- United States

- /

- Oil and Gas

- /

- NYSE:WMB

Williams Companies (WMB) Margin Miss Challenges Bullish Narratives on Earnings Growth and Dividend Outlook

Reviewed by Simply Wall St

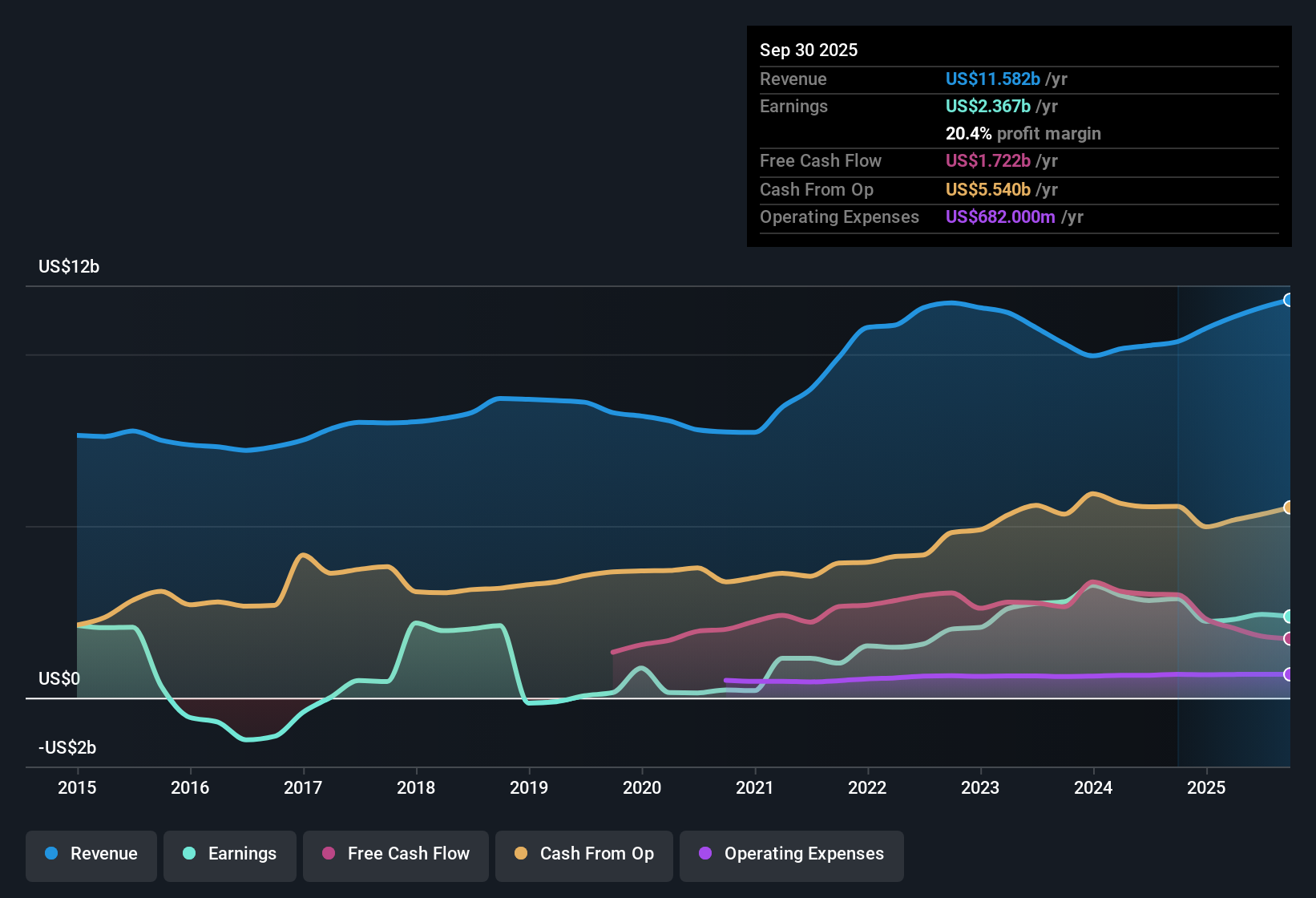

Williams Companies (WMB) posted net profit margins of 20.4% for the recent period, down from last year’s 27.8%. Although earnings are forecast to grow at 13.53% annually, this is slower than both the US market average of 16% and the broader oil and gas industry. The current share price of $56.51 sits below an estimated fair value of $75.76. With a Price-to-Earnings ratio of 29.2x, WMB trades at a significant premium to its peers. Investors will note strong historical earnings growth over the past five years, yet recent declines in margins and earnings highlight shifting pressures in the business.

See our full analysis for Williams Companies.The next step is to see how these results line up with the dominant narratives about WMB. By comparing the key numbers to long-standing market views, we can spot where the story holds and where it might be shifting.

See what the community is saying about Williams Companies

Project Backlog Fuels Margin Outlook

- Williams' fully contracted project backlog extends beyond 2030, supporting greater long-term earnings visibility and potential for margin expansion even as current net profit margins have slipped from 27.8% last year to 20.4%.

- According to the analysts' consensus view, robust investments in pipeline expansions and decarbonization are expected to help margins recover over the next three years.

- Forecasts see margins rising from 21.3% today to 22.7% in three years, supported by capacity additions in high-growth regions and resilient demand for natural gas infrastructure.

- Consensus narrative highlights that fully contracted projects and regulatory support are key to protecting long-term margins. However, any delays or cost surges could quickly erode this progress.

- Curious how analysts weigh Williams' long-term pipeline plans against recent margin pressure? See their full consensus case. 📊 Read the full Williams Companies Consensus Narrative.

Valuation Premium Remains Stark

- Williams trades at a Price-to-Earnings ratio of 29.2x, more than double its peer average of 14x and the broader oil and gas industry average of 12.8x, despite a forecasted earnings growth rate of 13.53% per year that is slower than both those benchmarks.

- Analysts' consensus view weighs the high multiple against estimated upside.

- While the discounted cash flow (DCF) fair value is $75.76, about 34% above today’s share price of $56.51, analyst price targets for Williams currently average $67.22, roughly 19% higher than current trading levels.

- Consensus notes that for Williams to justify the target, the company must not only achieve $3.3 billion in earnings by 2028 but also maintain its elevated PE ratio. This remains out of step with the broader industry and requires continued earnings delivery without margin slippage.

Debt and Dividend Questions Loom Large

- Recent EDGAR data signals that Williams may not be in a strong financial position, with renewed questions about the sustainability of its dividend under continued high capital expenditure and elevated leverage.

- Consensus narrative cautions that, even with fully contracted projects and disciplined capital planning,

- Heavy reliance on long-cycle projects and rising construction costs could pressure free cash flow and reduce Williams’ ability to cover dividends if market or regulatory conditions change.

- Bears highlight that limited financial flexibility and persistent M&A activity may leave Williams more exposed to higher debt service costs and earnings volatility if industry headwinds accelerate.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Williams Companies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different angle on the figures? Share your perspective in just a few minutes and shape how the story unfolds. Do it your way

A great starting point for your Williams Companies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Williams faces elevated debt levels and dividend sustainability concerns, as rising capital expenditure and industry headwinds threaten financial flexibility.

Focus on peace of mind by checking out solid balance sheet and fundamentals stocks screener (1981 results) to discover companies with stronger balance sheets and lower debt exposure for greater resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Williams Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMB

Williams Companies

Operates as an energy infrastructure company primarily in the United States.

Slightly overvalued with limited growth.

Similar Companies

Market Insights

Community Narratives