- United States

- /

- Oil and Gas

- /

- NYSE:TRGP

Targa Resources (TRGP) Margin Rise Reinforces Profit Narrative Despite Slower Revenue Growth

Reviewed by Simply Wall St

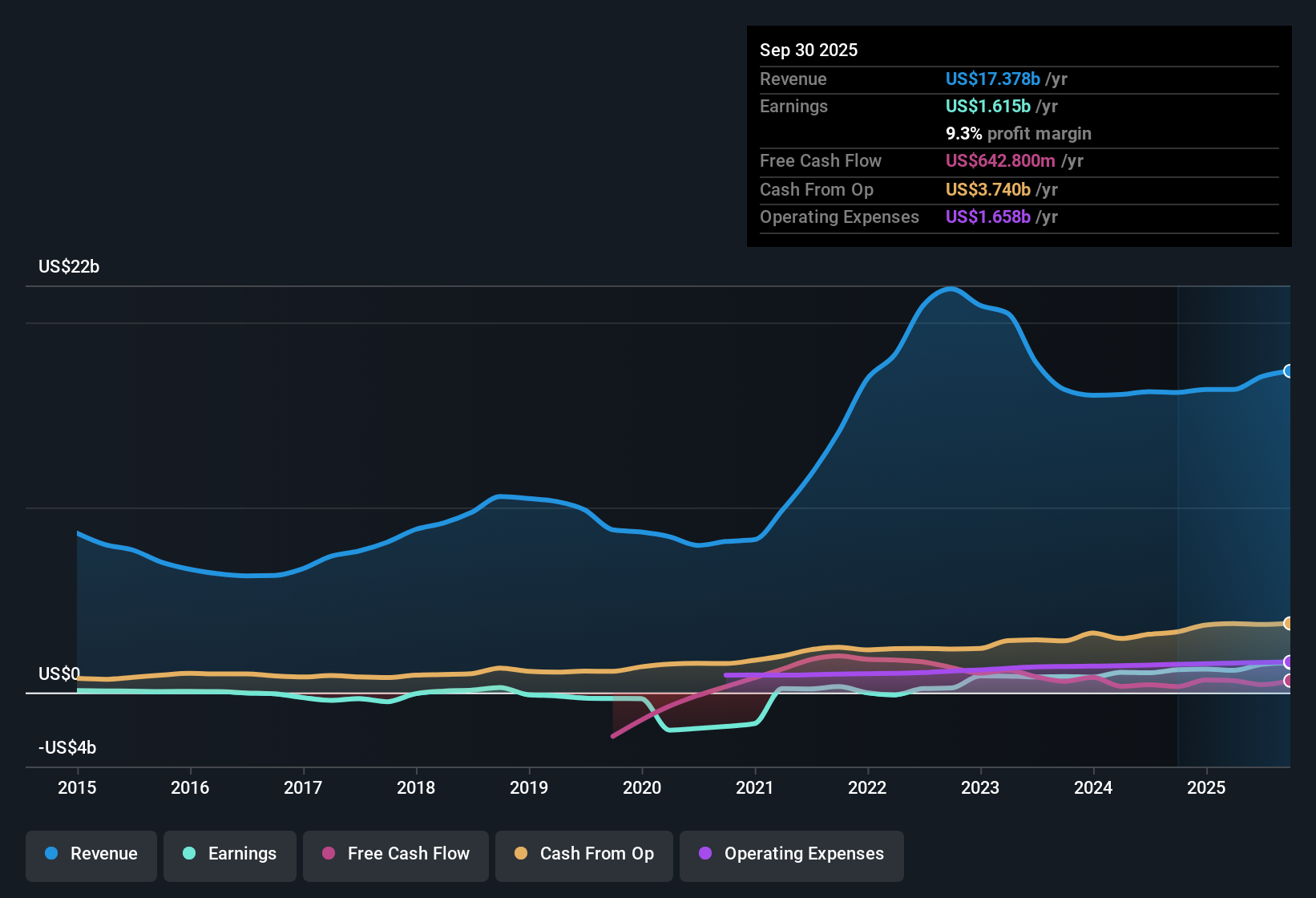

Targa Resources (TRGP) delivered annual revenue growth of 4.1%, trailing the broader US market’s 10.5% pace. Net profit margins have risen to 8.9% from 6.5%, highlighting greater operational efficiency. Earnings are forecast to climb 10% per year, which is short of the US market’s 16% annual projection, and the company’s share price currently stands at $162.69, which is below some analyst fair value estimates. While longer-term earnings surged by an average of 62.5% per year over the last five years, the most recent year’s growth of 43.2% marks a slowdown from this robust trend.

See our full analysis for Targa Resources.Now, let’s see how these numbers measure up against the broader market expectations and community narratives that often shape sentiment around Targa Resources.

See what the community is saying about Targa Resources

Margin Upswing Outpaces Industry Peers

- Net profit margins reached 8.9%, advancing from 6.5% previously, while analysts forecast further improvement to 10.3% over the next three years. This surpasses average margin expansion rates for comparable oil and gas firms.

- Analysts' consensus view highlights that these margin gains, along with stable fee-based contracts and growing export capabilities, heavily support the idea that Targa can sustain resilient earnings growth even as competition and costs rise.

- Contracted cash flows and targeted infrastructure expansion in the Permian are seen as key levers. Utilization and scale efficiencies are helping to counteract industry cost pressures.

- Still, the consensus warns that heavy capital spending and regulatory scrutiny remain important watchpoints for future margin preservation.

- See what underpins the market’s balanced perspective, and how margin trends set the tone for future debates about upside versus risk. 📊 Read the full Targa Resources Consensus Narrative.

Trading at a Premium, Yet Below Targets

- The company’s current Price-to-Earnings ratio sits at 23x, a notable premium over the peer average of 14.2x and the broader US oil and gas industry at 12.7x. Targa trades at $162.69 per share, which is below the consensus analyst price target of $205.05.

- Analysts' consensus view points out that, despite this premium, ongoing profit and revenue growth plus share buybacks support the argument for an undervaluation relative to future fundamentals.

- The analysts expect revenues to climb to $23.6 billion and earnings to reach $2.4 billion by 2028, with buybacks reducing shares outstanding by 1.32% annually. Both are seen as supportive for per-share value.

- However, in order to meet the price target, Targa would need to maintain a PE ratio of 21.9x on projected 2028 earnings, which is still well above sector norms.

Profit Growth Momentum Moderates

- Long-term earnings grew by 62.5% per year on average over the past five years, but slowed to 43.2% growth in the most recent year. This indicates that the pace of improvement may be moving closer to the broader market's 16% forecasted run rate.

- Analysts' consensus view notes that while Targa's core contract and infrastructure advantages remain a differentiator, the recent slowdown coincides with intensifying competition and the risk of overbuild in export and pipeline infrastructure.

- Consensus commentary highlights that as capital projects mature, maintaining rapid growth will require ongoing efficiency and successful execution against rising regulatory and competitive headwinds.

- Potential margin compression from new entrants and increased environmental regulation could further limit upside if not managed proactively.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Targa Resources on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at these numbers from a unique angle? In just a few minutes, you can build your own perspective and share your view. Do it your way

A great starting point for your Targa Resources research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Targa Resources’ growth pace is visibly moderating. Earnings and margins are facing pressure as competition intensifies and sector valuation remains a concern.

If you’re searching for more attractive opportunities with potential upside, discover these 843 undervalued stocks based on cash flows designed to highlight stocks trading below their fair value and offering stronger return prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Targa Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRGP

Targa Resources

Together with its subsidiary, Targa Resources Partners LP, owns, operates, acquires, and develops a portfolio of complementary domestic infrastructure assets in North America.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives