- United States

- /

- Energy Services

- /

- NYSE:RIG

Transocean (RIG): Examining Valuation After Deepening Net Losses and Fresh Guidance for 2026

Reviewed by Simply Wall St

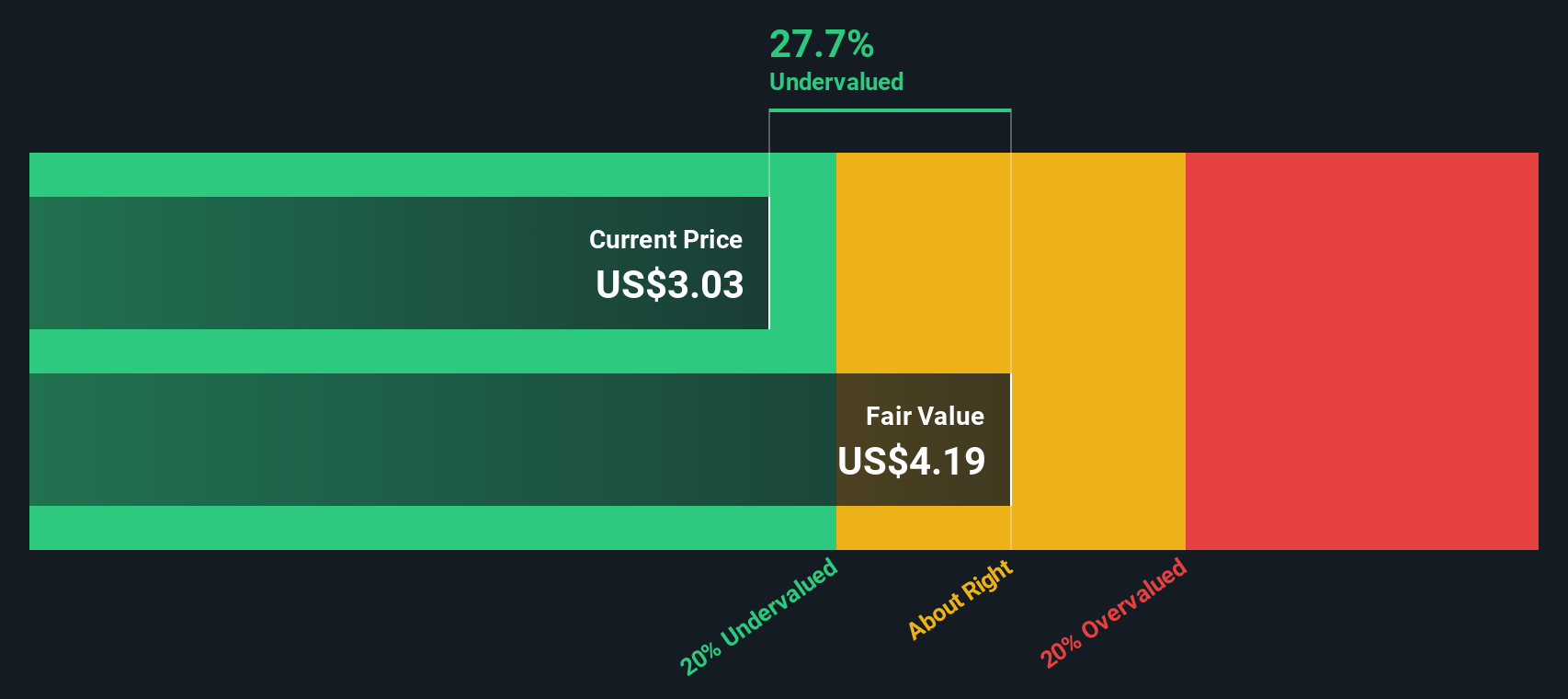

Transocean (NYSE:RIG) just posted sharply higher net losses for the third quarter and year to date, and then quickly followed up by issuing fresh guidance for upcoming revenues. Investors are weighing these new numbers and what they mean for the stock’s outlook.

See our latest analysis for Transocean.

Despite the steep net losses just reported, Transocean’s share price has shown a surprising burst of momentum recently, with a 36.4% return over the past month and a 42.9% return in the last 90 days. However, when you zoom out, the one-year total shareholder return is still negative at -6.7%, reflecting that longer-term investors have yet to see a sustained turnaround. Even so, markets may be picking up on potential upside as the company’s contract revenue outlook comes into focus.

If all this volatility has you wondering what else is capturing investor interest lately, broaden your search and discover fast growing stocks with high insider ownership

With net losses deepening and management rolling out fresh guidance, the central question is whether Transocean’s recent gains signal undervaluation or if the market has already factored in the company’s future growth prospects. Is there a buying opportunity here, or is everything priced in?

Most Popular Narrative: 3% Overvalued

According to the most widely followed narrative, Transocean’s updated fair value of $4.07 per share stands slightly above its recent closing price of $4.20. This suggests the stock is now trading at a mild premium. This marginal difference puts the spotlight on what assumptions are driving the narrative’s cautious optimism.

Strong contract pipeline and industry consolidation provide cash flow stability while supporting margin expansion and improved balance sheet strength. High debt, volatile dayrates, energy transition risks, customer concentration, and global rig oversupply all threaten Transocean's earnings stability and long-term growth prospects.

Want to know what powers this valuation? The real secret is in the model’s assumptions about roaring margin recovery, sticky revenues, and bold profit targets years ahead. Dive in to decode the full financial blueprint shaping this narrative.

Result: Fair Value of $4.07 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Transocean's heavy debt load and ongoing volatility in offshore dayrates could quickly undermine the current optimism regarding its margin recovery story.

Find out about the key risks to this Transocean narrative.

Another View: What Does the SWS DCF Model Suggest?

There's another way to look at Transocean. According to our SWS DCF model, shares are actually trading well below fair value. The model estimates a fair value of $8.95 per share, which is a significant discount compared to today's trading price. Does this mean the stock could be a hidden bargain, or is the gap reflecting real business risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Transocean for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 863 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Transocean Narrative

If you have your own take or want to dig into the numbers yourself, you can shape a unique view in just a few minutes. Do it your way

A great starting point for your Transocean research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Expand your investing potential and make smarter decisions by tapping into unique opportunities outside the usual headlines. Seize your chance to be ahead of the curve.

- Unlock high yields and steady growth with these 16 dividend stocks with yields > 3%, featuring companies with reliable dividends that exceed market averages.

- Tap into the dynamic world of digital currency trends and blockchain innovation by checking out these 82 cryptocurrency and blockchain stocks.

- Leverage emerging trends in advanced medical tech with these 32 healthcare AI stocks and discover fast-movers transforming the healthcare industry with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Transocean might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RIG

Transocean

Provides offshore contract drilling services for oil and gas wells in Switzerland and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives