- United States

- /

- Oil and Gas

- /

- NYSE:MPLX

MPLX (MPLX) Profit Margins Hit 40%, Reinforcing Bullish Value Narratives

Reviewed by Simply Wall St

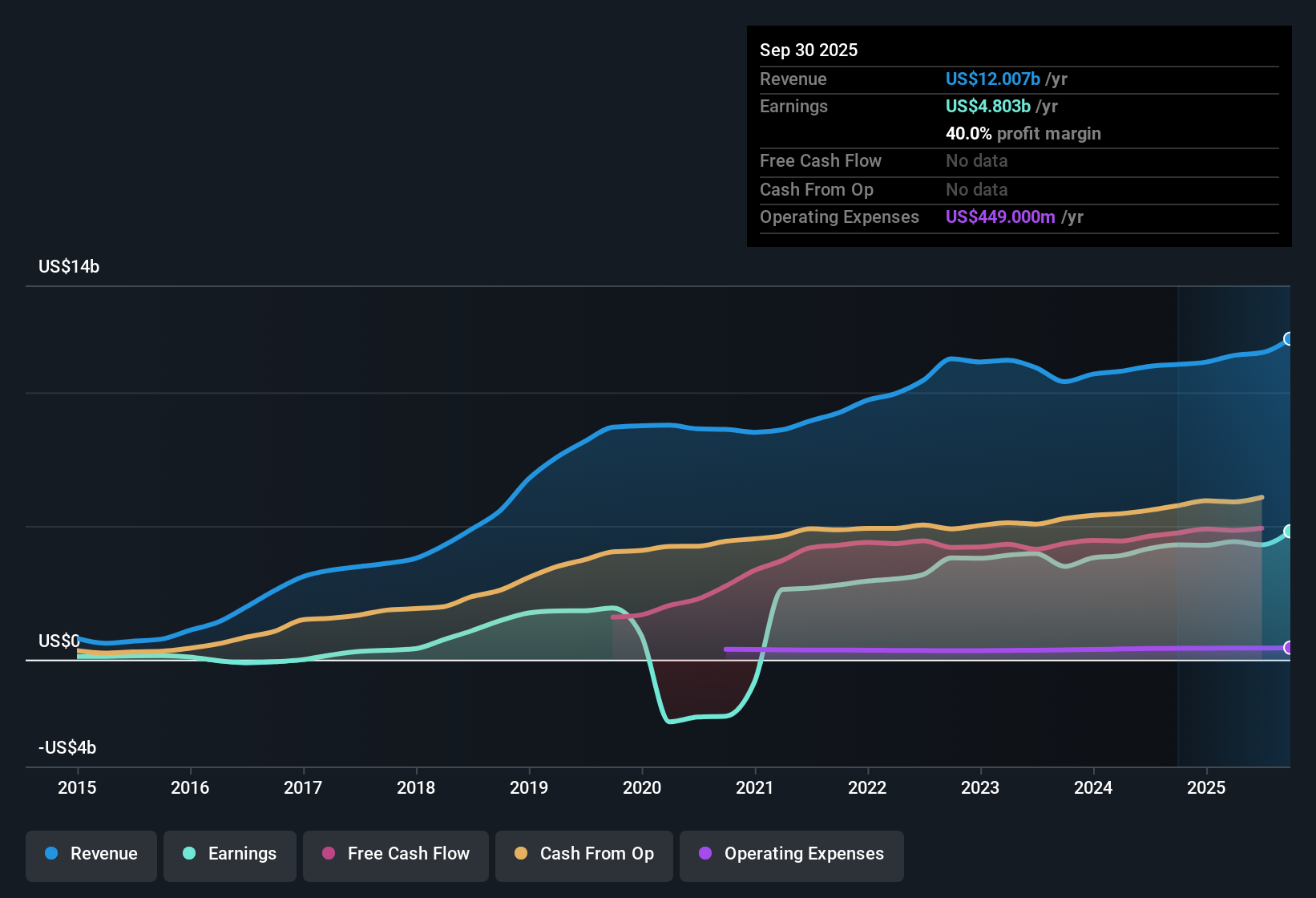

MPLX (MPLX) posted net profit margins of 40% for the latest period, up from 38.9% a year ago, signaling stronger profitability. While the company achieved an impressive 24% annual earnings growth rate over the past five years, its most recent annual growth of 11.9% points to a slower pace. Future forecasts now call for earnings and revenue to grow at 4.71% and 5.1% per year, respectively, which trails broader US market averages. Despite the slowdown, attractive valuation metrics and the appeal of reliable dividend income remain positive factors for investor sentiment.

See our full analysis for MPLX.Now, let’s see how these latest earnings results stack up against the widely followed narratives and what that might mean for MPLX’s outlook.

See what the community is saying about MPLX

Profit Margins Exceed 40% for First Time

- MPLX posted a 40% net profit margin this year, up from 38.9% last year. This tops its past performance and reinforces its reputation for efficient operations.

- According to the analysts' consensus view, these high margins are seen as a direct result of strategies such as disciplined capital allocation and multi-year producer contracts. These approaches are designed to keep cash flow stable and distributions growing, even as broader U.S. market growth slows.

- Consensus notes that MPLX's strong contracts and fee-based revenue support durable profits, while scale from acquisitions and expansions helps protect margins.

- However, dependence on the U.S. oil and gas cycle still raises questions about how long these margin levels can hold if energy demand stumbles.

- Looking deeper into both recent growth and near-term prospects, analysts highlight how these margin figures fit into their overall assessment of MPLX’s investment appeal. 📊 Read the full MPLX Consensus Narrative.

Growth Slows from 24% to 11.9%

- Earnings growth averaged 24% annually over five years, but the latest year came in at just 11.9%. This reflects a significant cool-off as forecasted growth now lands at only 4.71% per year.

- Consensus narrative flags this deceleration as a double-edged sword:

- On one hand, MPLX benefits from expansion projects and infrastructure investments, such as new processing and fractionation capacity, that are still expected to boost revenues and EBITDA through the decade.

- On the other hand, heavy capital spending and concentrated bets on the Permian and Delaware basins could limit upside if energy demand shifts or asset utilization fails to keep pace with projections.

Valuation Discount Remains Wide

- MPLX trades at a Price-To-Earnings ratio of 10.9x, which is lower than both its peer average (18.6x) and the U.S. Oil and Gas industry average (12.8x). This also sits far below its DCF fair value estimate of $131.85 per share, while its current share price is $51.20.

- Analysts' consensus view holds that this large valuation gap is underpinned by MPLX's high-quality cash flows and reliable distributions. They caution investors to factor in risks such as short contract terms on recent acquisitions and the company’s sensitivity to the oil and gas cycle.

- A wide discount to DCF fair value and peer multiples could attract value-focused investors, but only if MPLX’s projected growth and profitability hold up as industry dynamics shift.

- Bulls and bears are split over whether these safety nets are strong enough to justify betting on multiple expansion, especially as distribution and capital allocation discipline come into focus.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for MPLX on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Share your own perspective and shape the narrative your way in just a few minutes. Do it your way.

A great starting point for your MPLX research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

MPLX’s slowing earnings growth and sector sensitivity highlight the risks of relying on companies that cannot consistently sustain robust expansion over time.

If you would prefer steadier momentum and fewer growth hiccups, check out stable growth stocks screener (2077 results) for companies with a stronger track record of reliable results year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPLX

MPLX

Owns and operates midstream energy infrastructure and logistics assets primarily in the United States.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives