- United States

- /

- Oil and Gas

- /

- NYSE:WMB

A Fresh Look at Williams Companies (WMB) Valuation as Investor Optimism Builds

Reviewed by Simply Wall St

Williams Companies (WMB) may not be grabbing headlines this week with a major announcement, but recent trading data and its ongoing momentum continue to keep investors’ attention. The stock’s performance over the past month has been especially interesting for energy sector watchers.

See our latest analysis for Williams Companies.

This past year, Williams Companies has quietly built impressive long-term momentum, with a 101.7% total shareholder return over three years and a 258.8% gain over five years. Recent share price moves signal that optimism may be building again, especially after a 3.7% 1-month share price return and a steady year-to-date climb.

If you’re looking beyond the energy sector for stocks with robust performance and strong management backing, consider broadening your search and discover fast growing stocks with high insider ownership

With Williams Companies showing solid shareholder returns and consistent growth, the real question is whether its recent momentum leaves room for further upside or if future gains are already reflected in the current share price.

Most Popular Narrative: 11.6% Undervalued

Williams Companies' most-followed narrative suggests the stock's fair value is notably above its recent closing price, due to anticipated project contributions and margin expansion expected in the near future. This valuation puts investor focus on the next wave of growth drivers.

Widespread electrification (AI/data centers, power generation switching to gas), along with underinvestment and delays in new competing infrastructure, is causing system constraints and peak demand across Williams' existing assets. This supports higher pipeline utilization, pricing power, and margin improvement.

Curious why this pipeline leader demands a premium? There is a bold assumption fueling this price target. The focus is on future-proofing revenue from an unexpected source and maximizing returns from margin expansion. Interested in a deeper look into the projections behind this narrative? Discover the key trends and numbers involved—there may be surprises in store.

Result: Fair Value of $67.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this bullish scenario could change if decarbonization policies accelerate or if permitting delays hamper vital pipeline expansions. Both factors pose potential hurdles for future growth.

Find out about the key risks to this Williams Companies narrative.

Another View: Multiple-Based Valuation Paints a Cautious Picture

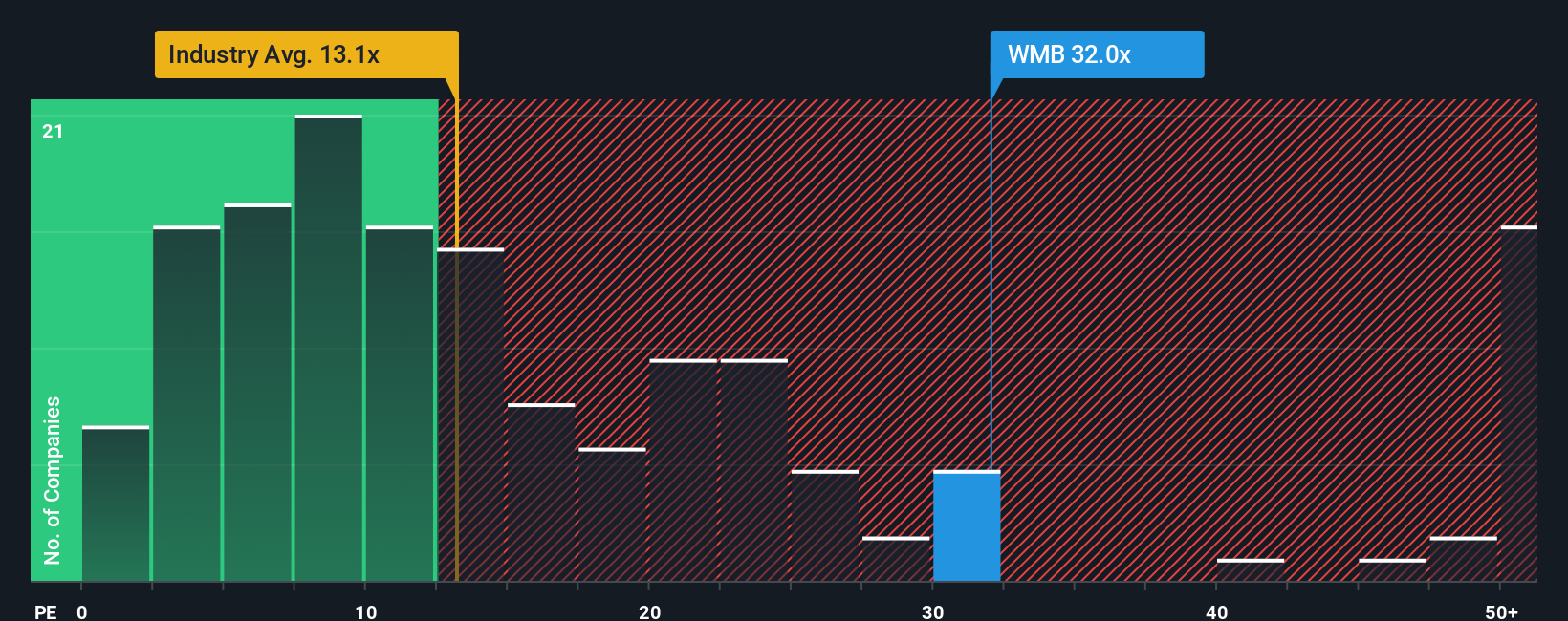

While the consensus narrative points to Williams Companies being undervalued, a look at the price-to-earnings ratio tells a more cautious story. The current P/E is 30.8x, which stands out versus both the U.S. Oil and Gas industry average of 13.1x and the peer group average of 14.7x. Even compared to the fair ratio of 21.8x, Williams trades well above what the market could rationally settle on. This gap hints at greater valuation risk if growth expectations fall short. Could this premium set investors up for disappointment, or is it a sign of genuine strength?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Williams Companies Narrative

If you want a fresh perspective or feel that your analysis tells a different story, it’s easy to dive into the numbers and shape your own view. Do it your way

A great starting point for your Williams Companies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Capitalize on the latest market opportunities and don’t let tomorrow’s winners pass you by. Use Simply Wall Street’s powerful tools to find your next standout investment:

- Spot untapped potential and fuel your portfolio with growth by seizing opportunities among these 3598 penny stocks with strong financials.

- Supercharge your returns as artificial intelligence transforms industries, and target companies at the forefront with these 26 AI penny stocks.

- Lock in passive income streams that can outpace inflation with these 16 dividend stocks with yields > 3%, spotlighting stocks with compelling yields and stable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Williams Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMB

Williams Companies

Operates as an energy infrastructure company primarily in the United States.

Limited growth with questionable track record.

Similar Companies

Market Insights

Community Narratives