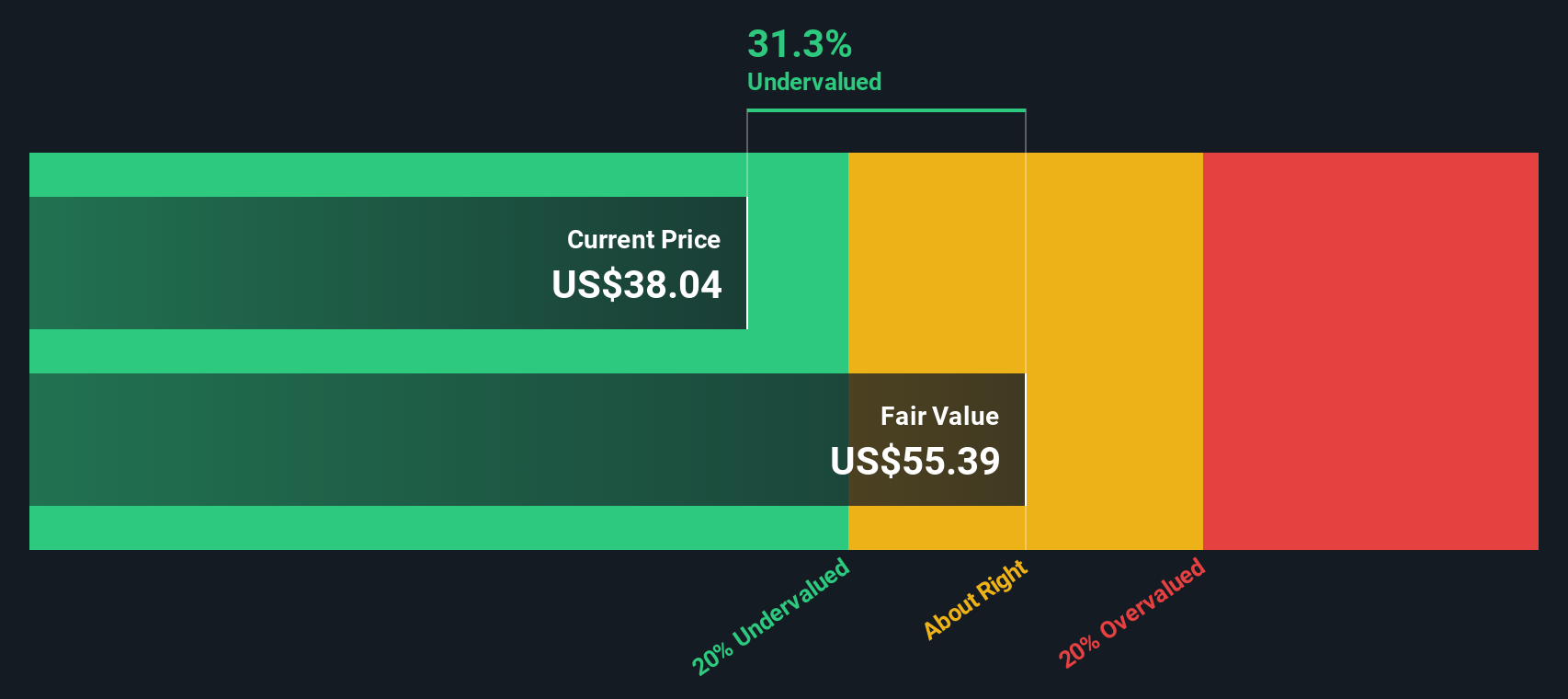

Looking at National Beverage through our DCF model offers a different angle. The SWS DCF model estimates the company's fair value at $55.39, which is about 40% above its current price. This suggests the shares may be significantly undervalued by the market at present. The question remains whether this model is capturing risks the market sees, or if the market is missing an opportunity.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out National Beverage for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 842 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own National Beverage Narrative

If you prefer to dig into the numbers yourself and shape your own view, it only takes a few minutes to create a custom narrative. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding National Beverage.

Looking for more investment ideas?

Smart investors know the market is always moving. Don’t wait on the sidelines while forward-thinkers get ahead. Simply Wall Street’s Screener opens doors to opportunity right now.

- Tap into robust cash flows and future potential by reviewing these 842 undervalued stocks based on cash flows primed for long-term value growth.

- Accelerate your portfolio’s income with these 18 dividend stocks with yields > 3% delivering yields above 3% for steady returns.

- Uncover the pioneers driving tomorrow’s technology by targeting these 26 AI penny stocks that stand at the forefront of artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Beverage might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FIZZ

National Beverage

Through its subsidiaries, develops, produces, markets, and sells a portfolio of sparkling waters, juices, energy drinks, and carbonated soft drinks in the United States and Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives