- United States

- /

- Oil and Gas

- /

- NYSE:OKE

How Investors May Respond To ONEOK (OKE) Record Q3 Profits, Share Buyback, and Insider Buying

Reviewed by Sasha Jovanovic

- ONEOK, Inc. reported strong third quarter 2025 results, with revenue rising to US$8.63 billion and net income increasing to US$939 million, supported by robust volumes and recent acquisitions.

- A director's recent insider share purchase and the completion of a US$234.16 million buyback program further highlighted management and board confidence during a period of operational expansion.

- We'll examine how these earnings gains and successful acquisitions influence the company's investment outlook and growth strategy.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

ONEOK Investment Narrative Recap

To be a shareholder in ONEOK today, you need to believe in growing global demand for U.S. natural gas and NGLs and that ONEOK’s recent operating gains can drive consistent cash flow and dividend strength despite ongoing industry shifts and compressed commodity spreads. The third quarter’s strong revenue and net income results were meaningful, but the biggest short-term catalyst, synergy capture from recent acquisitions, remains unchanged, while the main risk is still narrower commodity spreads squeezing margins; this news does not materially alter either factor.

Of the recent announcements, the completed US$234.16 million share buyback stands out as most relevant, reinforcing management’s efforts to return value to shareholders at a time when integration of new assets and maintenance of payout discipline are in focus. This action complements continued investments in fee-based volume growth, helping support the company’s strategy even as the market keeps a close eye on margin headwinds and balance sheet flexibility.

Yet, in contrast to the company’s expansion efforts, there are still risks from tighter commodity price spreads and...

Read the full narrative on ONEOK (it's free!)

ONEOK's narrative projects $34.0 billion revenue and $4.2 billion earnings by 2028. This requires 6.7% yearly revenue growth and an earnings increase of $1.1 billion from $3.1 billion today.

Uncover how ONEOK's forecasts yield a $90.84 fair value, a 34% upside to its current price.

Exploring Other Perspectives

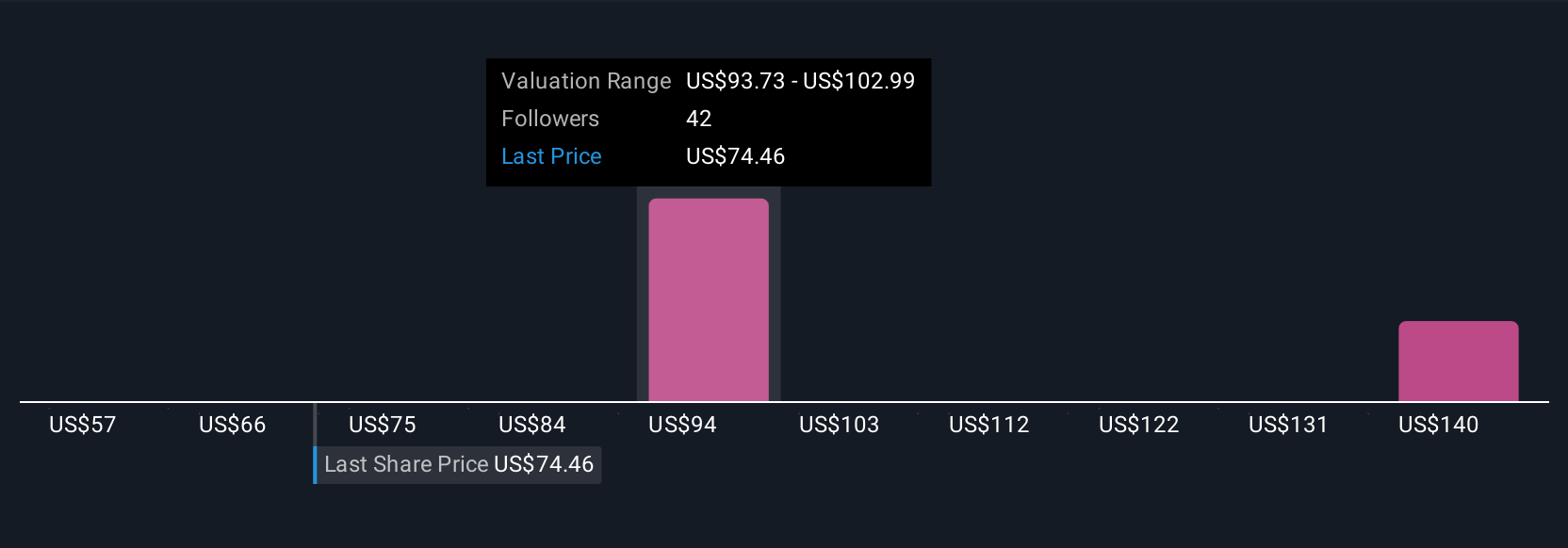

Simply Wall St Community members provided nine fair value estimates for ONEOK, ranging from US$65 to US$135. Investor outlooks vary widely, with many weighing the potential for acquisition synergies to offset margin pressures as a key influence on performance.

Explore 9 other fair value estimates on ONEOK - why the stock might be worth as much as 99% more than the current price!

Build Your Own ONEOK Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ONEOK research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ONEOK research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ONEOK's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 34 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKE

ONEOK

Operates as a midstream service provider of gathering, processing, fractionation, transportation, storage, and marine export services in the United States.

Very undervalued 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives