- United States

- /

- Oil and Gas

- /

- NYSE:LPG

Dorian LPG (LPG): Assessing Valuation After Strong Earnings and Special Dividend Announcement

Reviewed by Simply Wall St

DorianG (LPG) just reported a sharp jump in revenue and net income for its latest quarter. The company also declared an irregular cash dividend of $0.65 per share, returning nearly $28 million to shareholders. These moves are drawing plenty of attention from investors.

See our latest analysis for DorianG.

Following this strong earnings release and the announcement of a sizable cash dividend, DorianG’s stock has maintained real momentum. The share price has gained 16.6% year-to-date, and total shareholder return is up 12.5% over the past 12 months. Over a longer period, returns have been even more impressive, which points to both ongoing growth potential and steadily rising investor confidence.

If timely dividends and surging returns have you thinking bigger, now is the perfect chance to broaden your search and discover fast growing stocks with high insider ownership

With such a dramatic surge in profitability and a dividend well above expectations, investors are left asking whether DorianG stock remains attractively valued at current levels or if the market has already priced in these growth prospects.

Most Popular Narrative: 17.9% Undervalued

Compared to its last close of $29.57, the most-followed narrative estimates DorianG's fair value at $36. This suggests greater upside potential ahead. This view connects a higher valuation to a long-term structural advantage rather than near-term momentum.

DorianG's ongoing investments in enhancing fleet energy efficiency, retrofitting vessels for ammonia carriage, and early compliance with IMO decarbonization targets position the company to benefit from tightening environmental regulations. This supports improved margins and lower compliance costs.

Wonder what’s fueling this optimistic price target? The experts are betting on a shift in profit margins and revenue profile that could transform DorianG’s earnings landscape. Curious which bold projections underpin this rerated value? You’ll want to see how quickly these underlying assumptions point to hidden value that others might be missing.

Result: Fair Value of $36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing geopolitical tensions and swings in global freight rates could quickly upend DorianG's current growth trajectory and profitability outlook.

Find out about the key risks to this DorianG narrative.

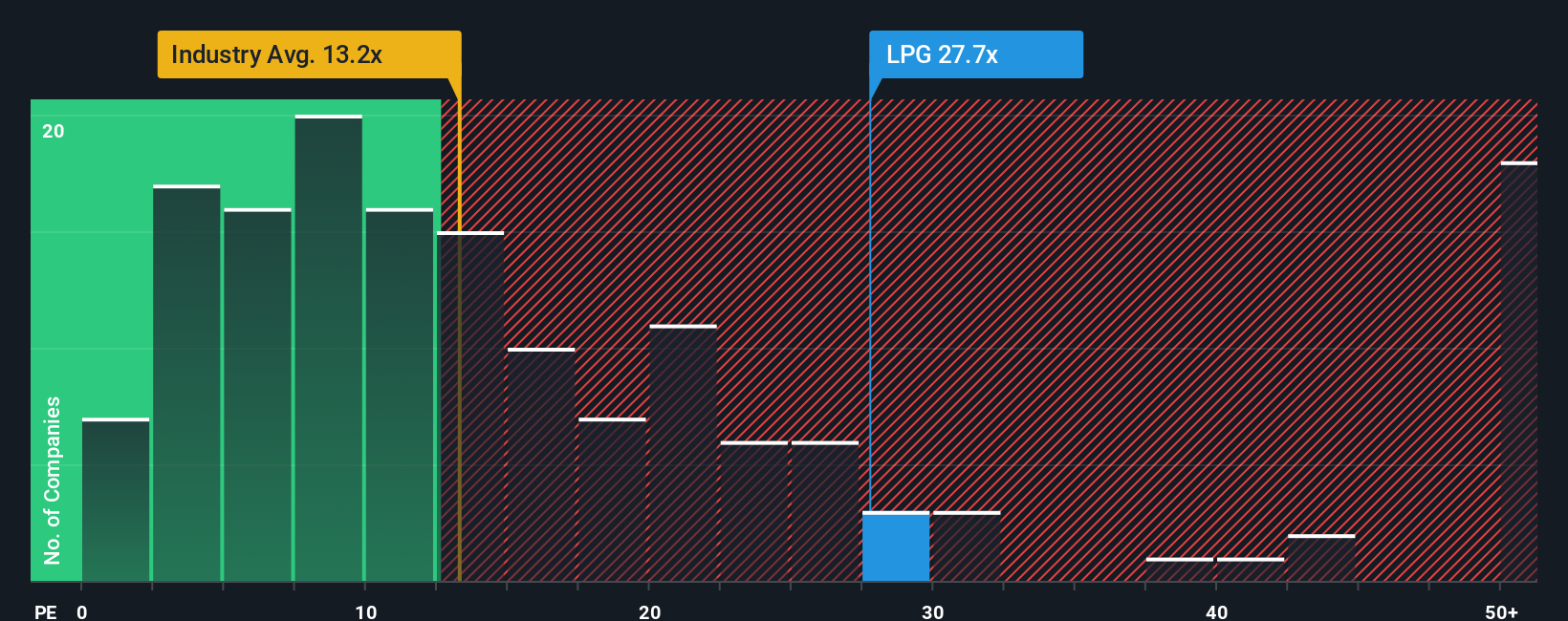

Another View: Market Multiples Tell a Different Story

Looking at DorianG through a market multiples lens, the shares trade at a price-to-earnings ratio of 25.8x. This is significantly higher than both the US Oil and Gas industry average of 12.7x and the peer average of 18.2x. It is also well above the fair ratio of 10.8x, suggesting the market price may already be factoring in much of the expected growth. Is this optimism a risk if expectations shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DorianG Narrative

If you see the story unfolding differently or want to dig into the numbers your own way, you can shape your own view in just a few minutes. Do it your way

A great starting point for your DorianG research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Shareholder Wins?

If you want an edge in spotting tomorrow’s biggest market movers, now is the moment. Don’t let the next high-conviction opportunity pass you by!

- Tap into unique growth stories by checking out these 3605 penny stocks with strong financials with strong financials and significant upside potential others might overlook.

- Target future trends as you browse these 25 AI penny stocks, where innovation in automation and artificial intelligence is driving powerful returns.

- Maximize your value hunt by reviewing these 836 undervalued stocks based on cash flows that are priced below their intrinsic worth and primed for re-rating.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LPG

DorianG

Engages in the transportation of liquefied petroleum gas through its LPG tankers worldwide.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives