- United States

- /

- Oil and Gas

- /

- NYSE:VG

Assessing Venture Global’s Valuation Amid LNG Expansion News and a 67% Share Price Drop

Reviewed by Bailey Pemberton

- Wondering if Venture Global is a bargain or overpriced right now? You are not alone. Many investors are closely watching the stock's valuation story unfold.

- Venture Global’s share price has increased 4.9% over the last week, but it is still down 67.1% year-to-date. This suggests both potential for a rebound and shifting risk perceptions.

- These price movements follow headlines about Venture Global’s expansion plans in the LNG sector and regulatory discussions affecting US exporters. The mix of ambitious growth announcements and external factors has certainly kept market sentiment cautious.

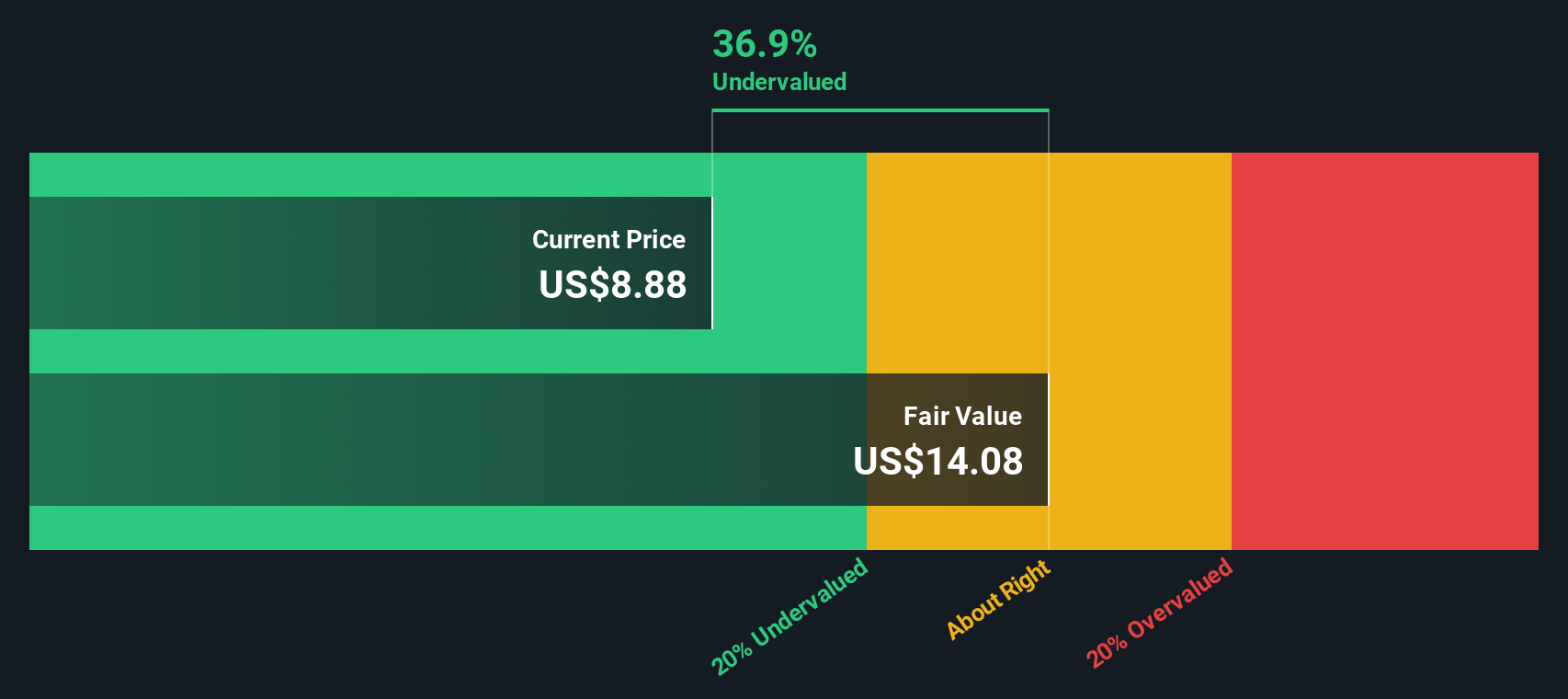

- Notably, Venture Global scores a 5 out of 6 on our undervaluation checks, which suggests attractive value across nearly every key measure. We will explore the usual valuation approaches next. There is also a more comprehensive method discussed later in this article.

Approach 1: Venture Global Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a valuation technique that estimates the intrinsic value of a company by projecting its future cash flows and then discounting them back to today's dollars. This helps investors determine what the business is truly worth based on the income it is expected to generate over time.

For Venture Global, the most recent reported Free Cash Flow (FCF) is negative, at approximately $10.7 Billion. Analyst forecasts indicate that FCF remains negative through 2028, but by 2029 it is projected to turn positive, reaching $1.56 Billion. Over the following decade, projections from Simply Wall St extrapolate growth, with FCF estimates surpassing $4 Billion by 2035.

Using these projections in the 2 Stage Free Cash Flow to Equity model, the intrinsic value per share is calculated at $12.01. Compared to the current share price, this implies a discount of 34.2%, suggesting that Venture Global is significantly undervalued based on its discounted future cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Venture Global is undervalued by 34.2%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

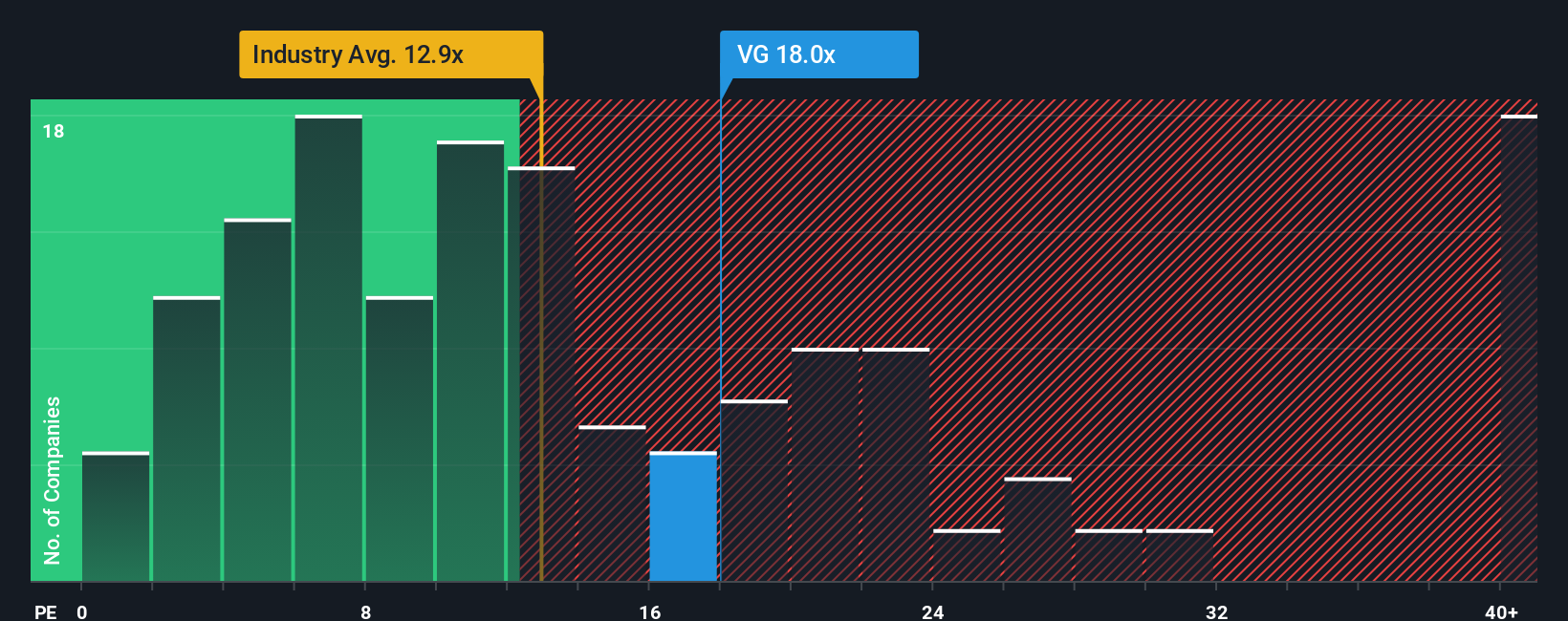

Approach 2: Venture Global Price vs Earnings (PE)

For companies with positive earnings, the Price-to-Earnings (PE) ratio is often the go-to valuation tool. It helps investors gauge how much they are paying for each dollar of current profits and provides a familiar benchmark for comparing similar businesses. A “normal” PE can vary significantly depending on growth expectations, market risks, and the overall confidence investors have in future profitability.

Venture Global’s current PE ratio stands at 9.5x. This is notably below the Oil and Gas industry average of 13.5x and well under the 22.5x peer group average. At first glance, this suggests the stock could be cheap relative to its sector and direct competitors. However, simply comparing these numbers does not factor in Venture Global’s unique growth, risk profile, profitability, or scale.

This is where the “Fair Ratio” from Simply Wall St comes in. The Fair Ratio, currently at 10.8x for Venture Global, is tailored to reflect the company’s specific earnings growth potential, its financial and operational risks, profit margins, industry category, and market capitalization. By looking beyond simple peer or industry averages, the Fair Ratio provides a more nuanced and relevant valuation benchmark.

Since Venture Global’s actual PE ratio is 9.5x and its Fair Ratio is 10.8x, the stock appears modestly undervalued based on this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1421 companies where insiders are betting big on explosive growth.

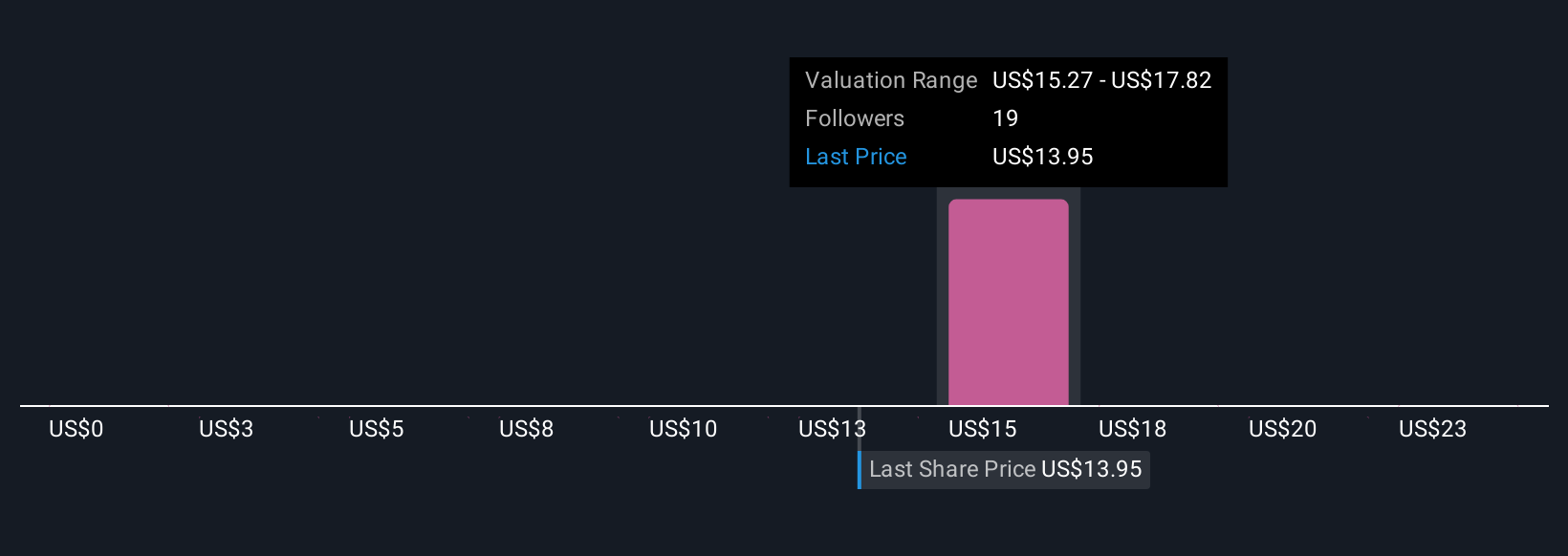

Upgrade Your Decision Making: Choose your Venture Global Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are simply the stories investors tell about a company, connecting their perspective and assumptions to concrete forecasts of future revenue, profits, margins, and fair value. This approach transforms numbers into meaning by linking Venture Global’s unique business journey to specific financial outlooks, making valuation both personal and dynamic.

On Simply Wall St’s Community page, Narratives are accessible and easy to use for millions of investors. They help you decide when to buy or sell by letting you compare your Narrative’s Fair Value with Venture Global’s current share price. In addition, every Narrative is updated in real time when significant news or company earnings are released, keeping your insights relevant and actionable. For example, one investor may build a Narrative based on aggressive future LNG market expansion and arrive at a Fair Value as high as $25 per share, while another foresees regulatory headwinds and estimates just $7 per share.

With Narratives, you get a practical, flexible tool to make smarter, more informed investment decisions. This approach is rooted not just in data but in your own interpretation of Venture Global’s future.

Do you think there's more to the story for Venture Global? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VG

Venture Global

Engages in the development, construction, and production of natural gas liquefaction and export projects near the U.S.

Undervalued with low risk.

Similar Companies

Market Insights

Community Narratives