- United States

- /

- Food

- /

- NasdaqGS:BYND

Beyond Meat (BYND): Evaluating Valuation Following a 46% Decline in the Past Month

Reviewed by Simply Wall St

Beyond Meat (BYND) shares have had a rough stretch, and investors are paying attention to how the company is navigating continued challenges in the plant-based protein market. Over the past month, the stock has dropped 46%.

See our latest analysis for Beyond Meat.

Beyond Meat’s share price has seen sharp declines recently, reflecting broader skepticism around the plant-based sector and shifting consumer trends. While momentum has certainly faded, as illustrated by a 45.96% drop in the past month, the total shareholder return over the past year sits at a steep -80.7%, highlighting persistent challenges for both short- and long-term investors.

If this latest slide has you rethinking your strategy, now could be a smart time to broaden your search and discover fast growing stocks with high insider ownership

After such a steep fall in Beyond Meat’s stock, investors are left wondering if the current price reflects all the risks ahead or if there is a potential buying opportunity before any future growth is priced in.

Most Popular Narrative: 42.9% Undervalued

The narrative consensus places Beyond Meat’s fair value at $2.23 per share, a significant premium to its last close of $1.27. With the current price well below this estimate, the numbers suggest a broad disconnect between market sentiment and narrative expectations. This sets the groundwork for a pivotal story in Beyond Meat’s valuation.

Beyond Meat is accelerating operational efficiency efforts, including substantial cost reduction, portfolio optimization, and manufacturing investments. These initiatives are expected to improve gross margins and drive the company toward EBITDA-positive operations. The result could benefit future net income and operating cash flow.

Curious where this upbeat outlook comes from? The heart of the narrative is bold cost reductions, dramatic shifts in core margins, and a future profit profile many would not expect from Beyond Meat. If you want to see what ambitious financial leaps underpin this fair value claim, the full narrative reveals it all.

Result: Fair Value of $2.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sharp sales declines and persistent consumer skepticism remain major hurdles. These challenges could quickly undermine any hopes for sustained recovery in Beyond Meat’s story.

Find out about the key risks to this Beyond Meat narrative.

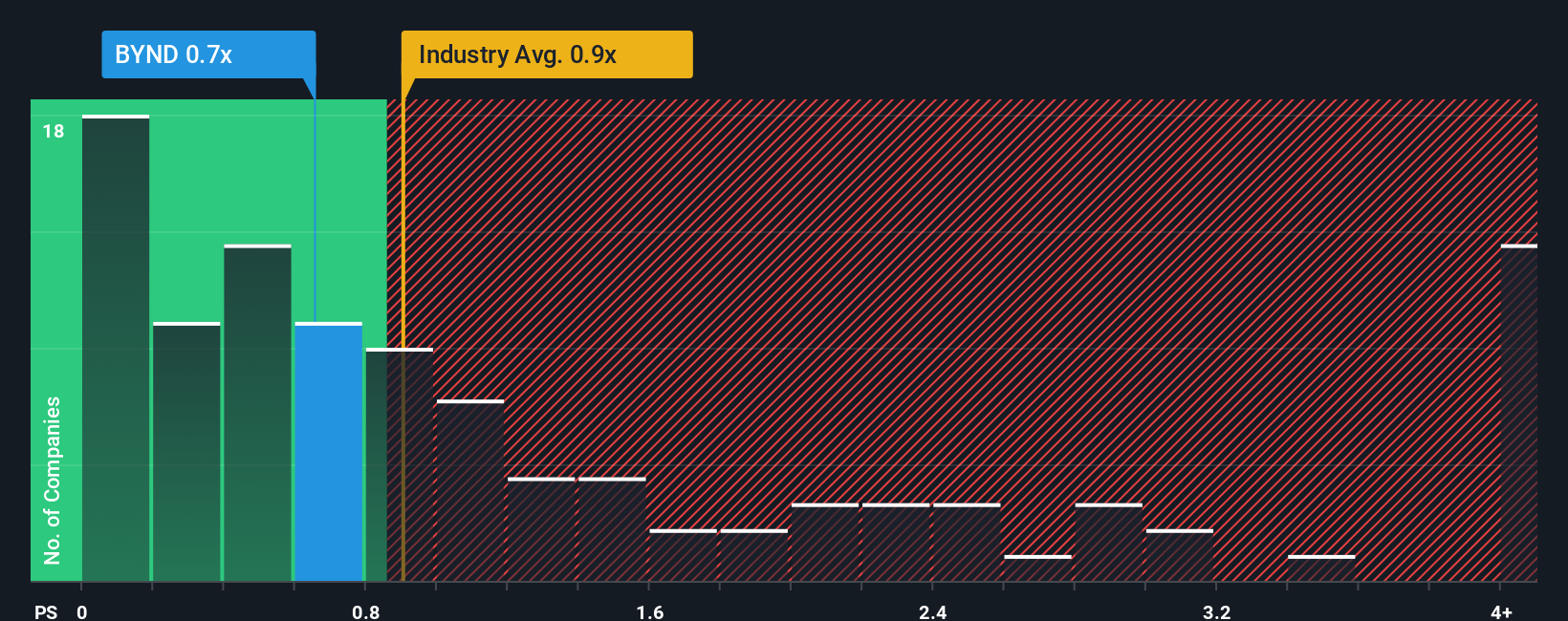

Another View: Multiples Tell a Different Story

While the fair value estimate suggests Beyond Meat is undervalued, looking at its price-to-sales ratio tells a different tale. The company's ratio stands at 1.7x, which is much higher than both the peer average of 0.6x and the industry standard of 0.9x. Even compared to a fair ratio of 0.6x, current pricing seems stretched. This wide gap highlights a risk that the market may be weighing BYND's near-term challenges more heavily than future hopes. Is the market too pessimistic, or is caution still needed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Beyond Meat Narrative

If you think there is more to the story or want to dig into the numbers yourself, you can build your own perspective in just a few minutes by using Do it your way

A great starting point for your Beyond Meat research is our analysis highlighting 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that casting a wider net uncovers opportunities they would otherwise miss. If you want to spot what others might overlook, check out these handpicked strategies now and get ahead of the crowd.

- Tap into high-growth potential by uncovering these 3606 penny stocks with strong financials with the financial strength to power through market volatility.

- Ride the wave of digital transformation by taking advantage of these 26 AI penny stocks that are revolutionizing industries with artificial intelligence breakthroughs.

- Seize bargains the market is missing by targeting these 848 undervalued stocks based on cash flows packed with hidden value waiting to be unlocked.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beyond Meat might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BYND

Beyond Meat

A plant-based meat company, engages in the development, manufacture, marketing, and sale of plant-based meat products under the Beyond brand name in the United States and internationally.

Slight risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives