- United States

- /

- Oil and Gas

- /

- NYSEAM:LEU

Centrus Energy (LEU) Raises Over $1 Billion After Strong Earnings Are Bigger Ambitions on the Horizon?

Reviewed by Sasha Jovanovic

- In early November 2025, Centrus Energy Corp. completed a follow-on equity offering totaling over US$196 million, filed for an additional US$1 billion at-the-market equity offering, and registered a diverse range of securities under a universal shelf registration, following the announcement of strong third quarter earnings results.

- This combination of significant capital-raising moves immediately after robust financial performance suggests Centrus is focused on expanding its funding flexibility to support potential new growth opportunities or operational initiatives.

- We'll examine how Centrus Energy's swift capital raising after strong earnings could affect expectations for growth and financial stability.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Centrus Energy Investment Narrative Recap

To be a shareholder in Centrus Energy, you generally need to believe in sustained growth for domestic nuclear fuel demand, continued support from government and industry, and Centrus' ability to capitalize on its unique position in American uranium enrichment. The latest wave of equity offerings and shelf registrations seems designed to enhance funding flexibility, but these moves do not materially alter the key short-term catalyst: the need for timely Department of Energy funding and government contracts for the Piketon plant expansion. The greatest risk continues to be potential delays or uncertainty around these federal awards, which could slow planned capacity expansions and contract wins.

The most relevant recent announcement is Centrus’ major Piketon plant expansion, which hinges on multi-billion US dollar federal support. This business expansion remains closely tied to Centrus’ growth prospects, as scaling up HALEU and LEU production is crucial to meeting projected demand and justifying revenue and margin assumptions. In this context, new capital from the November funding actions may help support operational readiness, yet proceeds alone cannot overcome risks related to government policy and contract allocation timing. Unlike investor enthusiasm, the impact of these funding moves...

Read the full narrative on Centrus Energy (it's free!)

Centrus Energy's outlook forecasts $640.9 million in revenue and $70.3 million in earnings by 2028. This relies on 13.6% annual revenue growth but represents a $34.5 million decrease in earnings from the current $104.8 million.

Uncover how Centrus Energy's forecasts yield a $258.05 fair value, a 12% downside to its current price.

Exploring Other Perspectives

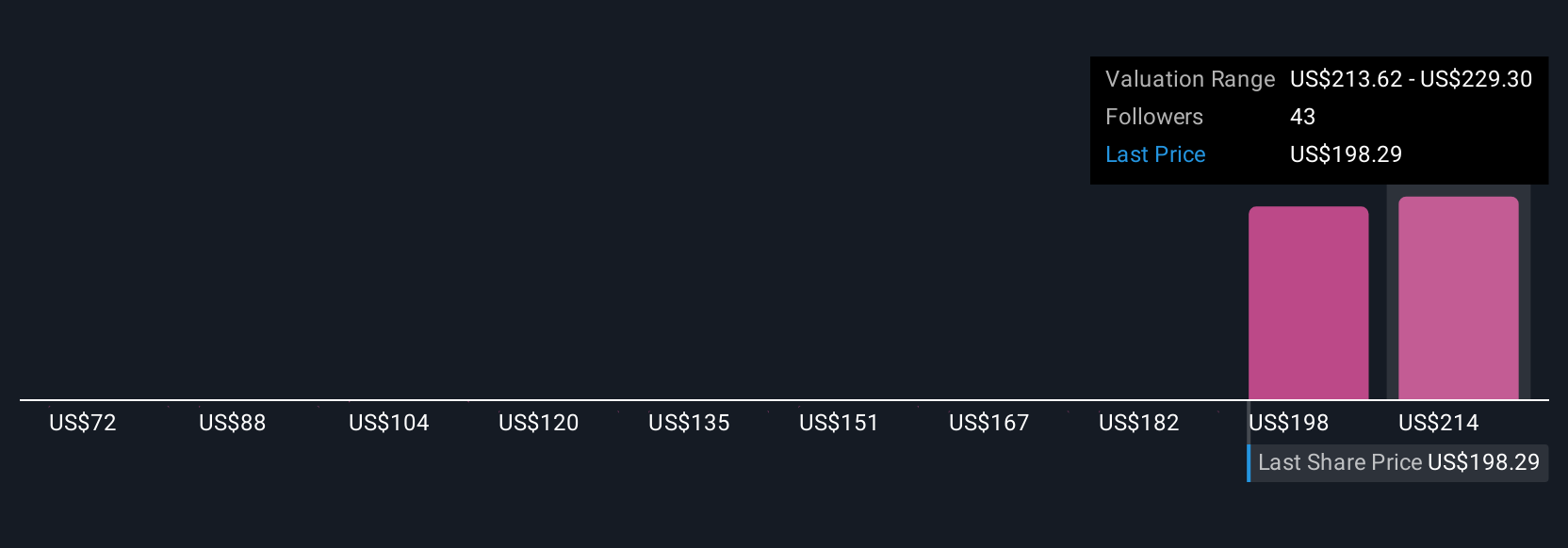

Ten community members at Simply Wall St project Centrus Energy’s fair value from as low as US$72.48 to as high as US$310. Uncertainty around Department of Energy awards and contract timing continues to shape expectations for Centrus’ future growth, so consider a range of viewpoints to inform your outlook.

Explore 10 other fair value estimates on Centrus Energy - why the stock might be worth as much as 5% more than the current price!

Build Your Own Centrus Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centrus Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Centrus Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centrus Energy's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:LEU

Centrus Energy

Supplies nuclear fuel components for the nuclear power industry in the United States, Belgium, Japan, the Netherlands, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives