- United States

- /

- Oil and Gas

- /

- NYSE:XOM

Is Exxon Mobil’s Permian Deal Creating Opportunity Amid 2025 Price Gains?

Reviewed by Bailey Pemberton

- Thinking about whether Exxon Mobil stock is a smart bargain or an expensive bet? You are not alone, as investors everywhere are asking the same question right now.

- The share price has gained 3.0% in the last week and 5.9% over the past month, adding to a 9.2% climb so far this year. This hints at shifting sentiment around the stock’s potential.

- Exxon Mobil has recently made headlines with its continued push into low-carbon energy and a major deal in the Permian Basin. Many see these moves as reshaping its long-term growth story. These developments have undoubtedly influenced investor confidence and could explain some of the latest price action.

- On our value checklist, Exxon Mobil scores 4 out of 6 for undervaluation, which is a strong result but only tells part of the story. The real art of valuation might surprise you in the sections ahead.

Approach 1: Exxon Mobil Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by extrapolating future cash flows and discounting them back to today’s dollars. This approach provides insight into what Exxon Mobil could be worth based on its long-term ability to generate free cash flow.

Currently, Exxon Mobil reports a Free Cash Flow of $28.1 billion. Analysts supply growth estimates for five years, after which projections are extended using long-term assumptions. Based on current forecasts, Exxon Mobil's free cash flow is expected to climb to approximately $44.7 billion by 2029, with further growth extrapolated for the next decade.

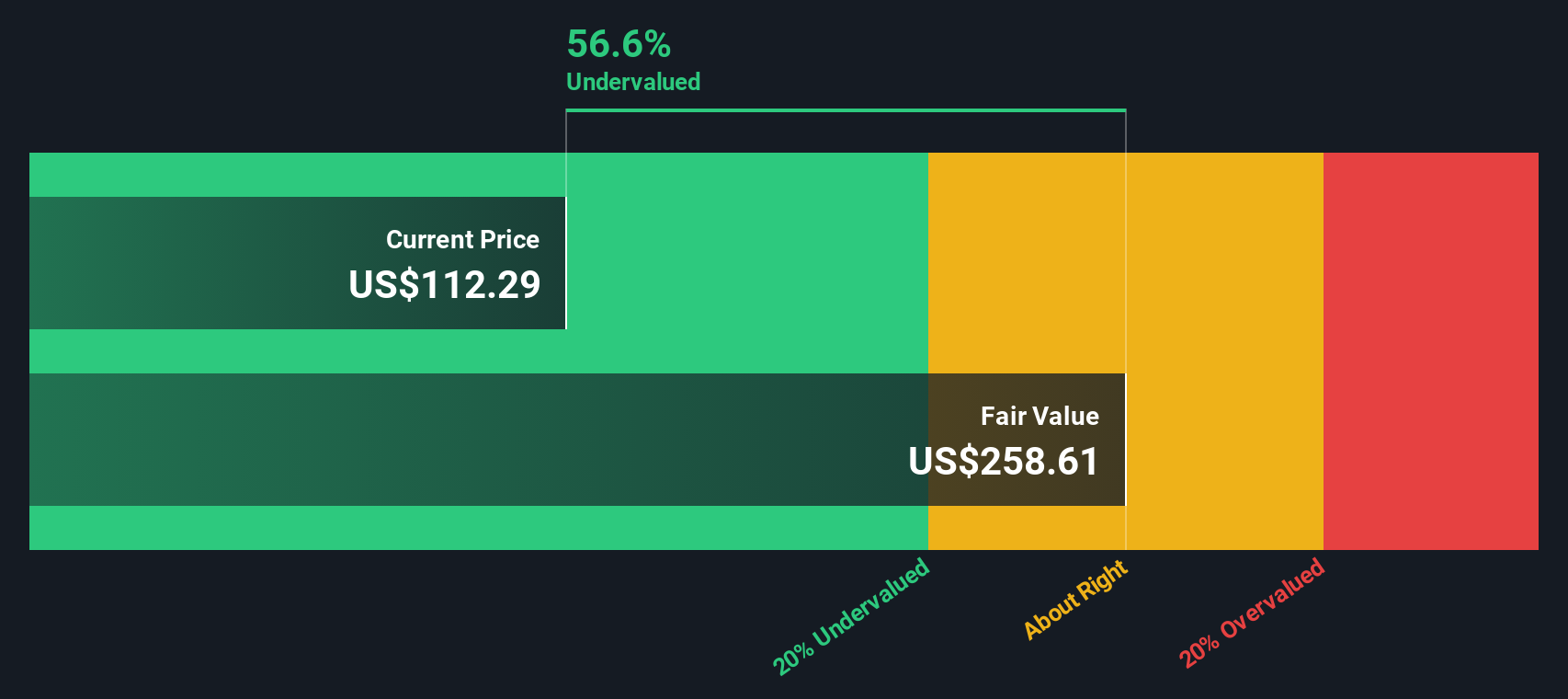

Applying the 2 Stage Free Cash Flow to Equity model, the DCF analysis calculates an intrinsic value of $289.17 per share. This figure implies the stock is trading at a 59.5% discount compared to its estimated fair value and suggests significant undervaluation at current prices.

In summary, the cash flow outlook and resulting model suggest Exxon Mobil is attractively priced for those seeking foundational value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Exxon Mobil is undervalued by 59.5%. Track this in your watchlist or portfolio, or discover 878 more undervalued stocks based on cash flows.

Approach 2: Exxon Mobil Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like Exxon Mobil. It connects a company’s current share price with its earnings performance. When a business has stable and predictable profits, the PE multiple provides a helpful benchmark for assessing whether investors are paying a reasonable amount for each dollar of earnings.

Growth outlook and risk both play a crucial role in determining what a “normal” PE should be. Higher expected earnings growth or lower business risks generally justify a higher PE, while uncertainty or stagnation can push the ratio lower. Investors weigh these dynamics against both company- and industry-specific trends to gauge if a stock looks cheap or expensive.

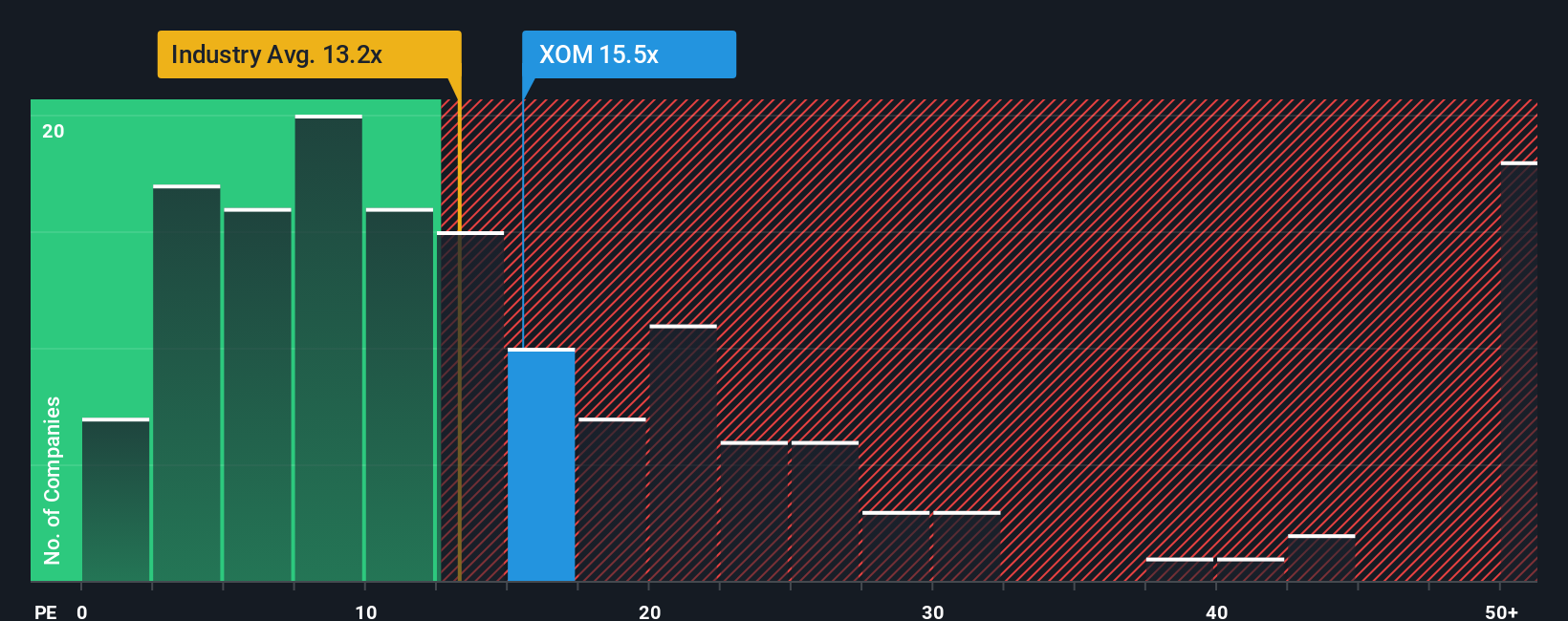

Exxon Mobil’s latest PE ratio stands at 16.5x, compared to the oil and gas industry’s average of 13.5x and a peer group average of 22.7x. On the surface, this places Exxon between more attractively priced peers and the sector average, suggesting the market sees both strengths and potential risks for the company.

Simply Wall St’s proprietary “Fair Ratio” model, which accounts for company-specific factors such as profit growth, margins, risks, and relative size, assigns Exxon Mobil a Fair PE of 22.7x. Unlike a basic comparison with peers or the industry, the Fair Ratio is tuned to Exxon Mobil's unique business profile, incorporating its growth potential and standing within the energy sector.

With Exxon Mobil’s current PE ratio significantly below its Fair Ratio, the data points toward the stock being undervalued on this metric. Investors may be getting an opportunity to buy earnings at a discount to what the company’s fundamentals suggest is justified.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Exxon Mobil Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is more than just a price target; it is your own story about Exxon Mobil, built by linking your perspective and assumptions (like future revenue, earnings, and margins) to a financial forecast, and then directly to a fair value estimate.

Narratives bridge the gap between the numbers and the company's real-world story, giving you a framework to articulate why you believe Exxon Mobil is worth a certain amount and how factors like new projects or market changes might impact that value. They are simple and accessible to any investor on Simply Wall St’s Community page, making it easy for millions to present and compare different viewpoints.

With Narratives, you can quickly see whether Exxon Mobil’s current share price offers a bargain or seems expensive by comparing your calculated Fair Value with the live market Price. As news or new earnings are released, Narratives update dynamically, so your investment view remains relevant with every new development.

For example, one Narrative estimates Exxon Mobil’s fair value at $132 per share driven by its transformation and synergy gains, while another sets it at $174 based on a more aggressive Guyana growth outlook and higher long-term margins. This highlights how different assumptions yield diverse, yet logically structured, investment stories.

Do you think there's more to the story for Exxon Mobil? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exxon Mobil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XOM

Exxon Mobil

Engages in the exploration and production of crude oil and natural gas in the United States, Guyana, Canada, the United Kingdom, Singapore, France, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives