- United States

- /

- Oil and Gas

- /

- NYSE:VLO

Will Valero Energy’s (VLO) CFO Transition Shed New Light on Its Financial Strategy?

Reviewed by Sasha Jovanovic

- On October 28, 2025, Valero Energy announced that Homer Bhullar will be promoted to Chief Financial Officer and Senior Vice President, succeeding Jason Fraser following his retirement at the end of December 2025.

- This leadership succession reflects Valero’s ongoing focus on continuity and deep internal experience, as Bhullar brings over a decade of company and sector expertise to his new financial stewardship role.

- We’ll explore how this CFO transition may influence Valero Energy’s investment narrative, especially in light of Mr. Bhullar’s extensive background.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Valero Energy Investment Narrative Recap

To be a Valero Energy shareholder, you need confidence in the company’s ability to adapt to industry shifts and maintain robust cash flows from refining, while managing regulatory and operational risks. The recent appointment of Homer Bhullar as CFO is not expected to materially impact the key short-term catalyst, the optimization project at St. Charles, nor does it significantly shift the biggest current risk, which remains potential asset impairments on the West Coast.

The company’s affirmation of a $1.13 per share quarterly dividend is especially meaningful in the context of leadership stability, as it highlights ongoing commitment to shareholder returns, even as executive roles transition. This dividend consistency may help support sentiment around Valero’s financial discipline and ability to execute on its near-term initiatives.

However, investors should also be aware that, despite management continuity, regulatory uncertainties tied to West Coast operations could...

Read the full narrative on Valero Energy (it's free!)

Valero Energy's outlook anticipates $116.8 billion in revenue and $3.8 billion in earnings by 2028. This projection involves a slight annual revenue decline of 0.2% and an increase in earnings of approximately $3.04 billion from the current $760 million.

Uncover how Valero Energy's forecasts yield a $180.78 fair value, in line with its current price.

Exploring Other Perspectives

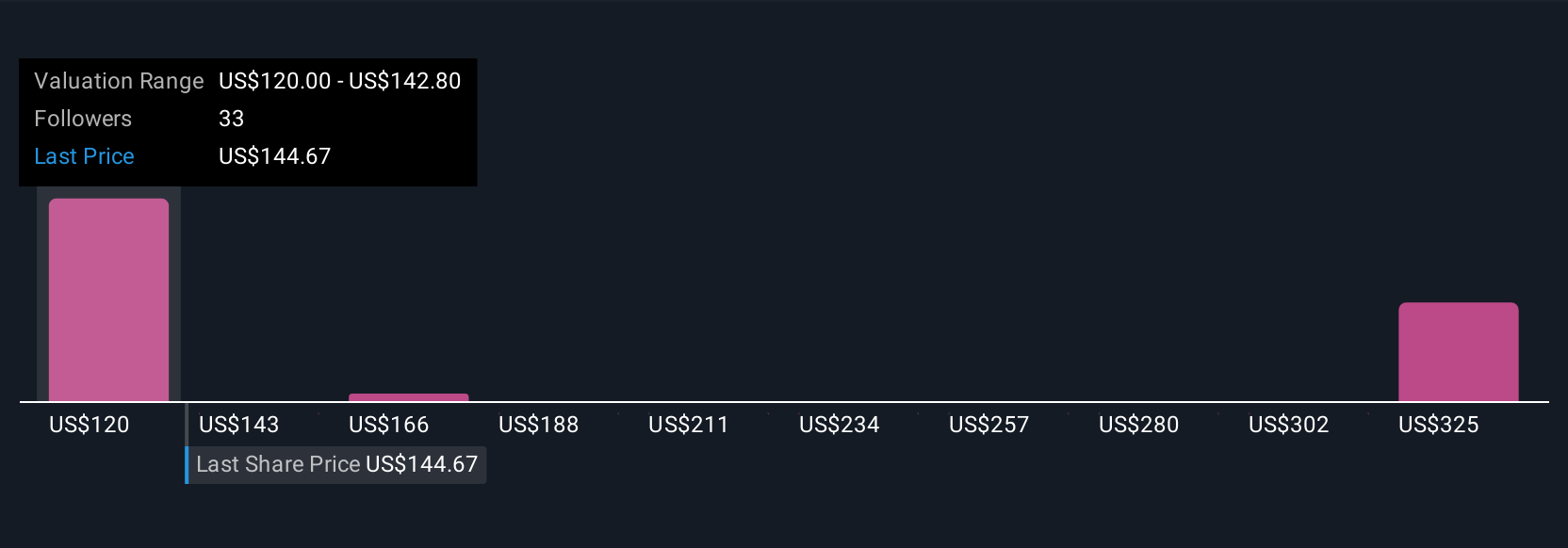

Four fair value estimates from the Simply Wall St Community range from US$128 to US$350, showing wide differences in growth projections and company outlooks. While views diverge, the risk of significant asset impairments on the West Coast remains a point many watch closely, be sure to consider several viewpoints before deciding how it might affect Valero’s long-term strength.

Explore 4 other fair value estimates on Valero Energy - why the stock might be worth 29% less than the current price!

Build Your Own Valero Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valero Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Valero Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valero Energy's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VLO

Valero Energy

Manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives