- United States

- /

- Energy Services

- /

- NYSE:SDRL

Seadrill's Raised Revenue Guidance Amid Losses Might Change the Case for Investing in SDRL

Reviewed by Sasha Jovanovic

- Seadrill Limited recently reported its third-quarter 2025 results, showing increased sales and revenue year-over-year but swinging from net income to a US$11 million net loss for the quarter, with a wider net loss of US$67 million for the nine months ended September 30, 2025.

- Despite these losses, management revised full-year 2025 guidance upward, narrowing the operating revenue forecast to between US$1.36 billion and US$1.39 billion, indicating improved expectations for the rest of the year.

- With management raising revenue guidance despite recent losses, we'll explore how this shift could reshape Seadrill's investment narrative going forward.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Seadrill Investment Narrative Recap

For Seadrill shareholders, conviction often rests on a belief in the long-term resurgence of offshore drilling demand and the company's ability to capitalize on a tightening supply of high-spec rigs. The latest earnings report, revealing growing quarterly revenue but widening losses, does little to shift the immediate catalyst, sustained improvement in fleet utilization, nor does it significantly ease the biggest near-term risk of ongoing dayrate pressure amid soft market conditions. The updated, higher revenue guidance suggests cautious optimism but doesn't independently change the risk profile.

Among recent announcements, the raised 2025 revenue guidance is closest in relevance to this earnings update. Management’s decision to narrow and increase its forecast signals confidence in contract execution for the final quarter, tying directly to whether stronger utilization and pricing can help offset rising costs and ongoing competitive pressures, the very factors driving the current risk-reward debate for investors.

However, against this backdrop, investors should be aware that prolonged weakness in dayrates and excess competition could still...

Read the full narrative on Seadrill (it's free!)

Seadrill's narrative projects $1.6 billion revenue and $231.6 million earnings by 2028. This requires 7.2% yearly revenue growth and a $154.6 million increase in earnings from $77.0 million today.

Uncover how Seadrill's forecasts yield a $43.50 fair value, a 40% upside to its current price.

Exploring Other Perspectives

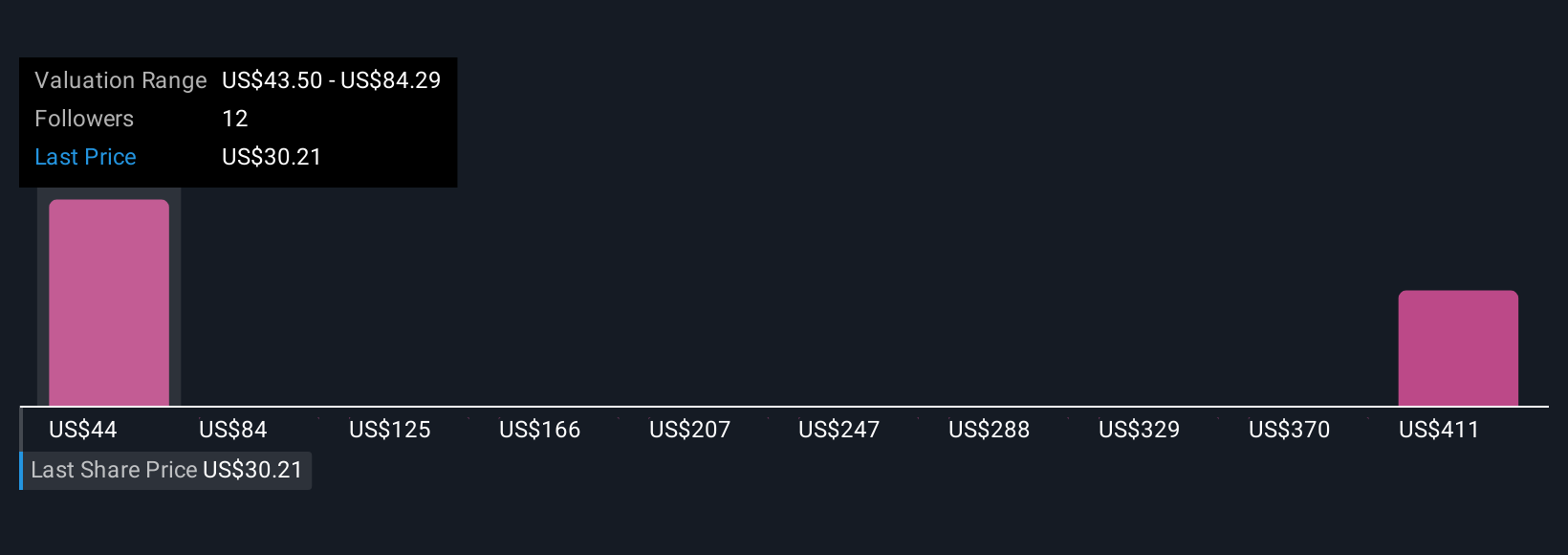

Fair value estimates from four Simply Wall St Community members span US$43.50 to US$451.44, underscoring wide differences in growth assumptions. While expectations can diverge, recent management guidance raises questions about near-term revenue stability and long-term earnings potential, consider reviewing these varied viewpoints for a more complete picture.

Explore 4 other fair value estimates on Seadrill - why the stock might be a potential multi-bagger!

Build Your Own Seadrill Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Seadrill research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Seadrill research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Seadrill's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SDRL

Seadrill

Provides offshore drilling services to the oil and gas industry worldwide.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives