- United States

- /

- Energy Services

- /

- NYSE:RIG

Are Transocean Shares a Bargain After New Offshore Drilling Contract Headlines?

Reviewed by Bailey Pemberton

- Curious if Transocean could be a value play or a bargain hiding in plain sight? Let’s break down what’s really going on behind the ticker before getting into the numbers.

- Transocean’s stock recently climbed 4.0% over the past week and is up 15.7% in the last month. However, it is still down 1.3% year-to-date and 12.4% over the past year. This suggests shifting market sentiment and possible growth potential ahead.

- Recent headlines have focused on industry optimism following news of new offshore drilling contracts and partnerships, which has sparked renewed market attention. However, uncertainties around energy prices and sector volatility remain significant topics for investors watching the stock.

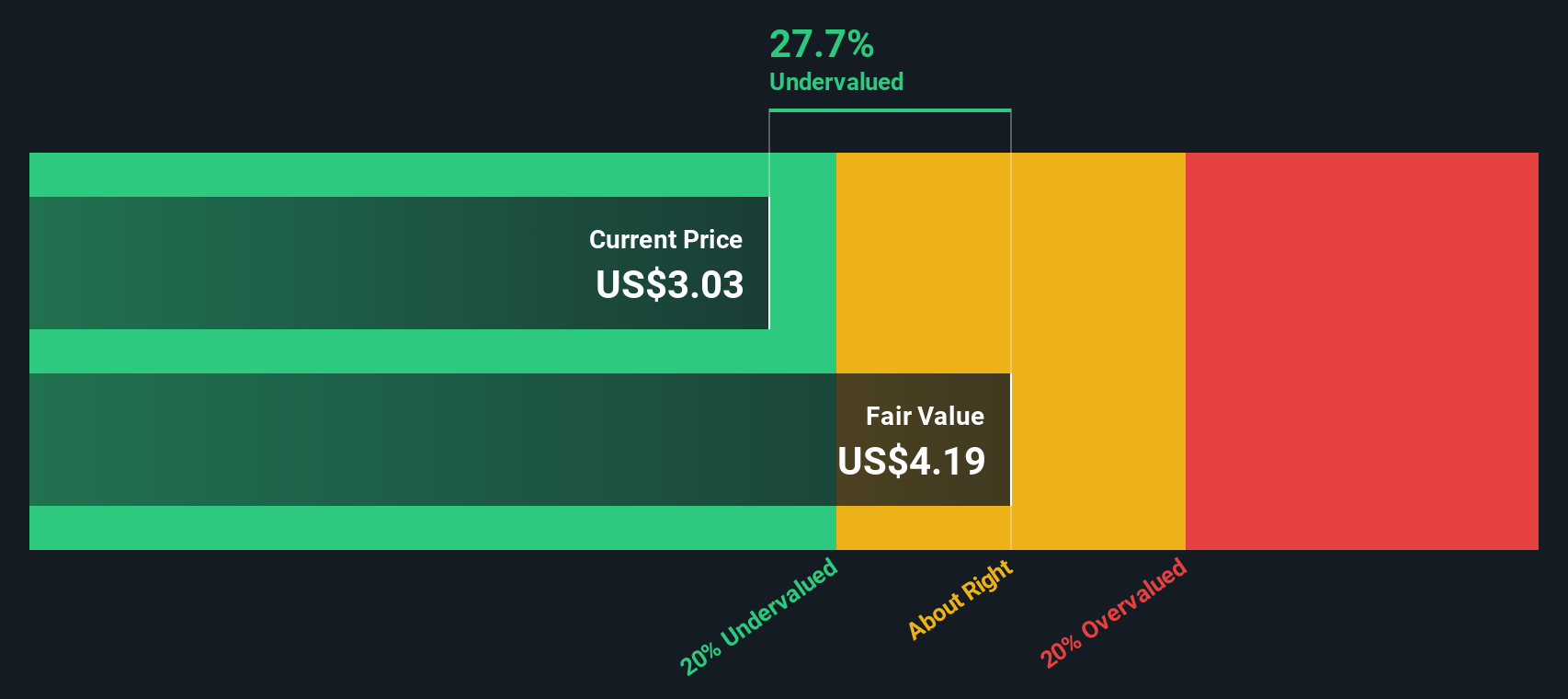

- According to our valuation model, Transocean scores a 2 out of 6 on the undervalued checks scale. There is definitely some nuance to explore. Next, we will walk through the key valuation approaches and also share a smarter way to put valuations in context.

Transocean scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Transocean Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to the present day. For Transocean, this approach means looking at how much cash the business is expected to generate, both in the short term and as trends develop over the next decade.

Currently, Transocean has a Free Cash Flow of $141.5 Million. Analyst forecasts show this figure climbing sharply, with Free Cash Flow expected to reach $584 Million by 2027. Beyond that, projections based on further extrapolations have Transocean’s cash flows gradually stabilizing between $450 Million and $450 Million per year through 2035. All values are reported in US dollars.

Based on this model, the estimated intrinsic value of Transocean shares comes out to $6.07, as of the latest calculation. Since the DCF suggests the stock is trading at a 35.8% discount to its fair value, this points to a potentially attractive entry point for value-focused investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Transocean is undervalued by 35.8%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

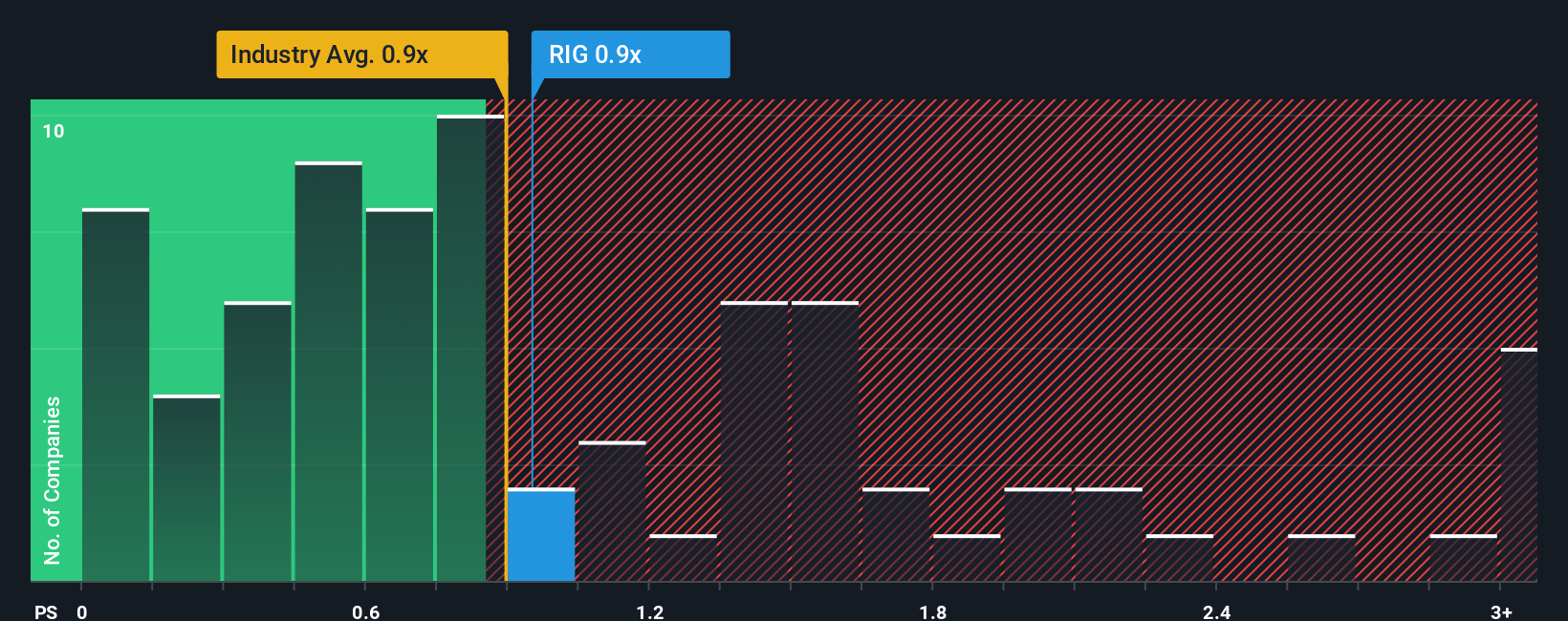

Approach 2: Transocean Price vs Sales

The Price-to-Sales (P/S) ratio is often the preferred valuation metric for companies where earnings can be volatile or not consistently positive, such as many in the energy services industry. It focuses on a company’s total revenue rather than profit, providing a more stable way to assess value in sectors with fluctuating bottom lines.

The “right” P/S ratio for a given company depends on both its expected revenue growth and the associated risks. A higher ratio can be justified for companies with rapid growth and lower risk, while a lower ratio may signal market concerns or weaker prospects.

Transocean currently trades at a P/S ratio of 1.11x. This is slightly higher than the broader peer average of 1.05x and above the Energy Services industry average of 0.96x. Simply Wall St also calculates a proprietary “Fair Ratio” for Transocean of 0.98x, which reflects the company’s unique blend of revenue growth expectations, profit margins, industry conditions, size, and risk profile.

Unlike standard peer or industry comparisons, the Fair Ratio offers a more tailored measure because it accounts for Transocean’s specific fundamentals in addition to market factors. By using the Fair Ratio, investors can get a clearer sense of whether the stock’s market price is justified given its outlook and risk.

Since Transocean’s actual P/S ratio of 1.11x is fairly close to its Fair Ratio of 0.98x, the stock appears to be valued about right in this context.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Transocean Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative goes beyond raw numbers, allowing you to tell your story about a company by combining your interpretation of its future, such as revenue, earnings, and margins, with an assumed fair value.

With Narratives, investors link what is happening in the business to their own forecasts and arrive at a fair value that reflects their unique perspective. Narratives are an easy, accessible tool available directly on Simply Wall St’s Community page, where millions of investors share their views.

This approach helps you decide when to buy or sell by comparing your Narrative's fair value with the current market price and creates a clear link between your expectations and your investment decisions. Narratives also update automatically when new information, like quarterly results or major news, becomes available. This ensures your outlook always reflects the latest developments.

For example, some investors on the platform see rising global energy demand and assign Transocean a target price of $5.50, while others remain cautious and give a target price as low as $2.50. This demonstrates how Narratives uniquely capture each investor’s view.

Do you think there's more to the story for Transocean? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Transocean might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RIG

Transocean

Provides offshore contract drilling services for oil and gas wells in Switzerland and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives