- United States

- /

- Oil and Gas

- /

- NYSE:TRGP

Will a 45% Dividend Hike Signal a New Chapter for Targa Resources' (TRGP) Growth Story?

Reviewed by Sasha Jovanovic

- Recently, Targa Resources, Inc. reported a 45.5% increase in its annualized dividend to US$1.00 per share, raising its dividend yield to 2.64%, alongside expectations for strong earnings growth this fiscal year.

- This marked increase in shareholder payouts highlights the company's confidence in its cash flow stability and potential for continued financial strength.

- We'll explore how robust dividend growth reinforces Targa Resources' investment narrative in light of recent bullish analyst assumptions.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

Targa Resources Investment Narrative Recap

Owning shares in Targa Resources requires confidence in the company’s ability to sustain strong cash flows amid continued investment in growth, especially in the Permian Basin and US Gulf Coast. The recent 45.5% dividend increase underlines management’s positive outlook, but it does not materially shift the short-term catalyst, which remains centered on expanding NGL and natural gas volumes, nor does it reduce the key risk of overbuild and intensifying competition in core regions.

Among the company’s recent developments, the September 2025 announcement of major organic growth projects, like the Speedway NGL Pipeline and Yeti Gas Processing Plant in the Permian, stands out. These expansions directly support the company’s short-term focus on boosting throughput and utilization, providing a potential tailwind for maintaining or growing earnings, but also heighten exposure to competitive and market risks as regional infrastructure capacity increases.

Yet, even as the dividend rises, investors should be aware that...

Read the full narrative on Targa Resources (it's free!)

Targa Resources' outlook anticipates $23.6 billion in revenue and $2.4 billion in earnings by 2028. Achieving this would require an annual revenue growth rate of 11.4% and a $0.9 billion increase in earnings from the current $1.5 billion.

Uncover how Targa Resources' forecasts yield a $205.30 fair value, a 32% upside to its current price.

Exploring Other Perspectives

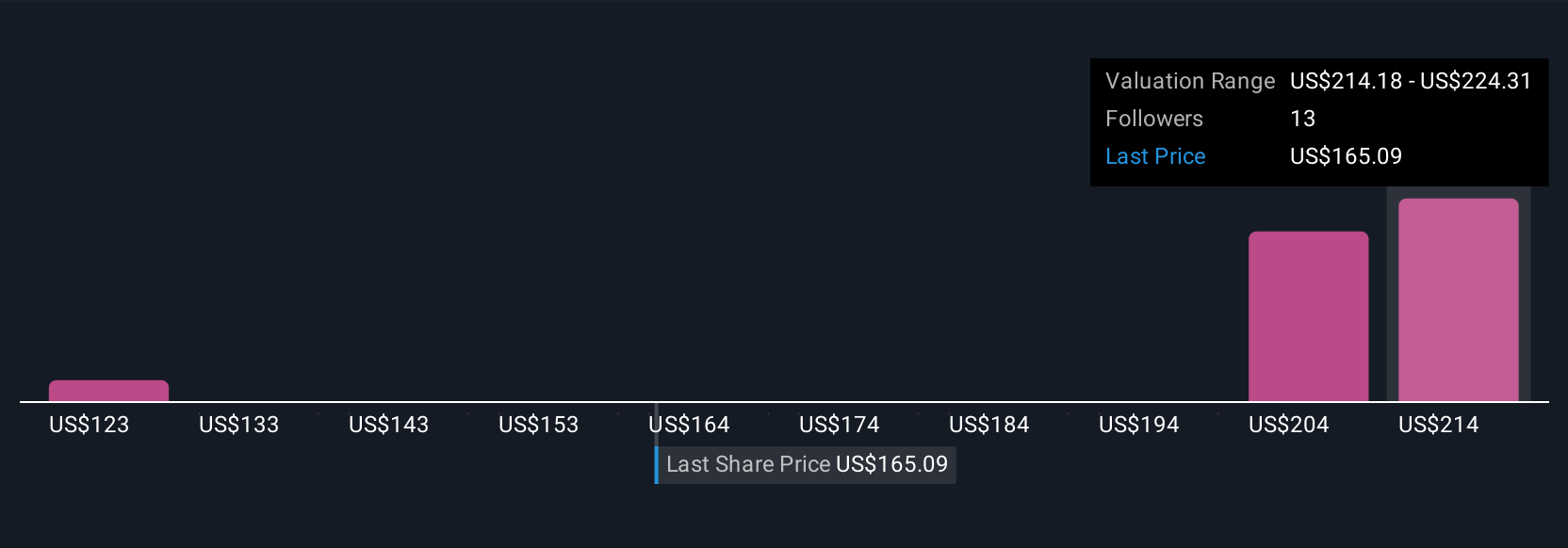

Simply Wall St Community members placed Targa’s fair value between US$128.57 and US$321.46, spanning five separate estimates. While opinions vary widely, planned Permian expansions and competitive threats underscore why performance expectations remain so divided, see how your view compares to others in the community.

Explore 5 other fair value estimates on Targa Resources - why the stock might be worth 18% less than the current price!

Build Your Own Targa Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Targa Resources research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Targa Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Targa Resources' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Targa Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRGP

Targa Resources

Together with its subsidiary, Targa Resources Partners LP, owns, operates, acquires, and develops a portfolio of complementary domestic infrastructure assets in North America.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives