- United States

- /

- Oil and Gas

- /

- NYSE:KMI

Kinder Morgan (KMI): Exploring Valuation After Recent Share Price Fluctuations

Reviewed by Simply Wall St

Kinder Morgan (KMI) has delivered steady results lately, with the stock showing both gains and pullbacks over the past few months. Investors may be watching closely for signals from recent company performance as well as sector dynamics to inform their next move.

See our latest analysis for Kinder Morgan.

Kinder Morgan’s share price has drifted slightly this year, down roughly 3.6% year-to-date, but the company’s longer-term track record stands out, with a remarkable 71% total return over the past three years and 142% over five. While recent price action has been modest, this strong multi-year performance hints at underlying resilience and renewed investor interest as market sentiment evolves.

If you’re keeping an eye out for what's next in the market, now could be a good moment to explore fast growing stocks with high insider ownership.

That raises the key question for investors: Is Kinder Morgan currently trading below its fair value, offering potential upside, or has the market already accounted for its future growth prospects and priced the stock accordingly?

Most Popular Narrative: 12.8% Undervalued

The most-watched narrative estimates Kinder Morgan’s fair value at $31.06, placing it above the latest close of $27.09. This sets the tone for debate, as investors examine the assumptions behind that target and consider what could fuel the next move higher.

The surging U.S. LNG export market, with U.S. gas feed to export terminals projected to double by 2030 and Kinder Morgan already transporting about 40% of this feed gas, is likely to significantly increase future earnings, especially as additional U.S. capacity comes online and new contracts are signed.

Want to know the secret to this valuation? The narrative banks on ambitious growth rates, higher-than-ever profit margins, and a premium earnings multiple for the energy sector. Curious which numbers make this possible? Click through to see how bold projections stack up against market reality.

Result: Fair Value of $31.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, energy transition policies and Kinder Morgan's heavy debt load could dampen growth and challenge the upbeat outlook reflected in analyst targets.

Find out about the key risks to this Kinder Morgan narrative.

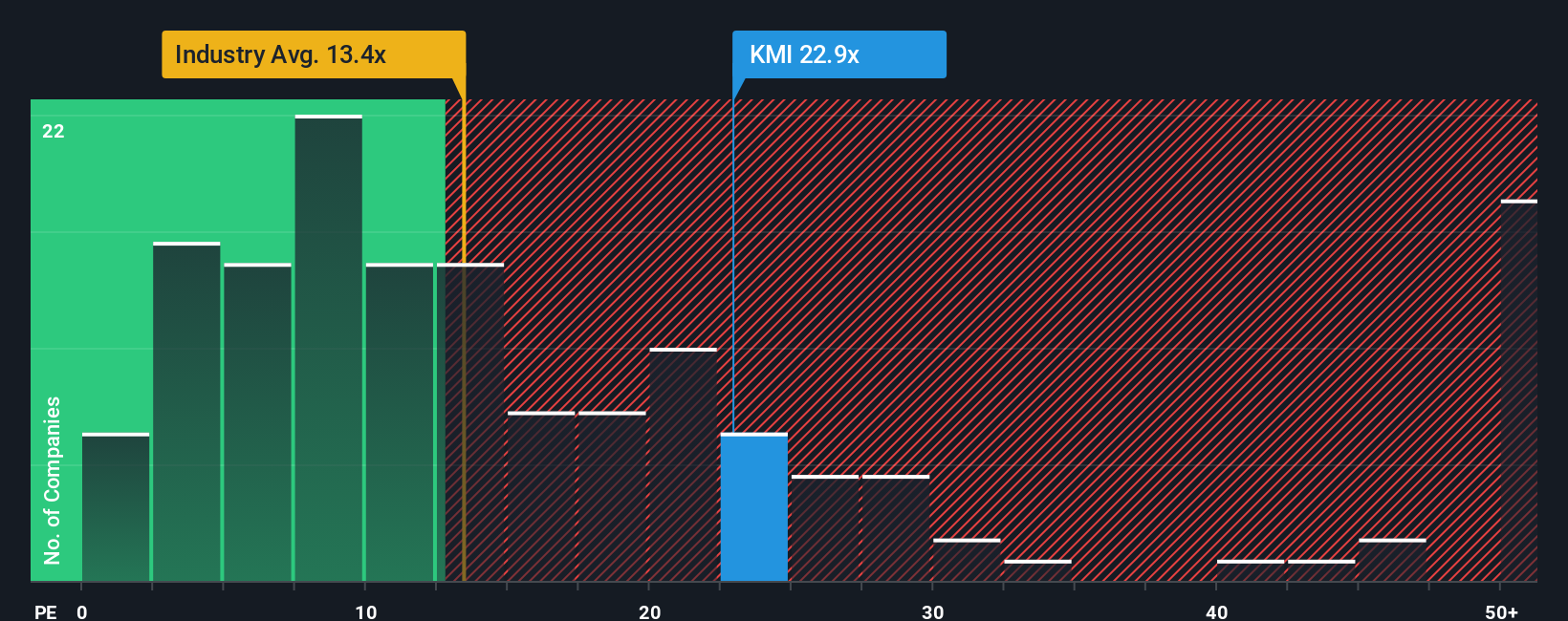

Another View: Trading at a Premium

Looking at valuation from a different angle, Kinder Morgan's shares are trading at 22.2 times earnings, noticeably higher than the US Oil and Gas industry average of 13.6 and the peer average of 16.8. This is also above the fair ratio of 19.8. Such a premium means investors are paying more compared to typical benchmarks, which could signal stretched valuations or reflect optimism about future prospects. Could the market be overestimating Kinder Morgan’s growth potential, or is there a reason for this confidence?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kinder Morgan Narrative

If you think the story looks different when you run the numbers yourself, there’s nothing stopping you from digging in and shaping your own view in just a few minutes. So why not take the next step and Do it your way.

A great starting point for your Kinder Morgan research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait on the sidelines while opportunities pass by. Grab the chance to power up your portfolio with these handpicked stock ideas built for today’s market.

- Unlock new growth potential with these 906 undervalued stocks based on cash flows, which could be trading below what they’re truly worth. This approach can provide a head start on value-driven investing.

- Boost your income strategy by targeting these 18 dividend stocks with yields > 3% that offer attractive yields above 3% and the potential for steady cash flow regardless of market swings.

- Spot innovation at the edge with these 27 AI penny stocks, which are reshaping entire industries through powerful advancements in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinder Morgan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMI

Kinder Morgan

Operates as an energy infrastructure company primarily in North America.

Acceptable track record and slightly overvalued.

Similar Companies

Market Insights

Community Narratives