- United States

- /

- Oil and Gas

- /

- NYSE:WTI

Take Care Before Jumping Onto W&T Offshore, Inc. (NYSE:WTI) Even Though It's 27% Cheaper

The W&T Offshore, Inc. (NYSE:WTI) share price has fared very poorly over the last month, falling by a substantial 27%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 56% loss during that time.

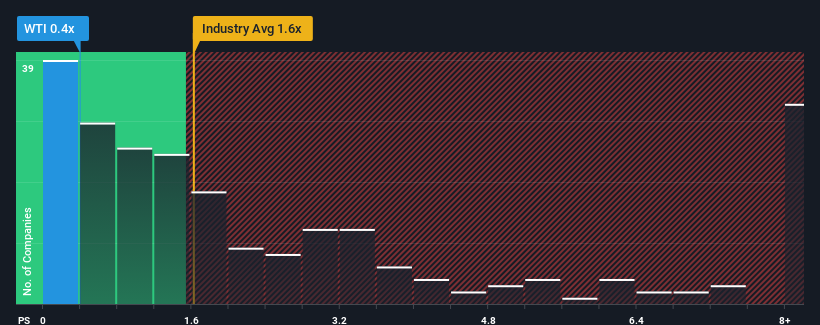

Following the heavy fall in price, W&T Offshore may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.4x, since almost half of all companies in the Oil and Gas industry in the United States have P/S ratios greater than 1.6x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for W&T Offshore

How Has W&T Offshore Performed Recently?

W&T Offshore has been struggling lately as its revenue has declined faster than most other companies. It seems that many are expecting the dismal revenue performance to persist, which has repressed the P/S. You'd much rather the company improve its revenue performance if you still believe in the business. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on W&T Offshore will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, W&T Offshore would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.9%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 11% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 7.1% as estimated by the two analysts watching the company. That's shaping up to be similar to the 9.1% growth forecast for the broader industry.

With this in consideration, we find it intriguing that W&T Offshore's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

W&T Offshore's recently weak share price has pulled its P/S back below other Oil and Gas companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've seen that W&T Offshore currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with W&T Offshore (at least 2 which are a bit concerning), and understanding them should be part of your investment process.

If you're unsure about the strength of W&T Offshore's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if W&T Offshore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WTI

W&T Offshore

An independent oil and natural gas producer, engages in the acquisition, exploration, and development of oil and natural gas properties in the Gulf of America.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives