- United States

- /

- Oil and Gas

- /

- NYSE:NVGS

Navigator Holdings (NVGS): Assessing Valuation as Analyst Earnings Estimates Move Higher Ahead of Results

Reviewed by Simply Wall St

Navigator Holdings (NVGS) is attracting investor interest after recent analyst estimate revisions pointed to higher expectations for its upcoming quarterly earnings. This shift comes as the market anticipates the company's results for the September period.

See our latest analysis for Navigator Holdings.

The upbeat sentiment around Navigator Holdings is showing up in its share price, which has steadily gained 6.1% over the past month and is up 4.5% this week alone. Momentum appears to be building, with shareholders enjoying an 8.2% total return over the last year and a remarkable 174% total return over five years as investors weigh the company’s improving earnings outlook.

If rising momentum has you looking for other opportunities, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

With shares up and analyst estimates trending higher, investors are left wondering whether Navigator Holdings is still undervalued or if the market has already priced in the company’s potential. Could there still be a buying opportunity here?

Most Popular Narrative: 21.7% Undervalued

Navigator Holdings recently closed at $16.44, while the most followed narrative sees fair value at $21.00, a significant gap that has investors paying attention. This difference reflects high expectations, but the numbers behind this target tell a compelling story.

The continued structural shift toward cleaner fuels, together with industrial growth and higher living standards in emerging markets, is driving rising demand for liquefied gas and petrochemical transport. Navigator is already seeing restored trade volumes post Q2 disruption, supporting higher utilization and revenue growth.

Curious how ambitious the profit forecasts are? There are bold revenue trends and margin assumptions inside this narrative that could surprise even veteran investors. Want to know what kind of future industry shifts and company moves must play out for this price to be reached? The blueprint is outlined. Discover exactly what analysts are betting on for Navigator Holdings.

Result: Fair Value of $21.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent geopolitical tensions or rising operating costs could derail Navigator Holdings' growth story and undermine the optimistic analyst outlooks.

Find out about the key risks to this Navigator Holdings narrative.

Another View: Beyond Analyst Targets

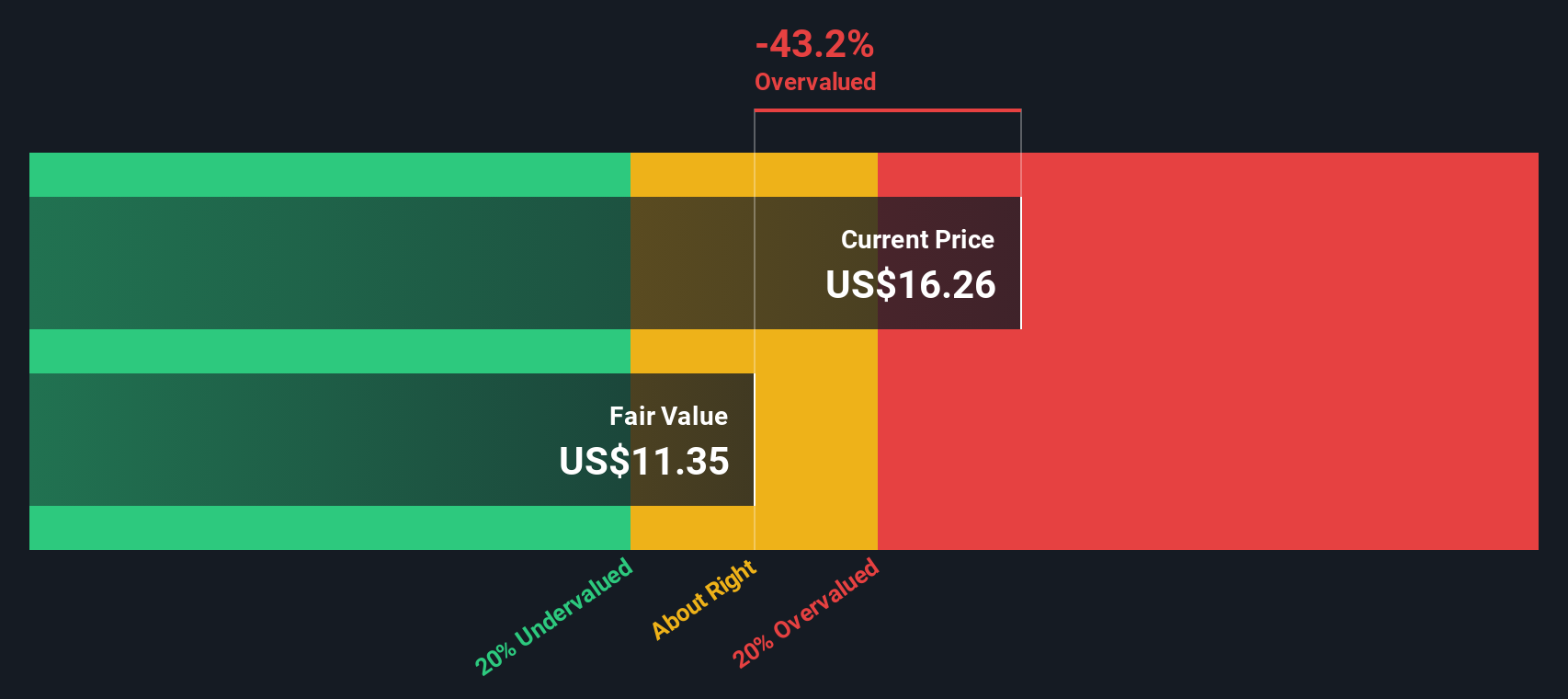

While analyst price targets currently paint a bullish picture, our SWS DCF model offers a far more conservative take. According to this approach, Navigator Holdings is trading well above what the discounted cash flow suggests is its fair value. Could the market's optimism be overextended?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Navigator Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Navigator Holdings Narrative

If you see things differently or want to analyze the numbers yourself, you can craft a personalized view in just a few minutes, Do it your way

A great starting point for your Navigator Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

If you want to get ahead of the market and shape your next move, start checking out these unique thematic stock ideas. Opportunities like these simply shouldn't be missed.

- Unlock growth by reviewing these 832 undervalued stocks based on cash flows, which the market has overlooked and may offer real potential at attractive prices.

- Tap into the future of medicine and find leaders in innovation through these 33 healthcare AI stocks, where healthcare and artificial intelligence converge.

- Strengthen your income stream with these 22 dividend stocks with yields > 3%, focusing on stocks delivering reliable, above-average yields for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navigator Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NVGS

Navigator Holdings

Owns and operates a fleet of liquefied gas carriers worldwide.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives