- United States

- /

- Oil and Gas

- /

- NYSE:PR

Can Permian Resources' (PR) Financial Flexibility Shape Long-Term Value Creation?

Reviewed by Sasha Jovanovic

- In the past week, Permian Resources announced an amendment to its credit agreement preserving its US$4.0 billion borrowing base and unveiled a significant public equity offering by Pearl Energy Investments and Riverstone Investment Group, without raising funds for the company itself.

- Alongside these developments, UBS reaffirmed confidence in Permian Resources' operational execution and free cash flow outlook ahead of its third quarter 2025 earnings report, highlighting improved efficiency and debt reduction potential.

- We will assess how maintaining financial flexibility through the amended credit agreement influences Permian Resources' investment narrative and outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Permian Resources Investment Narrative Recap

To be a shareholder in Permian Resources, you need to believe in the company’s ability to maintain strong free cash flow and operational efficiency against a backdrop of volatile commodity prices and high capital requirements. The recent amendment to its credit agreement, which preserves a US$4.0 billion borrowing base, is reassuring for financial flexibility, but does not materially change the near-term catalyst, continued execution on improving efficiency, or the largest risk: a downturn in oil and gas prices affecting earnings. Among recent updates, the credit agreement amendment stands out for its significance. By maintaining liquidity and integrating a more favorable pricing grid linked to credit ratings, the company’s capacity to deploy capital as opportunities arise is reinforced, directly connecting to the short-term focus on efficiency and capital discipline highlighted by analysts. However, investors should also keep in mind the heightened exposure to commodity price swings and how even the best financial structure cannot fully offset that risk if prices retreat...

Read the full narrative on Permian Resources (it's free!)

Permian Resources' outlook anticipates $6.1 billion in revenue and $1.4 billion in earnings by 2028. This is based on a 6.1% annual revenue growth rate and a $0.3 billion increase in earnings from the current $1.1 billion.

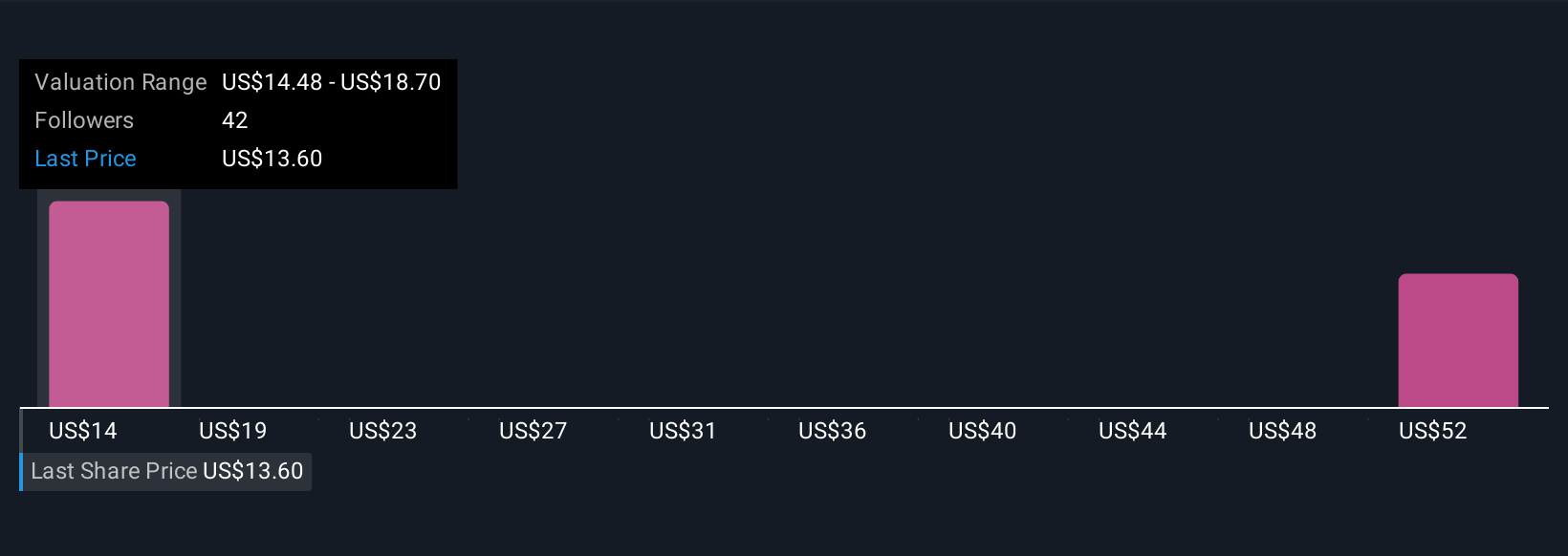

Uncover how Permian Resources' forecasts yield a $18.19 fair value, a 45% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members submitted five fair value estimates for Permian Resources, ranging from US$11.70 to US$44.65 per share. While many see value potential, the company’s fortunes remain closely linked to shifting oil and gas prices, meaning opinions across the market can vary considerably.

Explore 5 other fair value estimates on Permian Resources - why the stock might be worth over 3x more than the current price!

Build Your Own Permian Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Permian Resources research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Permian Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Permian Resources' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PR

Permian Resources

An independent oil and natural gas company, focuses on the development of crude oil and associated liquids-rich natural gas reserves in the United States.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives