- United States

- /

- Oil and Gas

- /

- NYSE:KMI

Kinder Morgan (KMI): Evaluating Valuation After Q3 Revenue Growth and a Dividend Increase

Reviewed by Simply Wall St

Kinder Morgan (NYSE:KMI) released its third quarter results, highlighting year-over-year revenue growth along with a 2% increase in its quarterly dividend. Investors now have a fresh update on both earnings and shareholder returns.

See our latest analysis for Kinder Morgan.

The third quarter brought a few headlines for Kinder Morgan, including steady earnings growth and a higher dividend, along with talk of possible acquisitions. Still, the momentum has not translated into the share price lately. The stock is down about 9% over the past month and 8% year-to-date, while its one-year total shareholder return stands at a healthy 9%. The five-year total return is an impressive 168%. Despite recent softness, long-term shareholders are still sitting on strong gains, and the company's ability to deliver consistent returns continues to make it one to watch.

If you’re looking for more ways to spot companies with staying power, consider broadening your search and discover fast growing stocks with high insider ownership.

With earnings and dividends rising, but the share price lagging, is Kinder Morgan an overlooked value in the energy sector, or is the market already anticipating all its future growth?

Most Popular Narrative: 16.8% Undervalued

With Kinder Morgan closing at $25.84 while the narrative assigns a fair value of $31.06, the difference is drawing increasing attention from investors. The gap is sending a clear signal about divergent expectations for future growth and profitability.

Anticipated growth in global natural gas demand, driven by rising populations in Asia and Africa and increased energy needs from urbanization, is expected to sustain or increase utilization of Kinder Morgan's core pipeline and LNG infrastructure. This is seen as supporting long-term revenue growth through higher throughput volumes and long-term contracts.

Want the real story behind this valuation? The narrative hinges on ambitious earnings milestones and a striking profit margin outlook. Curious which numbers and bold projections drive this head-turning fair value? Unlock the full analysis to uncover the growth expectations that power this price target.

Result: Fair Value of $31.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Kinder Morgan's high debt load, along with growing energy transition policies, could limit its future expansion and put pressure on long-term margins.

Find out about the key risks to this Kinder Morgan narrative.

Another View: What Does the Price Tag Say?

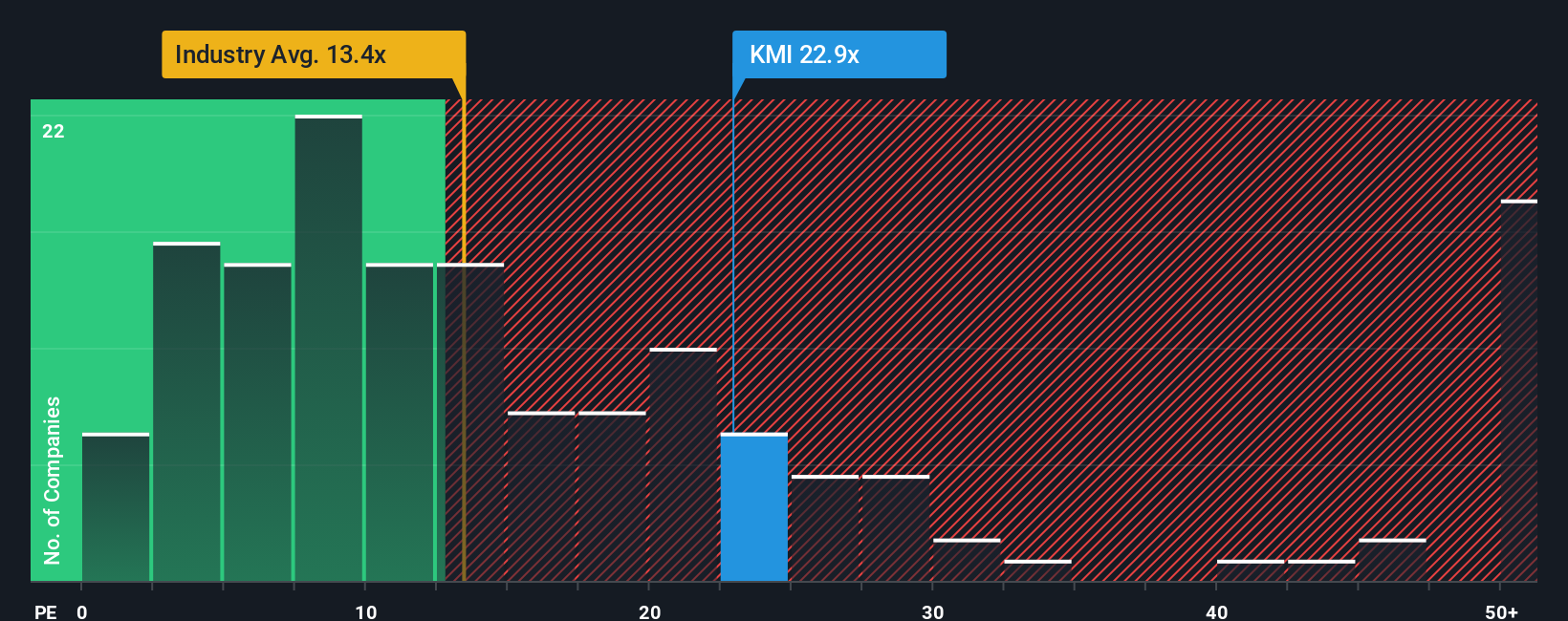

Looking at Kinder Morgan through the lens of its current valuation ratio, the stock trades at 21.2 times earnings. This is much higher than the US Oil and Gas industry average of 12.7 and also above its own fair ratio of 19.6 times. This premium suggests investors are pricing in more growth and lower risk, but it raises the question of how much optimism is already built in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kinder Morgan Narrative

If you see these results differently, or want to test your own investment thesis, you can craft a custom Kinder Morgan story in just a few minutes. Do it your way.

A great starting point for your Kinder Morgan research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Give yourself the edge by sizing up opportunities you might have missed. These screens highlight high-potential stocks and trends worth your attention.

- Uncover potential market movers by analyzing these 840 undervalued stocks based on cash flows, which could be trading below their intrinsic worth.

- Capitalize on the explosive growth of AI by reviewing these 26 AI penny stocks making significant advances in automation and machine learning.

- Lock in reliable income streams when you check out these 20 dividend stocks with yields > 3% offering yields above 3% for steady, long-term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinder Morgan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMI

Kinder Morgan

Operates as an energy infrastructure company primarily in North America.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives