- United States

- /

- Oil and Gas

- /

- NYSE:SM

SM Energy (SM) Net Margin Declines to 27.1%, Testing Bullish Case on Profit Resilience

Reviewed by Simply Wall St

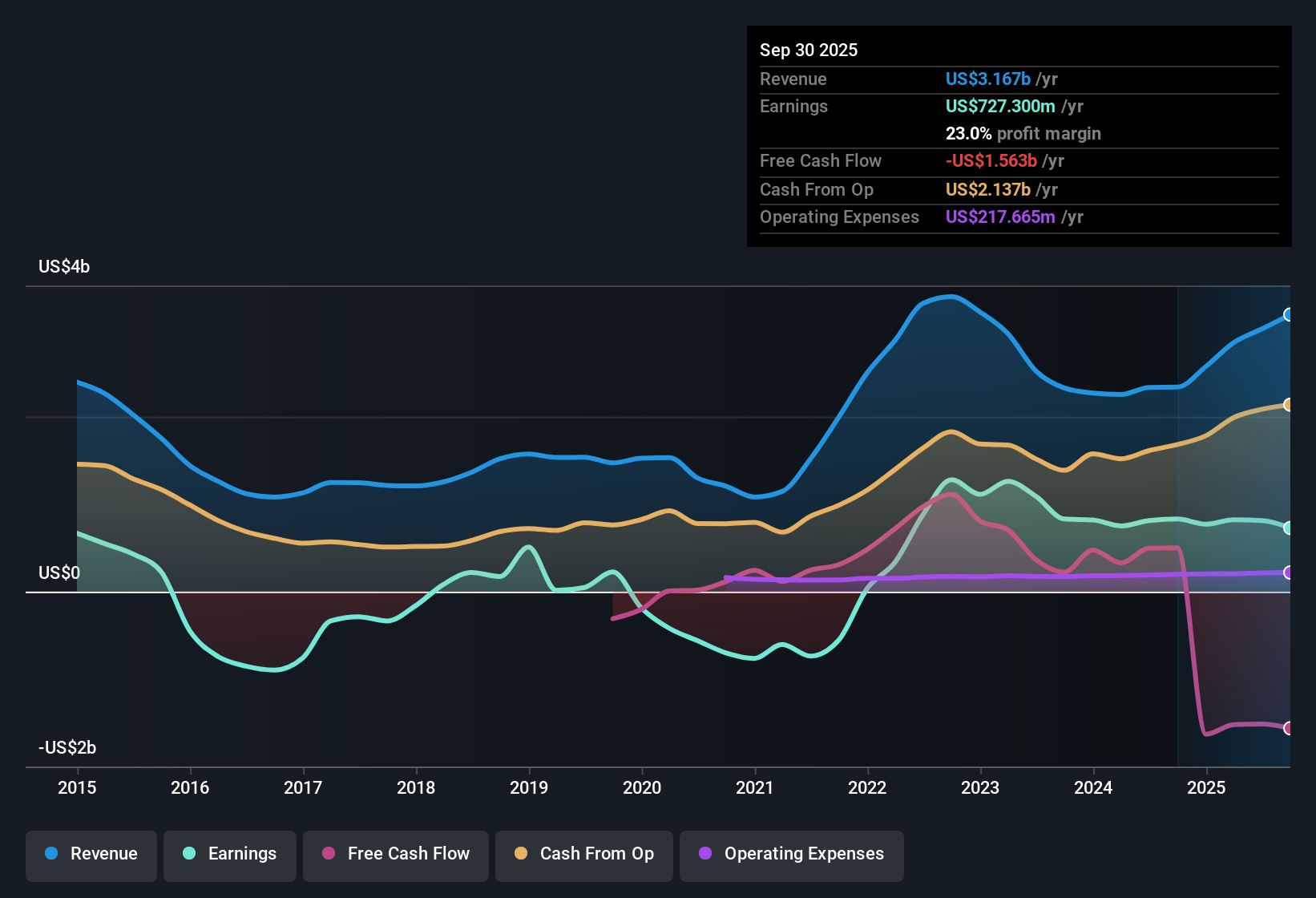

SM Energy (SM) reported a net profit margin of 27.1%, falling short of last year’s 34.3%. While the company became profitable over the past five years and averaged 47% annual earnings growth during that period, earnings growth in the most recent year slowed to just 0.2%. Looking ahead, investors are weighing the company’s historically strong profit growth against forecasts that call for a 14.6% annual decline in earnings over the next three years.

See our full analysis for SM Energy.Now, let’s see how these earnings results measure up against the current market narratives and what they might mean for SM Energy’s outlook going forward.

See what the community is saying about SM Energy

Share Price Lags 37% Analyst Target

- SM Energy trades at $19.35, which is about 48% below the analysts' consensus price target of $37.17, even though the company is forecast to deliver $550.3 million in earnings by 2028. Profit margins are expected to compress from 27.1% to 15.5% over that period.

- Analysts' consensus view sees a mix of strengths and headwinds shaping the near-term path for the stock.

- Forecasts point to revenue growing by 5.7% annually for three years, but anticipate earnings dropping 14.6% each year, largely due to margin contraction and cost pressures.

- Analysts believe operational improvements, including disciplined capital allocation and technology gains, will help cushion the downside. However, there is wide disagreement: projections for 2028 earnings range from a bearish $474 million to a bullish $1.1 billion.

Analysts argue there may be room for further upside based on long-term production growth and balance sheet strength. See how the full consensus narrative weighs these factors against downside risks. 📊 Read the full SM Energy Consensus Narrative.

Margin Compression Outpaces Revenue Growth

- While revenue is projected to increase by 5.7% per year, net profit margin is expected to fall to 15.5% in three years. This compares to the already narrower 27.1% margin today and last year’s 34.3%, a sign that costs are rising faster than top-line gains.

- Consensus narrative notes that despite technology and efficiency investments designed to bolster margins and support free cash flow resilience, SM Energy’s heavy operating dependence on a few shale regions could drag on profitability if transportation bottlenecks or regional price pressures emerge.

- Sustained capital spending is needed to maintain production levels in high-decline basins, so even modest declines in commodity prices or well performance could squeeze margins harder than expected.

- This challenge tempers the optimistic case that scale and operational excellence alone will preserve profit growth.

Valuation Appears Cheap Versus Peers

- SM Energy’s price-to-earnings (P/E) ratio is only 2.7x, much lower than the US oil and gas industry average of 12.9x and its peer average of 30.7x, and well below its DCF fair value estimate of $71.39.

- According to the analysts' consensus view, bulls see this low valuation, especially compared to industry multiples and DCF fair value, as supporting the case for long-term upside. Bears highlight that current market pricing also reflects skepticism about SM’s ability to maintain earnings as margins and growth both slow.

- Share price discount suggests investors are bracing for several years of weaker profit and ongoing risks to SM’s highly concentrated asset base.

- Unless operating improvements and capital discipline are visibly sustained, the valuation gap may persist even if revenue climbs.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for SM Energy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Noticing something the consensus missed? Share your take and craft your own narrative in just a few minutes. Do it your way

A great starting point for your SM Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

SM Energy’s declining profit margins and projected earnings drop highlight the challenges of sustaining growth when cost pressures outpace revenue gains.

If steady expansion is your priority, use stable growth stocks screener (2094 results) to find companies that consistently deliver reliable revenue and profit growth through various market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SM

SM Energy

An independent energy company, engages in the acquisition, exploration, development, and production of oil, gas, and natural gas liquids in the state of Texas.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives