- United States

- /

- Oil and Gas

- /

- NYSE:MNR

Mach Natural Resources (MNR): Assessing Valuation After Recent Share Price Decline

Reviewed by Simply Wall St

Mach Natural Resources (MNR) recently caught some attention following shifts in its stock price and underlying financials. With recent changes in its share price and fresh financial results, many investors are wondering what might be ahead for the company.

See our latest analysis for Mach Natural Resources.

Mach Natural Resources’ share price has taken a notable hit in recent months, despite solid revenue and profit growth. Momentum appears to be fading for now. With a year-to-date share price return of -33.86% and a 1-year total return of -17.11%, investors are increasingly cautious about short-term prospects even as fundamentals shift.

If you’re weighing what’s next after this sudden momentum shift, it could be the right time to broaden your horizons and discover fast growing stocks with high insider ownership

Given Mach Natural Resources’ sharp decline and mixed fundamentals, investors are left wondering if the current price offers a compelling entry point or if the market has already accounted for all potential future gains.

Most Popular Narrative: 46.2% Undervalued

Mach Natural Resources’ most widely followed valuation narrative puts its fair value at $21, a sharp contrast to the recent closing price of $11.29. The sizable gap between the two highlights bullish expectations for the company in the years ahead.

Strategic acquisitions of cash-flowing, low-decline assets in core U.S. basins at discounts to PDP PV-10, combined with disciplined reinvestment rates below 50% and rapid integration of operational synergies, are set to enhance free cash flow and expand operating margins. This approach allows for consistent, attractive returns to unitholders and future EPS growth.

Want to know what’s driving these powerful fair value calculations? The narrative leans heavily on future growth acceleration and a carefully tuned reinvestment strategy. Curious what key assumptions underpin such optimism? Unlock the full narrative to see which pivotal forecasts and big financial moves could change everything.

Result: Fair Value of $21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in natural gas prices or tighter capital markets could quickly challenge Mach’s bullish outlook and could stall future growth ambitions.

Find out about the key risks to this Mach Natural Resources narrative.

Another View: What Do the Numbers Really Say?

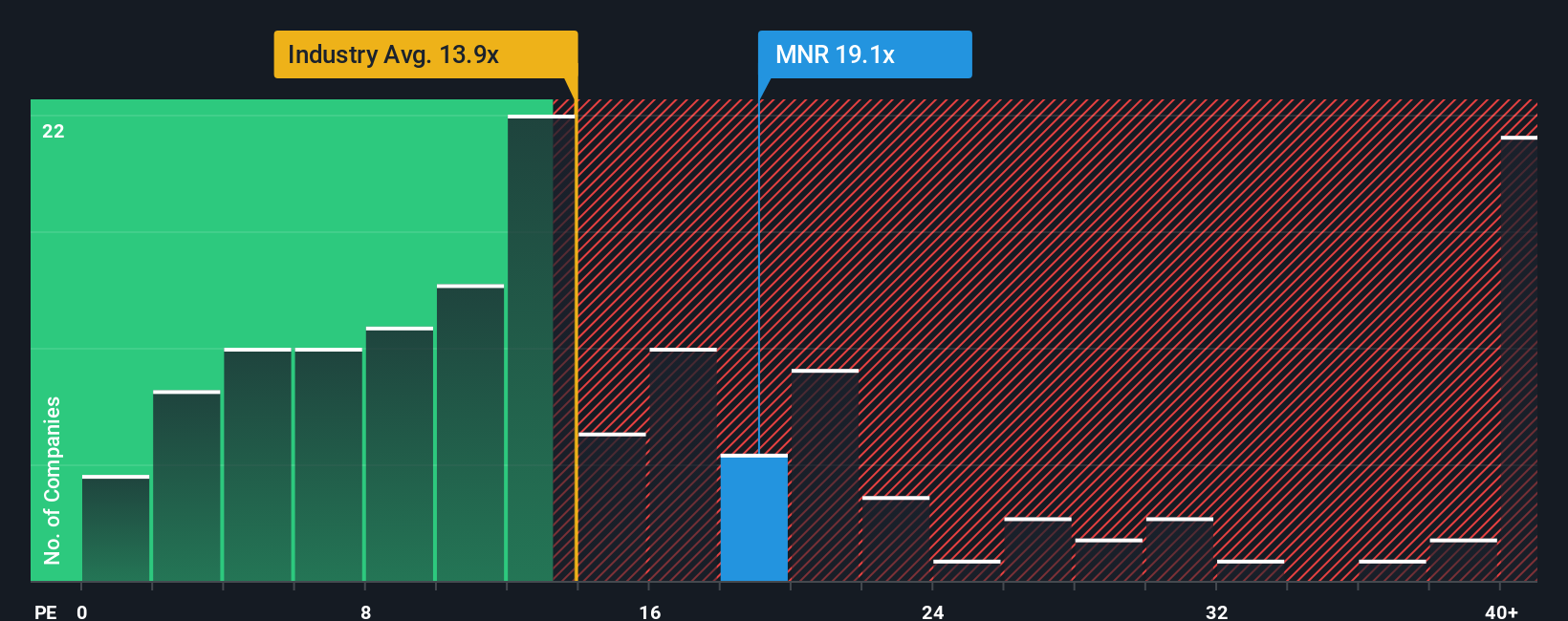

Taking a different approach, let's compare Mach Natural Resources' price-to-earnings ratio to its industry. At 17.9 times earnings, it is pricier than the US Oil and Gas industry average of 13.2 times. However, it appears more attractive compared to its peer average of 29.4 times and closely aligns with its fair ratio of 18.2 times. This suggests that valuation risk and potential upside are closely balanced. Is the market accurately reflecting this, or is it missing something important?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mach Natural Resources Narrative

If these perspectives don't quite match your own, or you like to dig into the numbers yourself, you can pull together your own evidence-driven story for Mach in just a few minutes. Do it your way

A great starting point for your Mach Natural Resources research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by when the market holds so many promising directions. Stay ahead by checking out hand-picked stock ideas tailored to different growth trends and strategies.

- Tap into real tech disruption by checking out these 26 AI penny stocks, which are powering innovation with artificial intelligence breakthroughs and advanced data solutions.

- Unlock income potential with these 14 dividend stocks with yields > 3%, featuring reliable companies offering attractive yields and steady payouts for long-term wealth building.

- Ride the wave of financial transformation with these 81 cryptocurrency and blockchain stocks, where you’ll find stocks at the forefront of blockchain and digital currencies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MNR

Mach Natural Resources

An independent upstream oil and gas company, focuses on the acquisition, development, and production of oil, natural gas, and natural gas liquids reserves in the Anadarko Basin region of Western Oklahoma, Southern Kansas, and the panhandle of Texas.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success