- United States

- /

- Oil and Gas

- /

- NYSE:TEN

Don't Race Out To Buy Tsakos Energy Navigation Limited (NYSE:TNP) Just Because It's Going Ex-Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Tsakos Energy Navigation Limited (NYSE:TNP) is about to go ex-dividend in just three days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. Therefore, if you purchase Tsakos Energy Navigation's shares on or after the 13th of July, you won't be eligible to receive the dividend, when it is paid on the 20th of July.

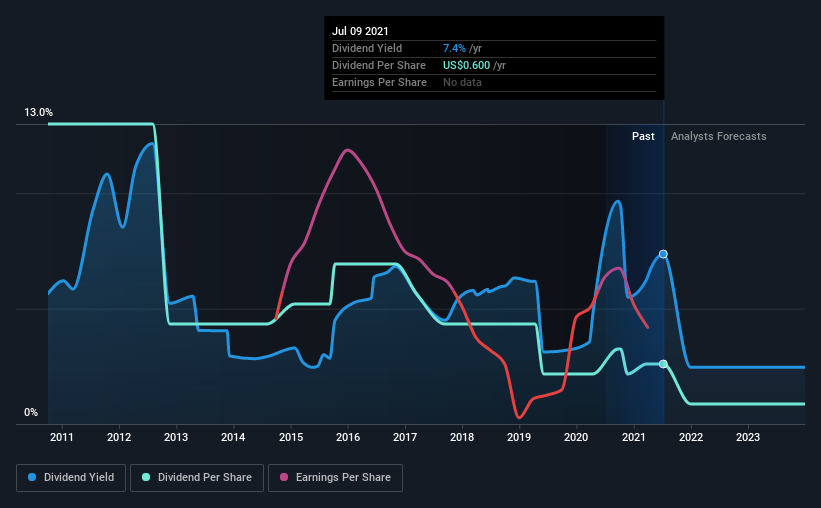

The company's next dividend payment will be US$0.10 per share, on the back of last year when the company paid a total of US$0.60 to shareholders. Calculating the last year's worth of payments shows that Tsakos Energy Navigation has a trailing yield of 7.4% on the current share price of $8.15. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. As a result, readers should always check whether Tsakos Energy Navigation has been able to grow its dividends, or if the dividend might be cut.

Check out our latest analysis for Tsakos Energy Navigation

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Tsakos Energy Navigation reported a loss last year, so it's not great to see that it has continued paying a dividend. Considering the lack of profitability, we also need to check if the company generated enough cash flow to cover the dividend payment. If cash earnings don't cover the dividend, the company would have to pay dividends out of cash in the bank, or by borrowing money, neither of which is long-term sustainable. Over the last year, it paid out dividends equivalent to 272% of what it generated in free cash flow, a disturbingly high percentage. Our definition of free cash flow excludes cash generated from asset sales, so since Tsakos Energy Navigation is paying out such a high percentage of its cash flow, it might be worth seeing if it sold assets or had similar events that might have led to such a high dividend payment.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Tsakos Energy Navigation reported a loss last year, and the general trend suggests its earnings have also been declining in recent years, making us wonder if the dividend is at risk.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Tsakos Energy Navigation's dividend payments per share have declined at 15% per year on average over the past 10 years, which is uninspiring. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

Remember, you can always get a snapshot of Tsakos Energy Navigation's financial health, by checking our visualisation of its financial health, here.

The Bottom Line

Has Tsakos Energy Navigation got what it takes to maintain its dividend payments? It's hard to get used to Tsakos Energy Navigation paying a dividend despite reporting a loss over the past year. Worse, the dividend was not well covered by cash flow. Bottom line: Tsakos Energy Navigation has some unfortunate characteristics that we think could lead to sub-optimal outcomes for dividend investors.

So if you're still interested in Tsakos Energy Navigation despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. Every company has risks, and we've spotted 2 warning signs for Tsakos Energy Navigation (of which 1 is concerning!) you should know about.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Tsakos Energy Navigation or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tsakos Energy Navigation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:TEN

Tsakos Energy Navigation

Provides seaborne crude oil and petroleum product transportation services worldwide.

Good value average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026