- United States

- /

- Oil and Gas

- /

- NYSE:PARR

A Look at Par Pacific Holdings’s Valuation Following Breakout Q3 Earnings and Share Repurchase Completion

Reviewed by Simply Wall St

Par Pacific Holdings (PARR) just released third-quarter and year-to-date results, showing a sharp jump in net income and earnings per share, even as sales declined. The company also wrapped up a sizable share repurchase program this quarter, which reinforces its ongoing capital return strategy.

See our latest analysis for Par Pacific Holdings.

After finishing its latest buyback initiative and reporting breakout earnings, Par Pacific Holdings has seen momentum build in its share price. The stock’s 146.6% year-to-date price return and 154.96% total shareholder return over the last year capture just how dramatically sentiment has shifted. Long-term holders have been rewarded as well, with total shareholder returns up 289% across five years, easily outpacing the broader market.

If Par Pacific’s rapid turnaround caught your attention, now is a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With such a strong run and impressive financial turnaround, is Par Pacific still undervalued, or has the market already priced in further growth? Could this be a buying opportunity, or is it too late to jump in?

Most Popular Narrative: Fairly Valued

Par Pacific’s last close of $41.15 lands just above the narrative’s fair value of $40.38, suggesting the market is closely tracking analyst projections. With the difference this narrow, the focus is on whether upcoming catalysts and strategic moves will tip the balance.

The strategic partnership with Mitsubishi and ENEOS, along with the upcoming SAF (Sustainable Aviation Fuel) project launch, positions Par Pacific for growth in renewable fuels. This enhances market access, leverages global feedstock procurement expertise, and is expected to positively contribute to earnings and net margin expansion starting in 2026.

Curious what ambitious revenue and margin assumptions make up this calculation? There’s a bold story here involving a major pivot to renewables, rising operational efficiency, and profit targets most companies in this sector only dream of. Ready to see what surprising numbers power this fair value?

Result: Fair Value of $40.38 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on older refineries and exposure to regional regulatory changes could still challenge Par Pacific’s impressive momentum and long-term margin outlook.

Find out about the key risks to this Par Pacific Holdings narrative.

Another View: What Does Our DCF Model Say?

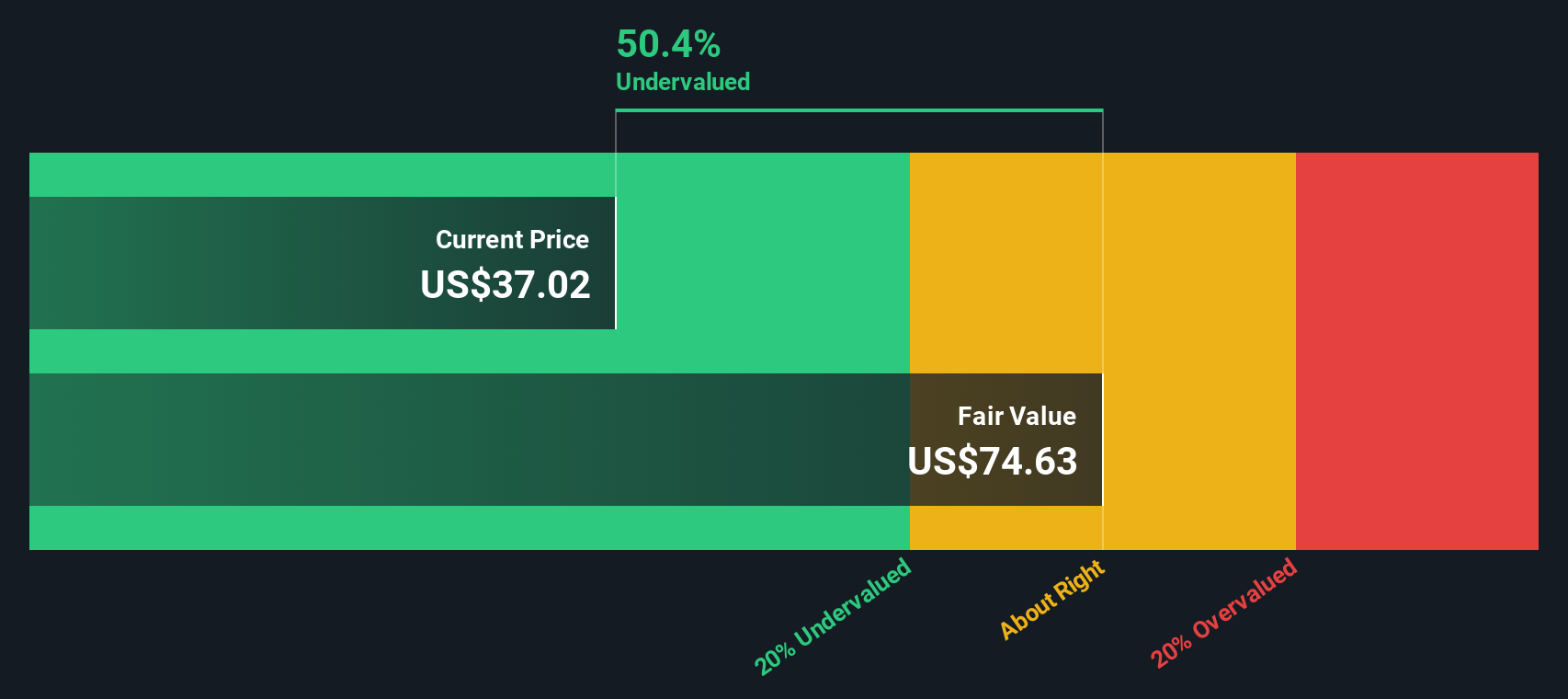

While market multiples suggest Par Pacific is fairly valued, the SWS DCF model tells a more optimistic story. Our DCF analysis estimates a fair value of $58.93 per share, which is well above the current price and implies more upside than the multiples approach suggests. Could the market be missing long-term potential here?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Par Pacific Holdings Narrative

If you’d rather chart your own path or see the numbers from a new angle, you can build a custom Par Pacific narrative in just minutes. Do it your way

A great starting point for your Par Pacific Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Seize your next big opportunity today. These tailored stock lists are packed with fresh possibilities for investors who want their money working smarter, not harder.

- Uncover new income streams by targeting companies paying higher yields with these 16 dividend stocks with yields > 3% before the next round of payouts reaches investor accounts.

- Tap into the momentum of artificial intelligence by building your watchlist with these 24 AI penny stocks as these companies transform entire industries in real time.

- Capitalize on tomorrow’s breakthroughs by backing innovation leaders in quantum computing with these 27 quantum computing stocks and stay ahead of the market curve.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PARR

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives