- United States

- /

- Oil and Gas

- /

- NYSE:TNK

How Teekay Tankers’ (TNK) Strong Q3 Results Could Shift Investor Sentiment and Outlook

Reviewed by Sasha Jovanovic

- Teekay Tankers recently reported robust third-quarter 2025 results, with both adjusted earnings per share and revenue surpassing analyst forecasts and reflecting strong operational execution.

- This performance was met with mixed market reactions, highlighting how even standout quarterly results can generate uncertainty or prompt shifting investor sentiment.

- We'll now explore how Teekay Tankers' outperformance in its latest quarterly results could influence the company's investment narrative and outlook.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Teekay Tankers Investment Narrative Recap

Investing in Teekay Tankers requires confidence in the company's ability to capitalize on shifts in global oil trade, while managing exposure to market cyclicality and evolving regulatory standards. Despite recent outperformance in Q3 2025, this news does not materially alter the key short-term catalyst, tightening global fleet supply from limited new tanker orders; nor does it address the principal risk of falling oil demand growth and its potential impact on vessel utilization. One of the most relevant recent announcements is the continuation of quarterly dividends, with a fixed cash payout of $0.25 per share for Q3 2025. This reinforces management's focus on shareholder returns and capital discipline, directly linking to the importance of cash flow stability at a time when near-term tanker supply and demand dynamics remain in focus for investors. Yet, in contrast to consistent dividend payments, investors should be aware of...

Read the full narrative on Teekay Tankers (it's free!)

Teekay Tankers is projected to reach $464.3 million in revenue and $238.5 million in earnings by 2028. This outlook is based on an anticipated 22.5% annual decline in revenue and a $43.8 million decrease in earnings from the current $282.3 million.

Uncover how Teekay Tankers' forecasts yield a $64.33 fair value, a 4% upside to its current price.

Exploring Other Perspectives

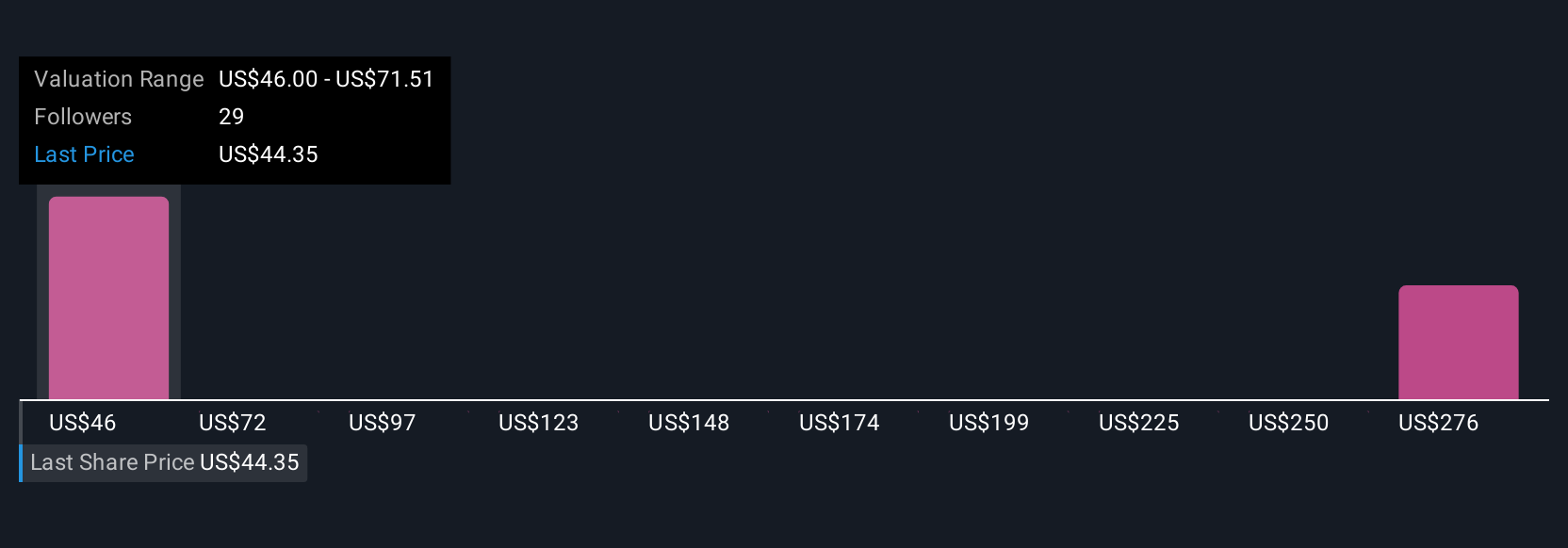

Simply Wall St Community fair value estimates for Teekay Tankers span US$61 to US$409, with 5 unique perspectives highlighting sharp differences in outlook. With tanker market volatility persisting, you can compare these varied views directly to recent near-record highs and see how shifting oil demand forecasts might affect future results.

Explore 5 other fair value estimates on Teekay Tankers - why the stock might be worth just $61.10!

Build Your Own Teekay Tankers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teekay Tankers research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Teekay Tankers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teekay Tankers' overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teekay Tankers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNK

Teekay Tankers

Provides marine transportation services to oil industries in Bermuda and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives