- United States

- /

- Oil and Gas

- /

- NYSE:TK

Teekay Corporation's (NYSE:TK) Shares Lagging The Market But So Is The Business

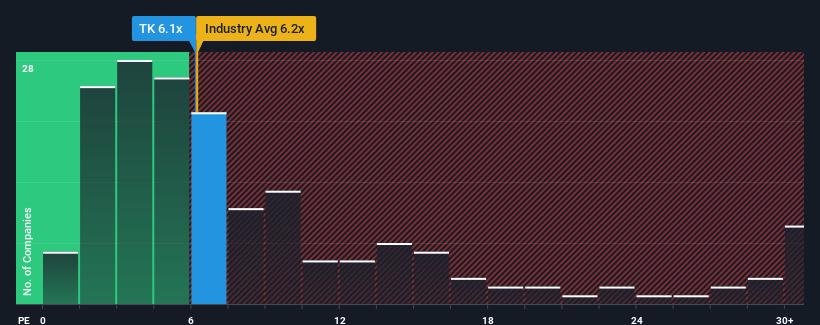

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 15x, you may consider Teekay Corporation (NYSE:TK) as a highly attractive investment with its 6.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

We'd have to say that with no tangible growth over the last year, Teekay's earnings have been unimpressive. One possibility is that the P/E is low because investors think this benign earnings growth rate will likely underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Teekay

Is There Any Growth For Teekay?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Teekay's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. That's essentially a continuation of what we've seen over the last three years, as its EPS growth has been virtually non-existent for that entire period. Therefore, it's fair to say that earnings growth has definitely eluded the company recently.

This is in contrast to the rest of the market, which is expected to grow by 4.3% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Teekay is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

What We Can Learn From Teekay's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Teekay revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Teekay with six simple checks.

Of course, you might also be able to find a better stock than Teekay. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Teekay might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TK

Teekay

Provides crude oil marine transportation and other marine services worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success