- United States

- /

- Oil and Gas

- /

- NYSE:STNG

Scorpio Tankers (STNG): Profit Margin Falls Sharply, Earnings Quality Concerns Challenge Bullish Narratives

Reviewed by Simply Wall St

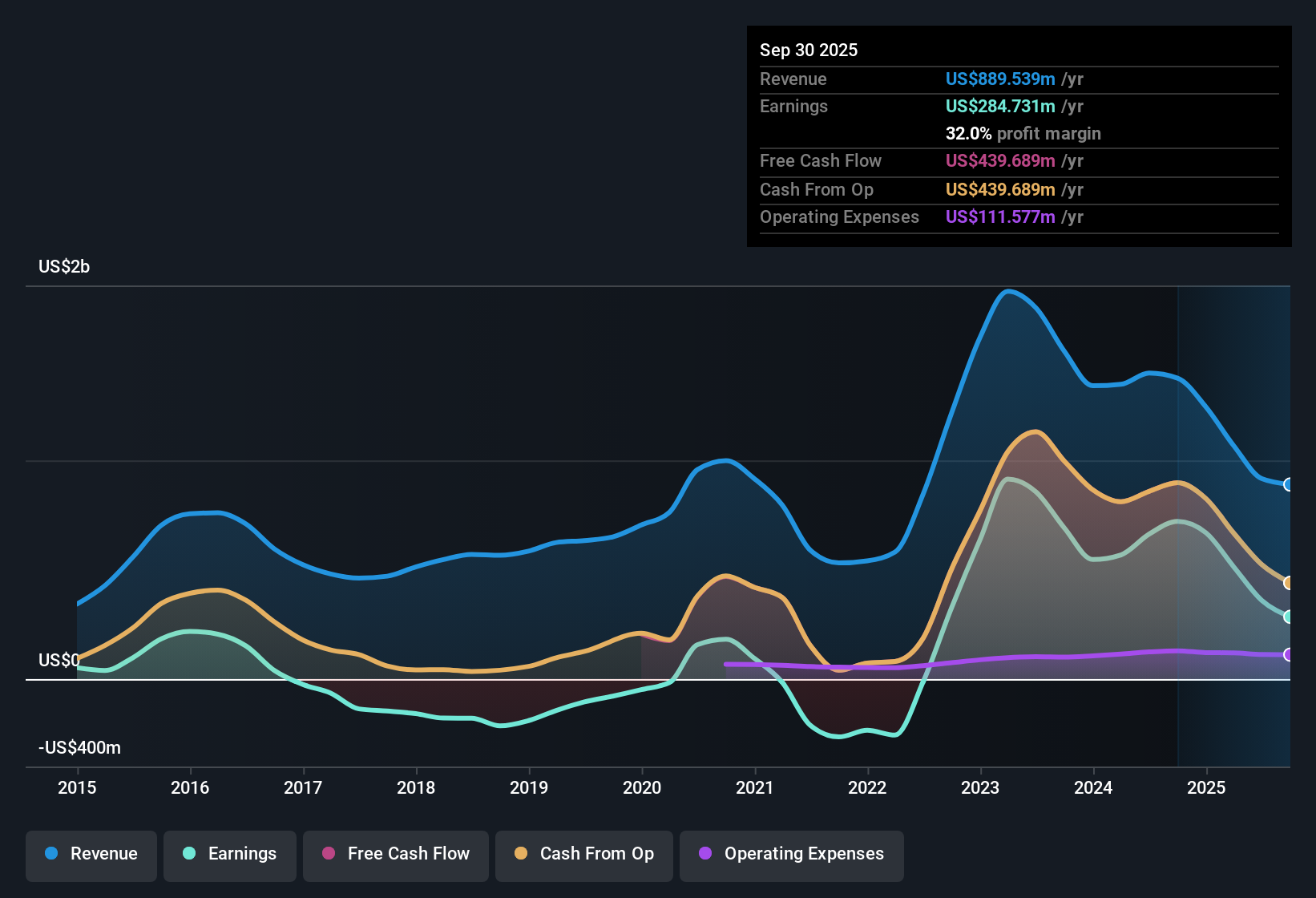

Scorpio Tankers (STNG) reported net profit margins of 39.2%, down from 47.4% in the previous period. This signals a notable decline in profitability. Over the last five years, earnings have impressively grown by 42.2% annually. However, the most recent year showed negative growth. The bottom line was also lifted by a $116.4 million one-off gain, making the quality of reported earnings a key focus for investors heading into the next period.

See our full analysis for Scorpio Tankers.Let’s see how these headline results compare with market expectations and the key narratives investors are monitoring right now.

See what the community is saying about Scorpio Tankers

Analyst Growth Forecasts Lag Market

- Wall Street forecasts Scorpio Tankers’ earnings growth at just 1% per year and revenue growth at 1.1% per year, which is materially slower than the broader US market’s expected growth rates. This also represents a marked reduction from its five-year average earnings growth of 42.2% per year.

- According to the analysts' consensus view, structural shifts in global refining and trade flows are anticipated to help counteract weaker forecast numbers. Scorpio’s young, efficient fleet and improved balance sheet put it in a position to potentially outperform modest market expectations.

- Consensus narrative highlights that Scorpio’s competitive edge lies in capturing demand stemming from refinery closures in the West and new capacity in Asia and the Middle East. This is expected to drive longer voyages and improved freight rates, partly balancing out the weaker top-line growth forecast.

- However, with future margins forecast to compress, from 39.2% currently to 31.1% in three years, even the fleet advantages may not fully offset sector pressures. This creates a balancing act for investors weighing optimism against cautious earnings guidance.

To see if the market’s cautious forecast aligns with other investors’ perspectives, catch the latest consensus thinking in the full narrative. 📊 Read the full Scorpio Tankers Consensus Narrative.

Valuation Appears Favorable Versus Sector

- At a current price-to-earnings ratio (PE) of 7.9x versus 12.8x for the broader industry and 12.4x for sector peers, Scorpio’s valuation screens as significantly cheaper. Its $61.14 share price also sits far beneath the DCF fair value estimate of $291.13, marking an unusually wide valuation gap for the group.

- The consensus narrative points out this discount could offer a cushion against slower profit growth, with analysts suggesting Scorpio’s revamped capital structure and lower net debt extend room for buybacks or dividends.

- Yet, while the value gap is attractive, consensus expects profit margins to contract noticeably over the next three years. Most analysts predict only modest upside for the share price to a target of $69.11, a roughly 13% gain from current levels, which is less than the DCF fair value would imply.

- This disconnect between strong capital fundamentals and muted price targets underscores the risk that lower forward growth and sector headwinds could keep a lid on re-rating potential, at least in the near term.

Dividend Flags and Earnings Quality Watch

- Scorpio’s robust net profit margin of 39.2% was flattered by a one-off gain of $116.4 million in the last 12 months, raising questions about the sustainability of this level of reported profitability. Additionally, the dividend has been flagged as potentially unsustainable if margins compress as forecast.

- The consensus narrative notes that although current liquidity and a reduced debt load could allow for continued shareholder returns via buybacks or dividends, ongoing regulatory shifts and industry supply risks threaten longer-term cash flow stability.

- Susceptibility to spot market swings and future capex needs associated with fleet renewal are concrete risks that could pressure both free cash flow and net income, challenging optimistic assumptions about future distributions.

- This focus on earnings quality and payout durability brings attention to how much of the headline profitability is repeatable, versus temporary spikes from non-recurring gains.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Scorpio Tankers on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a fresh take on the figures? Share your outlook and build your own narrative in just a few minutes. Do it your way

A great starting point for your Scorpio Tankers research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Scorpio Tankers faces pressure from shrinking profit margins, limited earnings growth, and concerns about the reliability of future dividends if profitability slips further.

Want more dependable income? Check out these 2002 dividend stocks with yields > 3% to find companies offering stronger, sustainable dividend yields even as markets face uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STNG

Scorpio Tankers

Engages in the seaborne transportation of crude oil and refined petroleum products worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives