- United States

- /

- Oil and Gas

- /

- NYSE:MNR

Mach Natural Resources (MNR): Valuation Perspective After Q3 Loss and Dividend Cut

Reviewed by Simply Wall St

Mach Natural Resources (NYSE:MNR) just released its third quarter results, showing higher revenues but also reporting a net loss after recording a large impairment charge. The company also announced a reduced quarterly cash distribution to shareholders.

See our latest analysis for Mach Natural Resources.

Mach Natural Resources’ latest report, which showed a boosted top-line but was hit by a hefty impairment charge and a dividend cut, seems to have caught investors' attention. After these announcements, the 1-day share price return of 2.2% hints at renewed interest, but over the past year, total shareholder return is still down 13.3%. This suggests momentum has faded as the market weighs near-term challenges against long-term potential.

If this shift in sentiment has you thinking bigger, now’s a good time to broaden your watchlist and discover fast growing stocks with high insider ownership.

Despite this recent dip in profitability and a lower dividend, shares still trade at a meaningful discount to analyst price targets and estimated intrinsic value. Is there a genuine buying opportunity here, or is the market already factoring in future growth?

Most Popular Narrative: 42% Undervalued

Mach Natural Resources’ most followed narrative implies significant upside, with a fair value ($21.00) well above the current share price of $12.09. This disparity has fueled debate about whether the market is missing the company’s potential or is rightly cautious about its prospects. Here is what could be driving these estimates:

Strategic acquisitions of cash-flowing, low-decline assets in core U.S. basins at discounts to PDP PV-10, combined with disciplined reinvestment rates below 50% and rapid integration of operational synergies, are set to enhance free cash flow and expand operating margins, allowing for consistent, attractive returns to unitholders and future EPS growth.

Analysts are betting on bold expansion: unlocking value through aggressive asset buys, optimizing reinvestment, and leveraging operational synergies. The catch? Their numbers hinge on sustained future growth and margins. Do you know which assumptions shape this ambitious valuation? Don’t miss the story behind the projection.

Result: Fair Value of $21.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on natural gas prices and challenging capital markets could quickly undermine these bullish forecasts if conditions shift unfavorably.

Find out about the key risks to this Mach Natural Resources narrative.

Another View: Market Multiples Tell a Different Story

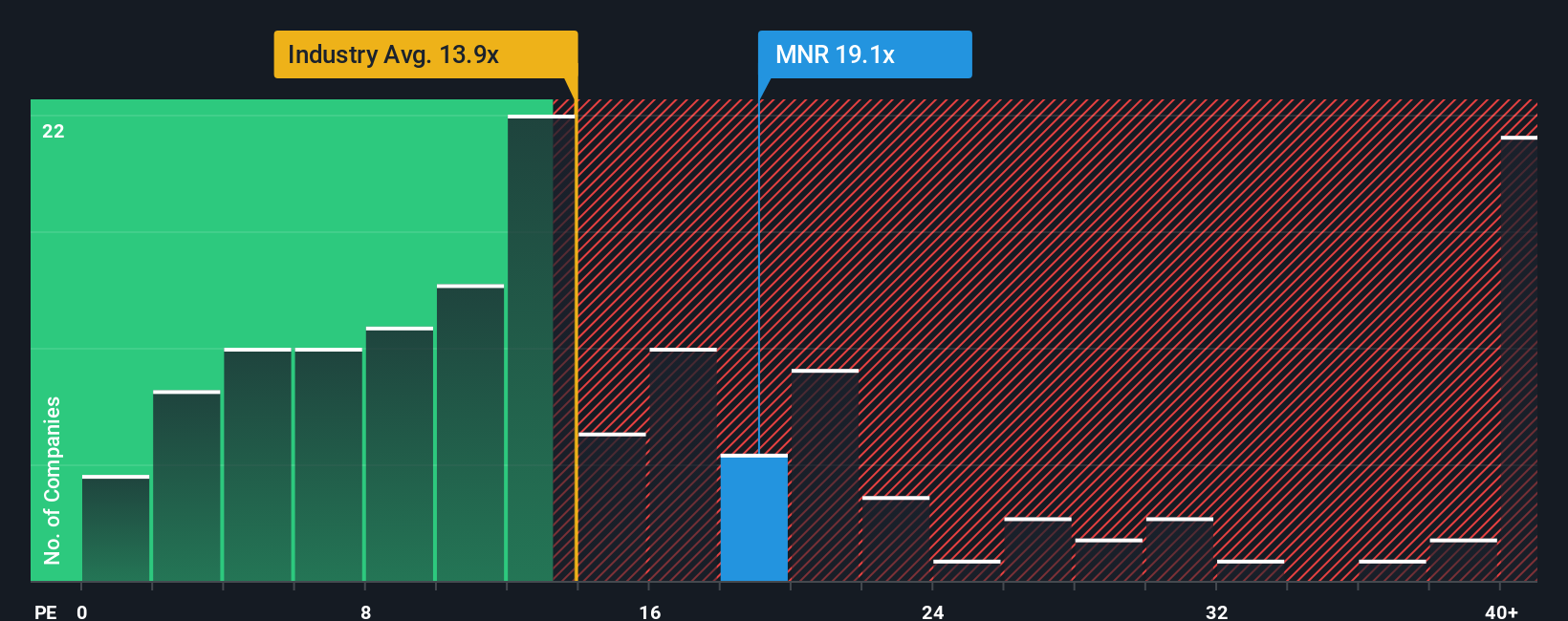

When we look beyond intrinsic value and focus on how shares are priced using earnings, Mach trades at a higher price-to-earnings ratio (19.1x) than both its peers (29x) and the industry average (13.6x). Compared to its fair ratio of 18.2x, this signals investors are paying a premium, which raises questions about near-term upside or risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mach Natural Resources Narrative

If you see things differently or want to draw your own conclusions from the numbers, crafting your own narrative takes less than three minutes. Do it your way

A great starting point for your Mach Natural Resources research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always stay one step ahead by scouting new opportunities across different market themes. Don’t limit yourself to just one stock. These investing ideas could change your outlook and portfolio returns.

- Unlock stable growth and smart cash flow by reviewing these 908 undervalued stocks based on cash flows with robust business fundamentals and attractive prices.

- Capitalize on megatrends and innovation by checking out these 27 AI penny stocks that are transforming the future with artificial intelligence breakthroughs.

- Boost your passive income and financial resilience with these 18 dividend stocks with yields > 3% offering attractive yields over 3% and consistent payouts for long-term peace of mind.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MNR

Mach Natural Resources

An independent upstream oil and gas company, focuses on the acquisition, development, and production of oil, natural gas, and natural gas liquids reserves in the Anadarko Basin region of Western Oklahoma, Southern Kansas, and the panhandle of Texas.

Good value with reasonable growth potential.

Market Insights

Community Narratives