- United States

- /

- Oil and Gas

- /

- NYSE:WMB

Are Williams Shares Priced Fairly After Announcing Major Infrastructure Expansion Projects?

Reviewed by Bailey Pemberton

- Curious whether Williams Companies’ shares are fairly priced right now? You’re not alone. Plenty of investors are wondering if there’s hidden value or untapped potential in this energy giant.

- Despite some short-term swings, with a 1.0% gain over the last week and a -9.5% pullback over the past month, Williams is still up a solid 3.0% year-to-date and an eye-popping 271.3% over the last five years.

- Market attention has picked up after Williams Companies announced major infrastructure expansion projects, as well as new partnerships aimed at boosting its natural gas transportation network. These moves have sparked renewed interest and contributed to recent volatility in the stock’s price.

- When it comes to valuation, Williams Companies scores just 2 out of 6 on our most common value checks. However, a score can only reveal so much. Next, let's dive deeper into the methods behind these numbers, and stick around for a perspective on value that goes beyond simple metrics.

Williams Companies scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Williams Companies Discounted Cash Flow (DCF) Analysis

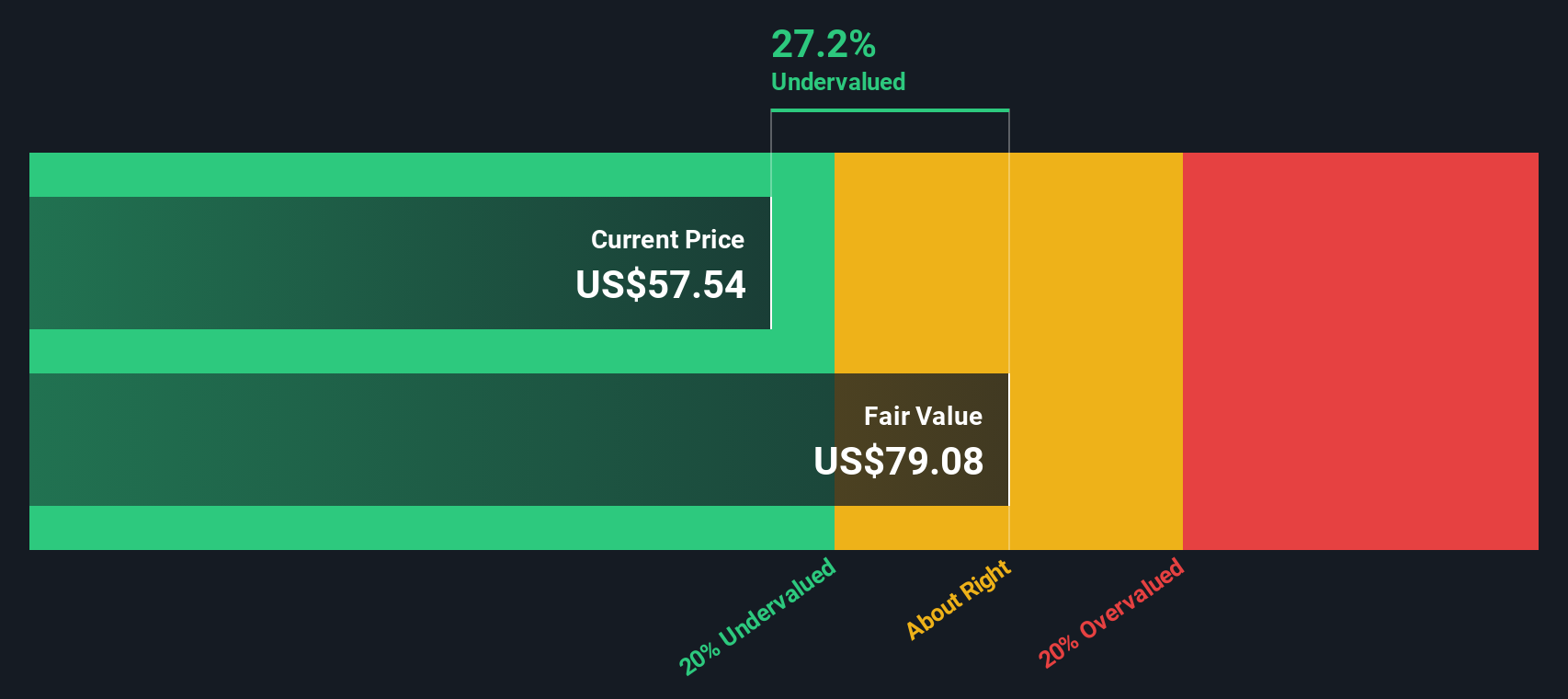

The Discounted Cash Flow (DCF) model estimates the worth of a business by projecting its future cash flows and discounting them to today's value. This approach helps investors gauge whether a stock is trading below or above its intrinsic value, based on realistic expectations for future performance.

For Williams Companies, the latest reported Free Cash Flow stands at $2.28 billion. Analysts predict that annual cash flows will continue to grow in the coming years, reaching around $4.26 billion by 2029. After the initial analyst estimates, further growth projections are extrapolated to extend up to a decade, relying on a blend of trends and conservative estimates.

Applying the 2 Stage Free Cash Flow to Equity model, the current DCF analysis values Williams Companies’ shares at an estimated intrinsic value of $79.08. This is roughly 27.2% higher than the prevailing share price, which suggests the stock may be undervalued.

In summary, even after a long run-up in share price, Williams Companies still appears attractively priced compared to its underlying cash flow power.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Williams Companies is undervalued by 27.2%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

Approach 2: Williams Companies Price vs Earnings

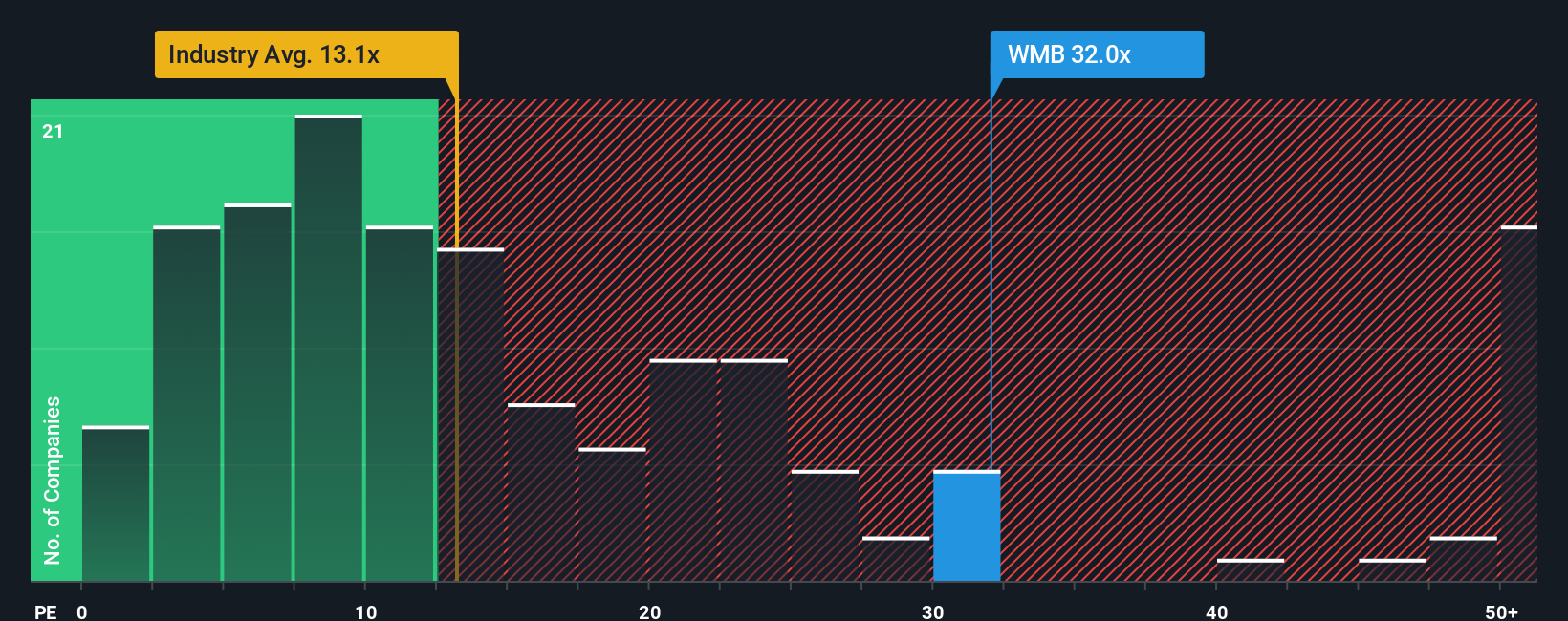

For profitable companies like Williams Companies, the Price-to-Earnings (PE) ratio is a widely used valuation tool. It gives investors a quick snapshot of how much they are paying for each dollar of the company’s current earnings. This makes it highly relevant for established, income-generating businesses.

It’s important to consider that a "normal" or "fair" PE ratio is not a fixed number. It often reflects the company’s future growth prospects, profit stability, and perceived risks. Higher expected earnings growth or lower risk usually justify a higher PE, while the opposite leads to a lower benchmark.

At present, Williams Companies trades on a PE ratio of 29.7x. This is considerably higher than the Oil and Gas industry average of 12.8x, as well as the peer average of 14.2x. On the surface, this might make Williams look expensive compared to its sector and closest competitors.

However, the Fair Ratio developed by Simply Wall St goes a step further. This proprietary metric adjusts the benchmark multiple by factoring in the company’s unique growth profile, profit margins, industry, market cap, and risk factors. This provides a more accurate gauge of what Williams’ PE should be.

Williams Companies has a Fair Ratio of 21.4x, which is below its actual PE of 29.7x. This suggests that, based on its fundamentals and risk profile, the current valuation is higher than what would be justified, even after accounting for its strengths and growth outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

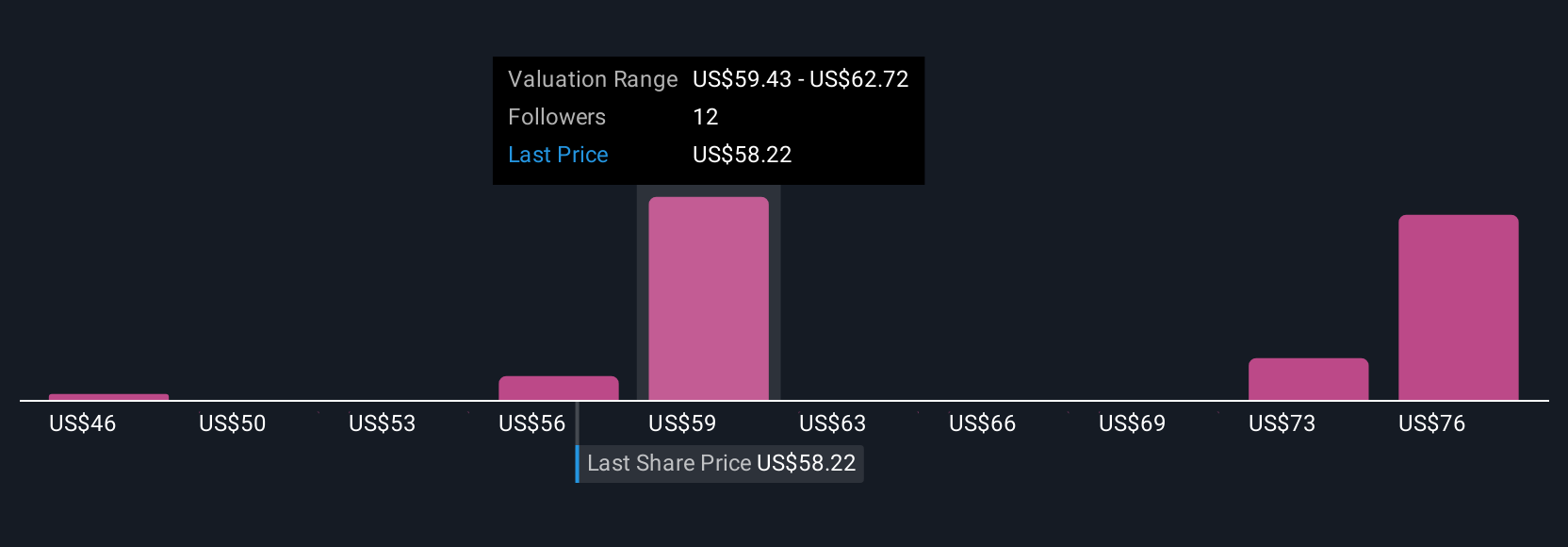

Upgrade Your Decision Making: Choose your Williams Companies Narrative

Earlier, we mentioned that there is a better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal, story-driven view on a company like Williams Companies. In a Narrative, you outline what you believe will happen to its future revenue, earnings, and profit margins, connecting those beliefs to a tailored financial forecast and fair value estimate. Narratives bridge the gap between the company’s bigger story, such as expanding infrastructure, regulatory risks, or sector shifts, and precise, forward-looking numbers. This approach helps make your analysis more deliberate and clear.

On Simply Wall St’s Community page, Narratives are easy to create and update, allowing investors of any experience level to track their own reasoning behind buy or sell decisions. They automatically update as new information emerges, so your point of view always reflects the latest news, earnings, or market changes. For example, one investor might build a bullish Narrative calculating a fair value of $74.00 per share based on robust LNG demand and steady margin gains. In contrast, a more cautious investor could assign a fair value of $44.00, focusing on regulatory and decarbonization risks. Narratives let you compare your view to the consensus and make investment decisions matched to your convictions and the real market price.

Do you think there's more to the story for Williams Companies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Williams Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMB

Williams Companies

Operates as an energy infrastructure company primarily in the United States.

Slightly overvalued with limited growth.

Similar Companies

Market Insights

Community Narratives