- United States

- /

- Food

- /

- NasdaqGS:AVO

Mission Produce, Inc.'s (NASDAQ:AVO) Shareholders Might Be Looking For Exit

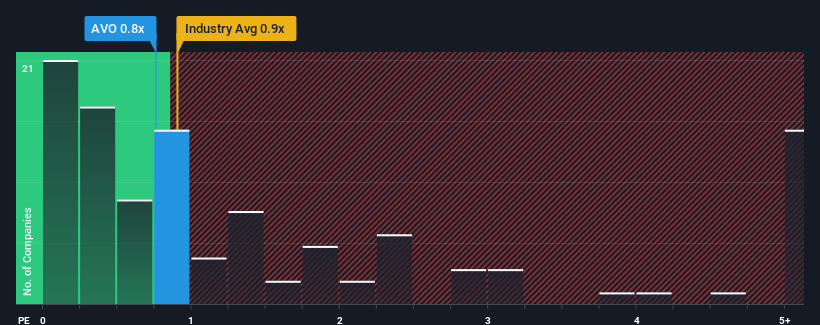

It's not a stretch to say that Mission Produce, Inc.'s (NASDAQ:AVO) price-to-sales (or "P/S") ratio of 0.8x seems quite "middle-of-the-road" for Food companies in the United States, seeing as it matches the P/S ratio of the wider industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Mission Produce

How Mission Produce Has Been Performing

With revenue growth that's superior to most other companies of late, Mission Produce has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Mission Produce's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Mission Produce?

Mission Produce's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 29%. Pleasingly, revenue has also lifted 38% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue growth is heading into negative territory, declining 10% over the next year. That's not great when the rest of the industry is expected to grow by 2.4%.

With this in consideration, we think it doesn't make sense that Mission Produce's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What Does Mission Produce's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our check of Mission Produce's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

You need to take note of risks, for example - Mission Produce has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AVO

Mission Produce

Engages in the sourcing, farming, packaging, marketing, and distribution of avocados, mangoes, and blueberries to food retailers, wholesalers, and foodservice customers in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives