- United States

- /

- Food

- /

- NasdaqGS:CPB

Is Campbell Soup a Bargain After Shares Drop Over 30% in the Past Year?

Reviewed by Bailey Pemberton

Thinking about Campbell's stock and not quite sure whether to hold tight, jump in, or move on? You’re definitely not alone. Plenty of investors find themselves weighing what the future looks like for this classic food company, and the stock's latest moves have only added more intrigue to the mix. In the past year, Campbell's shares slipped by 30.9%. Looking even further back, the five-year tally puts the drop at 23.3%. Shorter-term performance hasn’t offered much relief either, with the share price down 0.4% over the last week and 3.6% in the last month. While that kind of decline would normally ring alarm bells about increased risk, it could also hint at a potential opportunity if the market has been overly pessimistic.

What’s behind these moves? Much of the recent news has centered on shifting consumer tastes, supply chain adjustments, and industry consolidation which has put traditional packaged food makers under the microscope. While Campbell’s is not immune to these pressures, stability and brand recognition are still strong features in their favor. The company’s most recent valuation score stands at 4 out of 6, meaning it is undervalued in four of the six key checks analysts use to assess whether a stock is priced right.

So, what does this really mean for investors? That’s what we will explore in the next sections, starting with a closer look at the different valuation approaches and concluding with a smarter, more holistic way to figure out what Campbell's stock is truly worth today.

Why Campbell's is lagging behind its peers

Approach 1: Campbell's Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by projecting Campbell's future cash flows and calculating what those cash flows are worth in today's dollars. This method helps estimate the company's intrinsic value based on its potential to generate cash over time.

Currently, Campbell's reports free cash flow of $670.7 Million. Analyst forecasts for the next several years suggest steady growth, projecting free cash flow of $779 Million by 2028. For years beyond analyst estimates, further projections continue upward, with Simply Wall St extrapolating these trends through 2035. All these cash flows are expressed in US dollars.

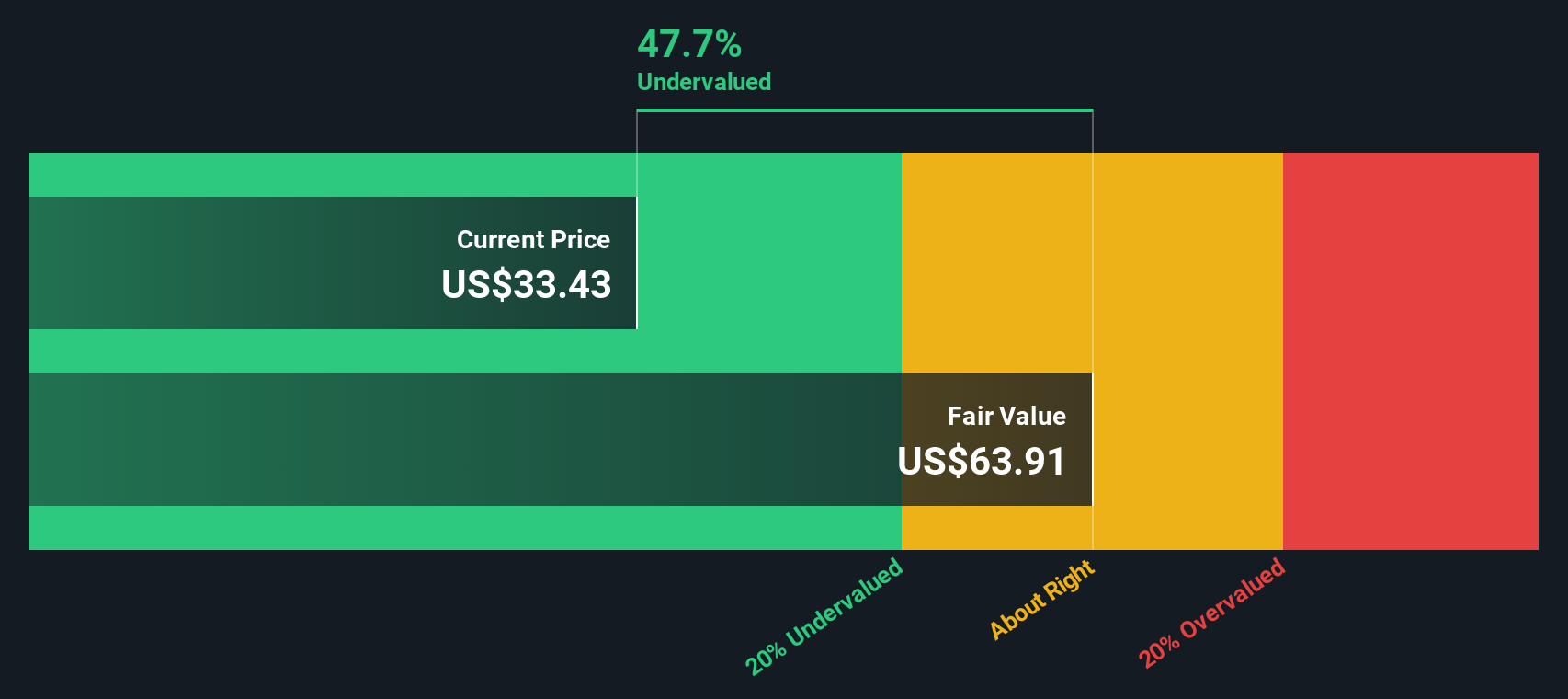

After discounting these future cash flows back to today, the DCF model estimates Campbell's fair value at $63.97 per share. Given that the stock is trading at a price reflecting a 51.6% discount to this intrinsic value, the analysis suggests the market may have been overly pessimistic about Campbell's prospects.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Campbell's is undervalued by 51.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Campbell's Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Campbell's because it connects a company's earnings performance directly with its share price. This provides a quick snapshot of how much investors are willing to pay for each dollar of profit. Generally, higher growth expectations justify a higher PE ratio, while increased risk or slower growth puts downward pressure on what is considered a fair multiple.

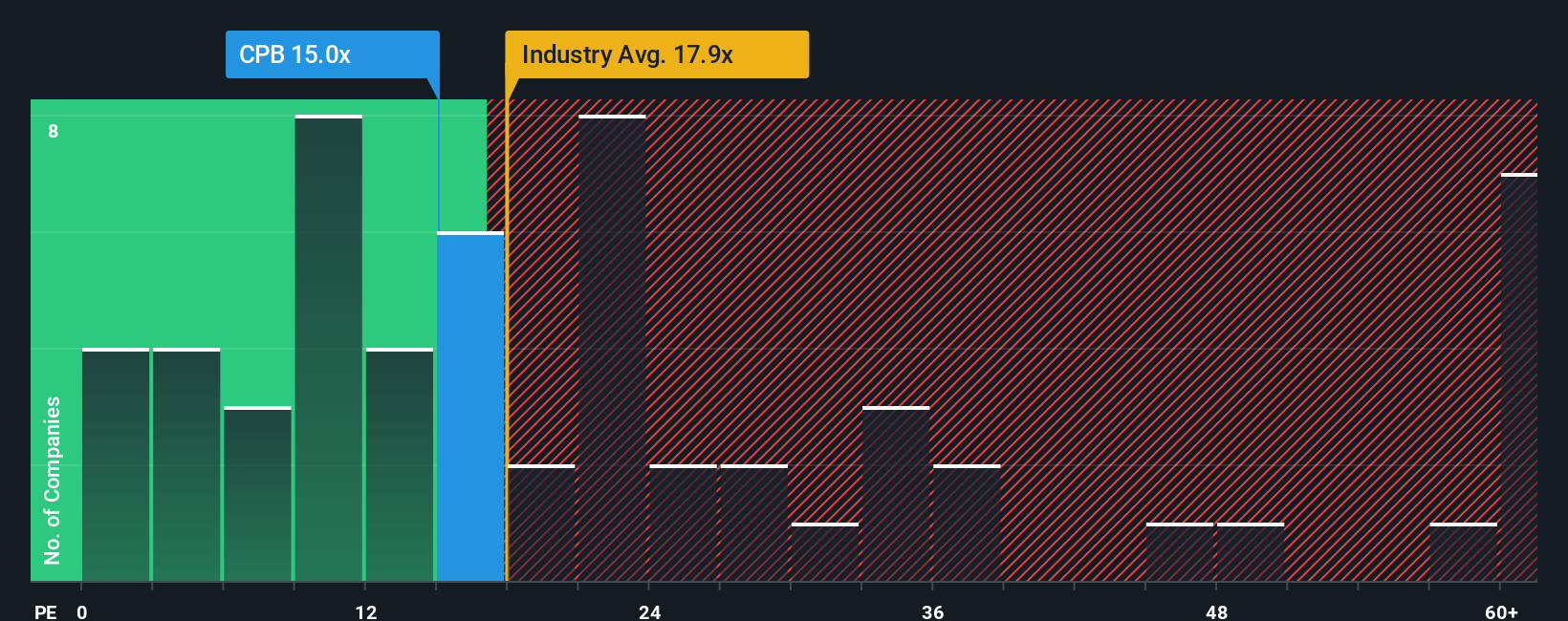

Campbell’s is currently trading at a PE ratio of 15.3x. Compared to its immediate peers, who average a slightly lower 14.8x, Campbell's valuation appears just a touch higher. In contrast, the broader Food industry trades at a higher average of 18.5x, making Campbell's seem less expensive relative to the sector overall. However, simple comparisons can miss the nuances of underlying company dynamics such as earnings growth, risk profile, profit margins, and market size.

This is where Simply Wall St’s “Fair Ratio” comes in. Calculated to be 19.3x for Campbell's, this proprietary metric tailors the expected multiple for factors such as future growth prospects, unique risk considerations, and profitability, which makes it more precise than broad industry or peer comparisons.

Comparing Campbell’s current PE ratio of 15.3x to its Fair Ratio of 19.3x, the stock appears undervalued relative to what might be justified given its fundamentals and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Campbell's Narrative

Earlier, we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a clear, personalized story you bring to a company, connecting your view of its future performance with key numbers such as forecasts for revenue, profit margins, and your estimate of fair value. Rather than just reviewing past ratios or analyst opinions, Narratives help you map out how Campbell's unique story could play out financially, and then see what that means for today's stock price.

On Simply Wall St’s Community page, millions of investors use the Narratives tool to easily outline their perspective, update their forecasts, and compare their assumptions against others. Narratives make your investment decision much more dynamic, because they are constantly updated as new information, such as earnings announcements or industry news, comes in, ensuring your view stays relevant.

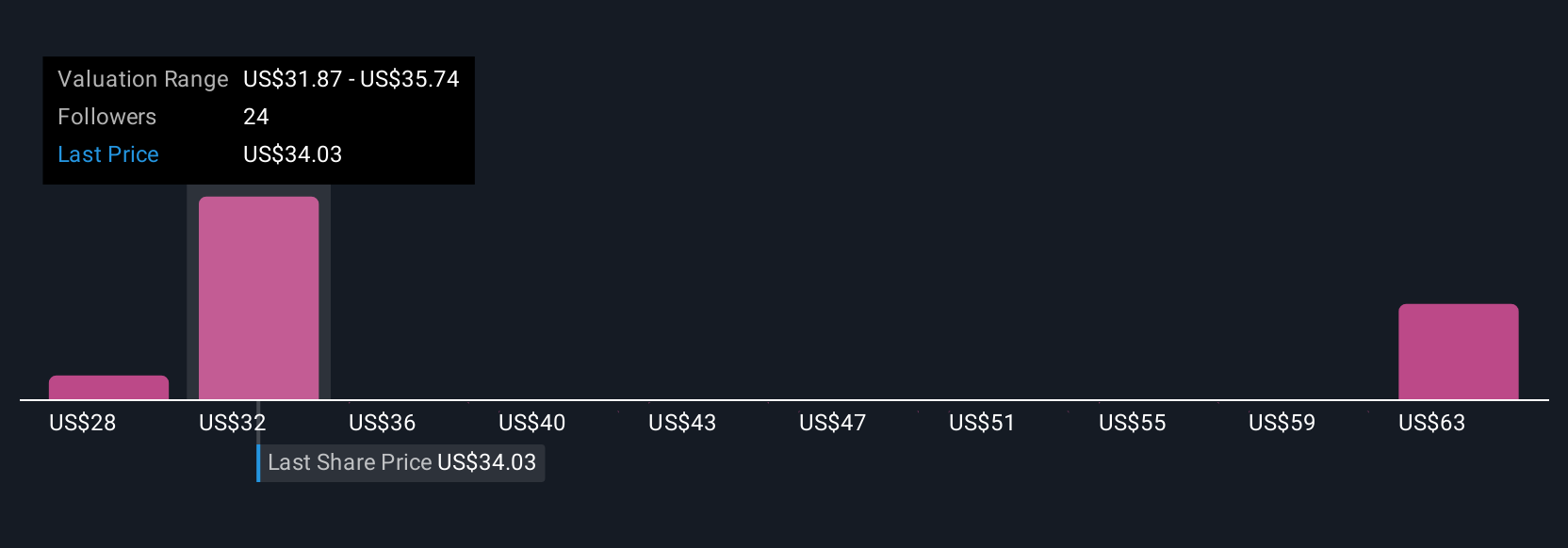

With Narratives, you can decide what you think Campbell's shares are really worth by comparing your Fair Value to the current price, making investment decisions grounded in both numbers and real-world context. For instance, some investors currently see Campbell’s as worth as much as $62 per share, expecting strong growth from operational improvements and health-focused products, while others set the value as low as $29 due to industry headwinds and cost pressures.

Do you think there's more to the story for Campbell's? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CPB

Campbell's

Manufactures and markets food and beverage products in the United States and internationally.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives