- United States

- /

- Oil and Gas

- /

- NYSE:VG

Can Venture Global (VG) Turn LNG Expansion and Mitsui Deal Into Lasting Global Advantage?

Reviewed by Sasha Jovanovic

- Earlier this month, Venture Global filed regulatory applications with U.S. authorities for its Plaquemines LNG brownfield expansion and announced a 20-year LNG supply agreement with Mitsui & Co. Ltd. of Japan beginning in 2029.

- This dual move highlights Venture Global's significant expansion in LNG production capacity and its strengthening long-term international client relationships.

- Next, we'll look at how the large-scale capacity boost from the Plaquemines expansion shapes Venture Global's investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Venture Global's Investment Narrative?

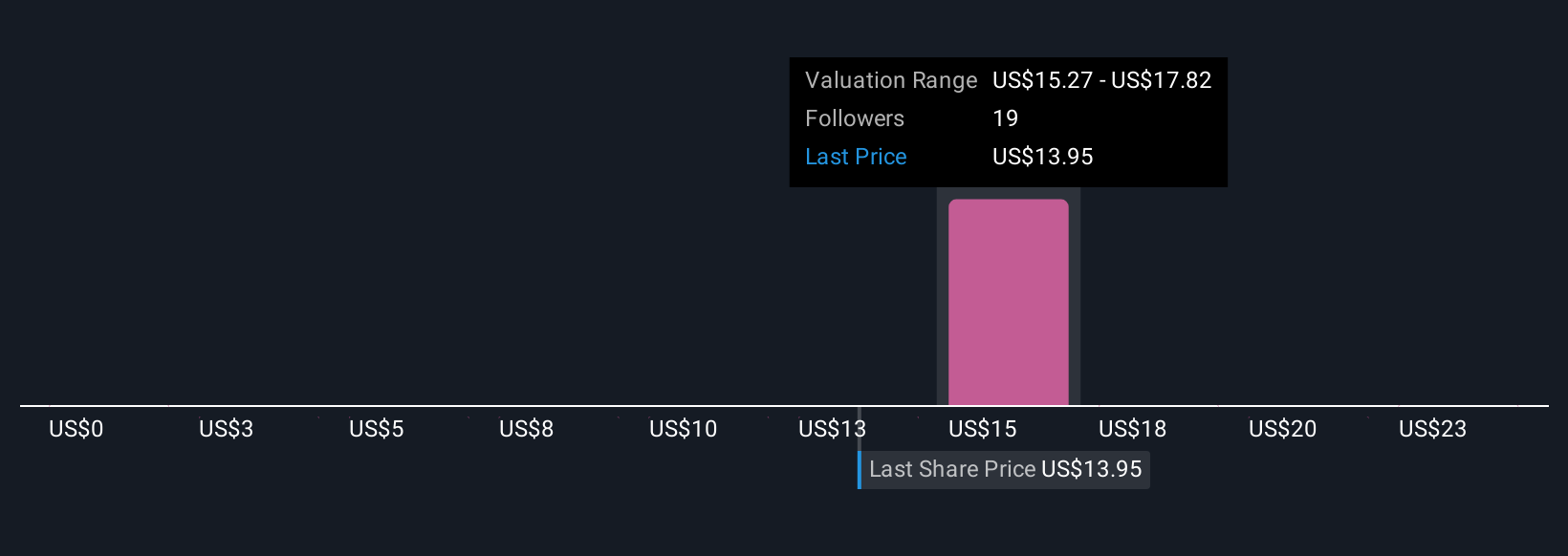

For someone considering Venture Global, the big picture revolves around betting on a company determined to be a major force in U.S. LNG exports, fueled by ambitious brownfield expansions and a flurry of long-term global supply contracts. The recent filing to expand the Plaquemines LNG complex and the 20-year SPA with Mitsui both speak to active client acquisition and significant capacity upgrades, which could boost future revenue potential and help offset current short-term concerns. Previously, a projected multi-year profit decline was flagged as a key risk, alongside a new and less experienced board. However, with the nearly 40% increase in Plaquemines output capacity and robust market demand, the near-term catalyst profile may now include renewed optimism on revenue growth or improved contract visibility. Given the massive expansion and deepening client relationships, current risks around execution and management depth now feel even more prominent. Still, the steep year-to-date share price pullback suggests the market may still be weighing these uncertainties heavily.

But the board’s lack of experience is something investors should keep in mind. Despite retreating, Venture Global's shares might still be trading 35% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 8 other fair value estimates on Venture Global - why the stock might be worth over 3x more than the current price!

Build Your Own Venture Global Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Venture Global research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Venture Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Venture Global's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VG

Venture Global

Engages in the development, construction, and production of natural gas liquefaction and export projects near the U.S.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success