- United States

- /

- Oil and Gas

- /

- NYSE:TALO

Why Talos Energy (TALO) Raised Production Guidance Despite Reporting Quarterly Loss and Property Impairment

Reviewed by Sasha Jovanovic

- Talos Energy announced past third quarter results with a net loss of US$95.91 million as revenue declined, and issued increased production guidance for the remainder of 2025 alongside US$60.21 million in property impairment charges.

- While financial pressures were evident, the company raised its full-year production outlook, signaling operational momentum despite recent earnings and impairment challenges.

- We'll examine how the upward revision in oil and gas production guidance shapes Talos Energy's broader investment narrative going forward.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Talos Energy Investment Narrative Recap

To see value in Talos Energy, an investor needs confidence that rising production per management guidance can offset recent net losses, impairments, and sector volatility. This latest guidance uplifts the short-term production outlook, yet does not materially shift the biggest immediate risk, which remains Talos’s exposure to Gulf of Mexico operational interruptions and regulatory liabilities that can impact cost and earnings stability.

The November announcement updating full-year production guidance stands out as the most relevant, since higher expected output can serve as a catalyst to stabilize revenues following a challenging earnings period. Investors will be monitoring whether this increase in production meaningfully translates to improvements in cash flow and margin amid ongoing cost and regulatory pressures.

But against this opportunity, investors should be aware that more frequent storms and climate-driven risks in the Gulf of Mexico may...

Read the full narrative on Talos Energy (it's free!)

Talos Energy's projections anticipate $1.8 billion in revenue and $260.2 million in earnings by 2028. This outlook assumes a 3.0% annual decline in revenue and an earnings increase of $432.3 million from current earnings of -$172.1 million.

Uncover how Talos Energy's forecasts yield a $12.91 fair value, a 24% upside to its current price.

Exploring Other Perspectives

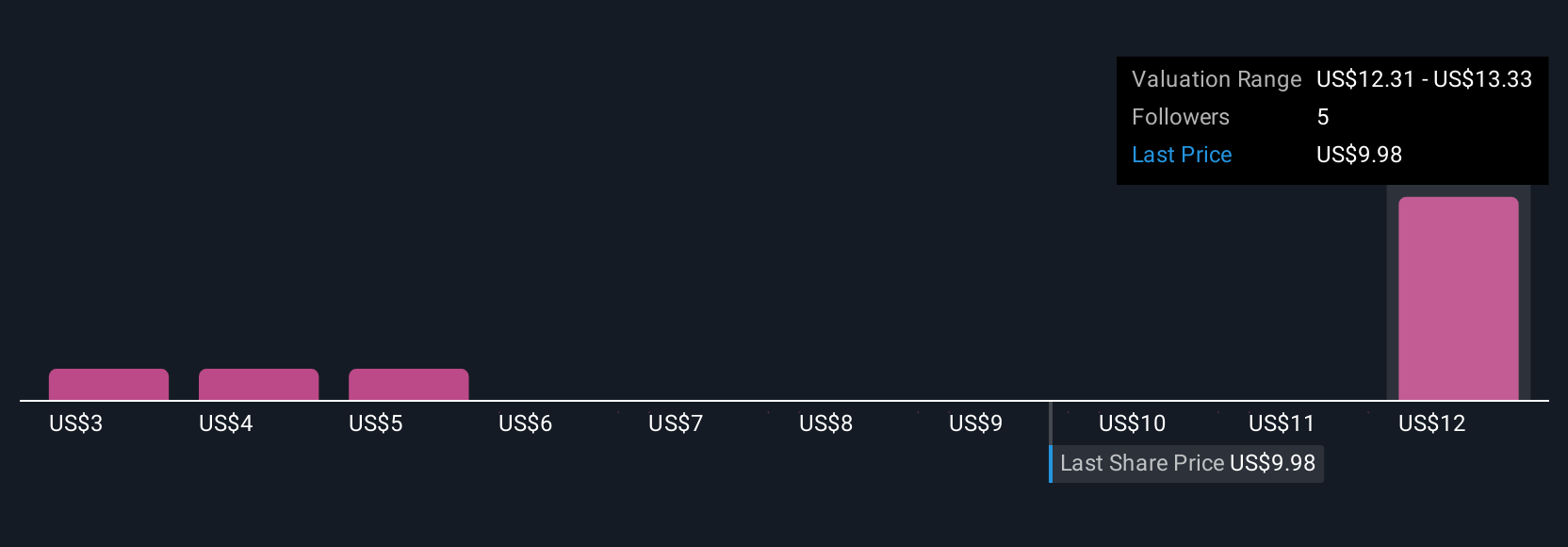

Four community-sourced fair value estimates for Talos range from US$3.07 to US$12.91 per share on Simply Wall St. While many see possible upside, persistent profitability challenges could impact long-term returns, so compare these viewpoints for a broader sense of sentiment.

Explore 4 other fair value estimates on Talos Energy - why the stock might be worth less than half the current price!

Build Your Own Talos Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Talos Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Talos Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Talos Energy's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Talos Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TALO

Talos Energy

Through its subsidiaries, engages in the exploration and production of oil, natural gas, and natural gas liquids in the United States and Mexico.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives