- United States

- /

- Beverage

- /

- NasdaqGS:COCO

Vita Coco (COCO): Valuation Insights Following Raised Guidance and Strong Earnings Momentum

Reviewed by Simply Wall St

Vita Coco Company (COCO) released its latest earnings report, showing higher sales and net income for the third quarter and the first nine months of 2025. Management also raised expectations for the rest of the year, supported by growing product demand.

See our latest analysis for Vita Coco Company.

Vita Coco Company’s upbeat results and stronger full-year outlook seem to be energizing investor sentiment, especially after the company’s recently completed share buyback and ongoing demand for its core products. While the 90-day share price return stands out at 28.91% and this year’s total shareholder return has reached 17.6%, the exceptional three-year total shareholder return of 314% really underscores the company’s long-term momentum and growth story.

If these kinds of results have you curious about what else is on the move, it could be the perfect moment to discover fast growing stocks with high insider ownership.

With strong recent gains and analyst price targets suggesting even more upside, the key question now is whether Vita Coco shares remain undervalued or if the market has already priced in all that future growth potential.

Most Popular Narrative: 15.7% Undervalued

Compared to the last close price of $41.82, the most widely followed narrative points to a fair value near $49.63, suggesting meaningful upside remains. This sets the stage for a closer look at what is fueling such optimism.

Heightened investment in international markets (notably Europe) is resulting in accelerating sales growth and market share gains. Management expects international revenues to ultimately rival the Americas business, which could significantly impact consolidated revenues and earnings power.

Want to know how this fair value came together? The future forecast hinges on double-digit growth, margin expansion, and a bold new destination for the business. The financial leap they're projecting will surprise you. Find out which numbers make this narrative so compelling.

Result: Fair Value of $49.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff uncertainty and fluctuating freight rates could pressure Vita Coco’s margins, which may challenge the optimistic outlook around future growth and valuation.

Find out about the key risks to this Vita Coco Company narrative.

Another View: What Do Price Multiples Suggest?

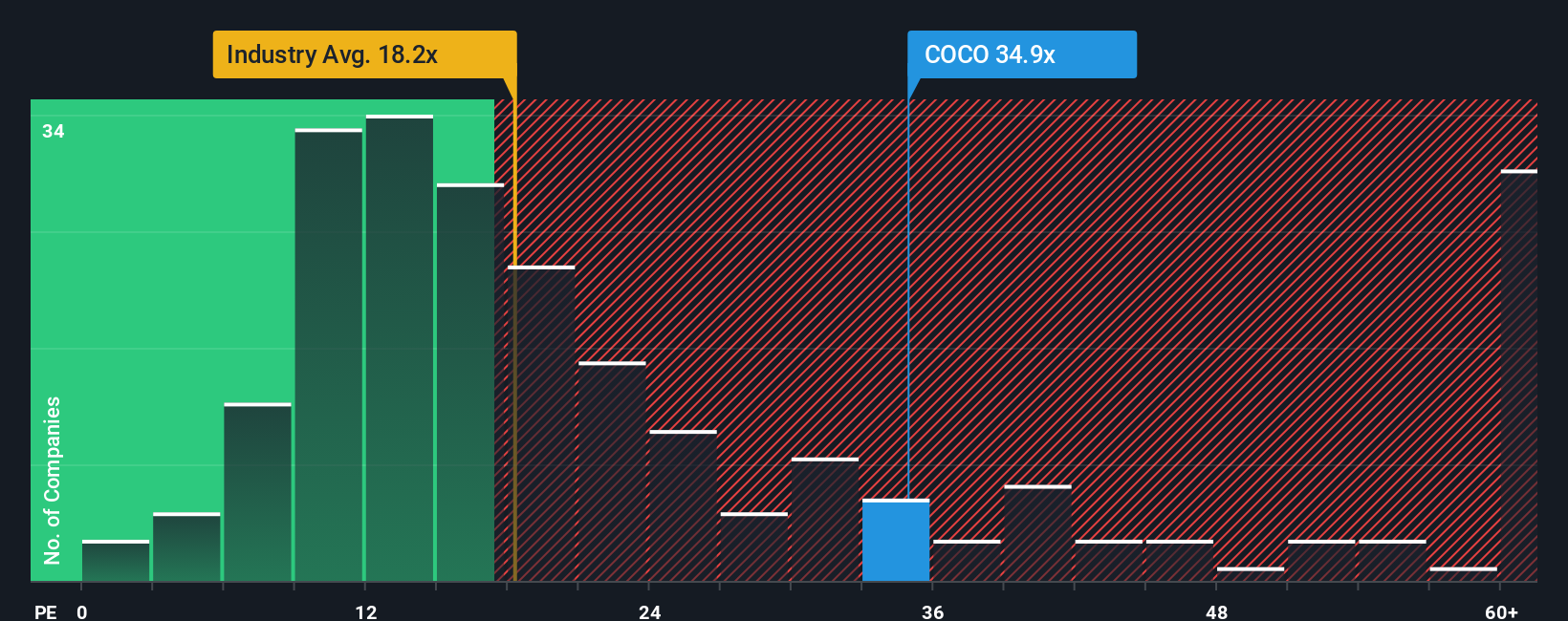

Looking at Vita Coco’s valuation through the lens of its price-to-earnings ratio brings a different perspective. The shares currently trade at 34.4 times earnings, which is almost double both the global beverage industry average of 17.6 times and the fair ratio of 17.3 times that the market could eventually move toward. This high valuation signals that investors have lofty expectations baked in, which raises the stakes if the company’s robust growth story weakens. Should investors trust in the premium, or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vita Coco Company Narrative

If you want to dive into the numbers and challenge this view with your own analysis, you can put together a narrative of your own in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vita Coco Company.

Looking for More Investment Ideas?

Your smartest move could be checking out breakthrough opportunities beyond Vita Coco. The Simply Wall Street Screener is packed with hand-picked stock ideas for savvy investors seeking the next advantage.

- Capitalize on strong yield potential by reviewing these 17 dividend stocks with yields > 3%, which is packed with high-yield opportunities ideal for boosting your income portfolio.

- Gain first-mover insight by scanning these 25 AI penny stocks, which features companies making waves in artificial intelligence with game-changing innovations and real-world applications.

- Secure your edge with these 849 undervalued stocks based on cash flows, which offers stocks trading below their intrinsic value before the broader market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COCO

Vita Coco Company

Develops, markets, and distributes coconut water products under the Vita Coco brand name in the United States, Canada, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives