- United States

- /

- Energy Services

- /

- NYSE:SDRL

Seadrill (NYSE:SDRL) Valuation in Focus After Recent Share Price Dip

Reviewed by Simply Wall St

See our latest analysis for Seadrill.

This pullback comes after a challenging year for Seadrill, with the share price down 27.2% so far in 2024 and total shareholder return off nearly 29% over the past twelve months. Momentum appears to be fading, reflecting shifting investor sentiment as the market digests the company’s earnings progress against a backdrop of sector uncertainty.

If you’re looking for other opportunities amid these market shifts, now is a great time to explore fast growing stocks with high insider ownership.

With shares now trading at a notable discount to analyst price targets and a solid revenue uptick, the real question is whether Seadrill is now undervalued or if the market is simply factoring in future risks and growth expectations.

Most Popular Narrative: 34.5% Undervalued

With Seadrill’s consensus fair value set at $43.5, the stock’s recent price of $28.49 puts it at a steep valuation discount. Investors seeking catch-up potential may want to look closer at what’s driving this assessment.

Tight ultra-deepwater rig supply and high-spec fleet focus support Seadrill's pricing power, margin improvement, and premium contract opportunities. Increased offshore drilling and digital innovation drive future revenue growth, cash flow durability, and the potential for enhanced capital returns.

Eager to unpack the “why” behind this bullish target? The most popular narrative is built on aggressive forecasts for earnings, margins, and share count, projections that could transform the company’s financial standing if realized. Curious about these bold assumptions? Jump into the full narrative to see the game-changing math that justifies Seadrill’s premium.

Result: Fair Value of $43.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued softness in rig utilization or prolonged contract delays in regions like Angola could pressure Seadrill’s revenue and slow earnings momentum.

Find out about the key risks to this Seadrill narrative.

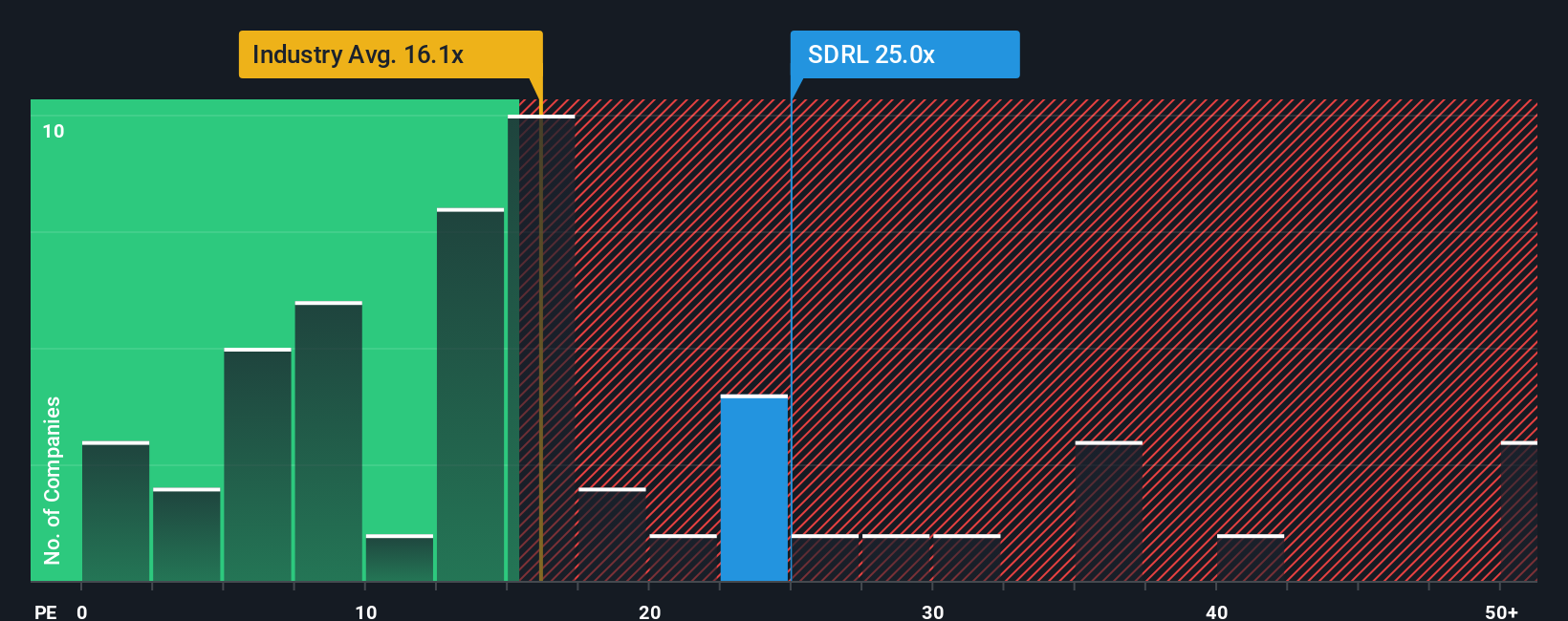

Another View: Using Multiples

While some models highlight strong upside for Seadrill, a glance at the price-to-earnings ratio paints a less optimistic picture. The company’s P/E stands at 52.3x, much higher than both its industry’s average of 16.3x and its peers at 11.7x, as well as above its fair ratio of 48.7x. This premium suggests that investors may be paying up for growth that has yet to fully materialize. This raises questions about valuation risk if future earnings do not live up to expectations. How should investors weigh these conflicting signals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Seadrill Narrative

If you see the story differently or want to dive into the details firsthand, you can easily build your own narrative in just a few minutes. Do it your way.

A great starting point for your Seadrill research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Don’t let standout opportunities slip past you. The Simply Wall Street Screener is your edge to uncover fresh stocks chosen for their untapped growth and value potential.

- Boost your returns by targeting high-quality businesses trading at bargains. Get started with these 884 undervalued stocks based on cash flows before the crowd catches on.

- Capture superior yields and steady income by reviewing these 16 dividend stocks with yields > 3%, featuring companies delivering dividends above 3%.

- Stay on the frontier by investing in the innovators powering AI transformations through these 25 AI penny stocks and build a future-focused portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SDRL

Seadrill

Provides offshore drilling services to the oil and gas industry worldwide.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives