- United States

- /

- Food

- /

- NasdaqGS:CPB

Can Campbell's (CPB) Holiday Partnership Redefine Its Brand Narrative and Community Impact?

Reviewed by Sasha Jovanovic

- Earlier this week, Campbell announced the launch of its limited-edition Sides Collection in partnership with Cynthia Rowley and Kit Keenan, coinciding with the company's declaration of November 6 as Sides Season™ and the release of its 2025 State of the Sides Report.

- Each Sides Collection bag purchase supports Feeding America with notable food donations, while Campbell also increased financial support for community partners to address food insecurity nationwide.

- We'll assess how Campbell's partnership-driven product launch ahead of the holidays may impact its investment narrative and broader brand engagement.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Campbell's Investment Narrative Recap

Owning Campbell’s shares often comes down to confidence in its ability to maintain resilient profits from core pantry brands while managing persistent input cost pressures and adapting to changing consumer preferences. The latest Sides Collection campaign, while creatively tied to the holidays and supportive of charitable initiatives, is unlikely to materially affect near-term earnings, margin pressure from higher input costs and shifting demand remains the company’s most significant short-term risk. The brand collaboration stands out for building relevance and engagement, but does not directly resolve these fundamental business headwinds.

Among recent company news, Campbell’s ongoing rollout of new products, such as the earlier launch of Prego Creamy Pesto, demonstrates a steady commitment to product innovation designed to meet evolving consumer tastes, a key catalyst that could help offset softness in traditional processed categories. While limited-edition launches like the Sides Collection may create buzz and goodwill, broader, scalable innovation in health-oriented and convenient foods remains central to driving sustained growth and countering category stagnation.

By contrast, investors should be aware that if Campbell’s is unable to contain margin pressure from elevated input costs, especially those related to tariffs on...

Read the full narrative on Campbell's (it's free!)

Campbell's narrative projects $10.2 billion revenue and $868.6 million earnings by 2028. This requires a 0.0% yearly revenue decline and a $266.6 million increase in earnings from $602.0 million today.

Uncover how Campbell's forecasts yield a $34.58 fair value, a 12% upside to its current price.

Exploring Other Perspectives

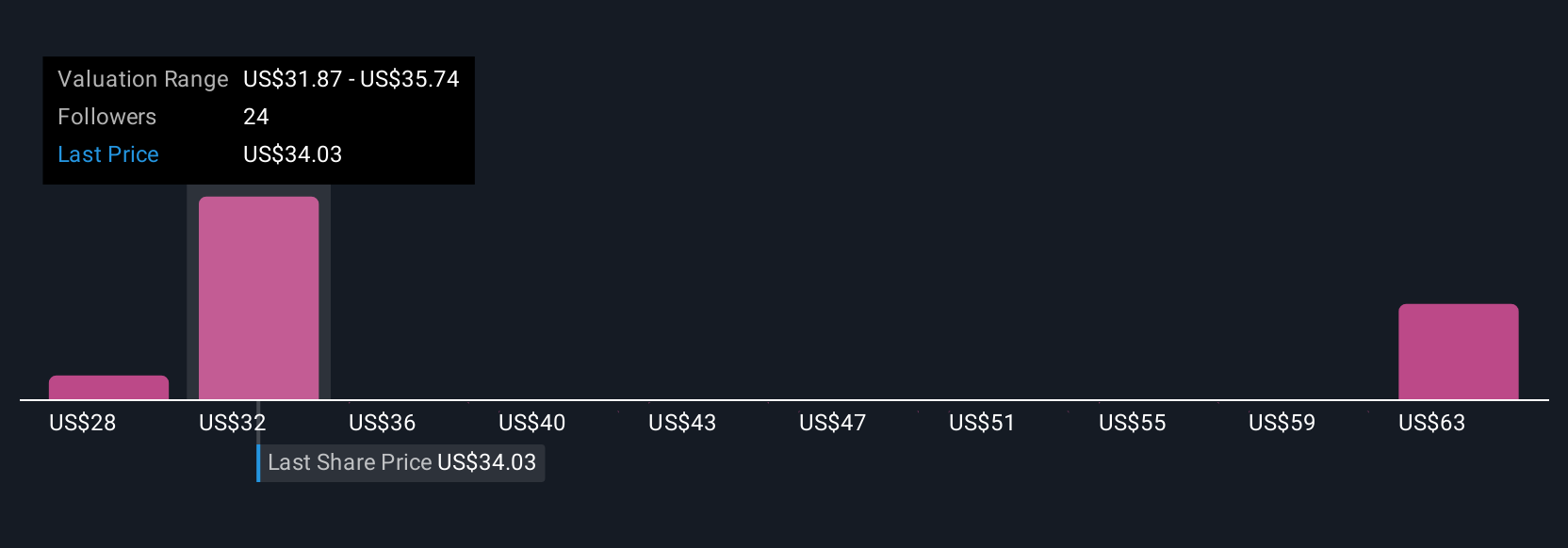

Community fair value estimates for Campbell's range widely from US$29.00 to US$63.56, with 5 perspectives featured from the Simply Wall St Community. Many point to ongoing input cost pressures as a crucial factor shaping the company’s outlook, underscoring how opinions on future profitability can strongly vary.

Explore 5 other fair value estimates on Campbell's - why the stock might be worth over 2x more than the current price!

Build Your Own Campbell's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Campbell's research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Campbell's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Campbell's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CPB

Campbell's

Manufactures and markets food and beverage products in the United States and internationally.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives