- United States

- /

- Oil and Gas

- /

- NYSE:KMI

How a Rare Insider Purchase Could Influence Confidence in Kinder Morgan (KMI)

Reviewed by Sasha Jovanovic

- On October 31, 2025, Kinder Morgan director Amy Chronis purchased 4,287 shares, increasing her total holdings to 39,051 shares and marking a rare insider buy amid a year of more insider selling.

- This insider transaction stands out as a potential signal of confidence in the company, particularly given the overall trend of more insider sells than buys in the past year.

- With this insider purchase drawing investor attention, we'll examine its impact on the current investment narrative for Kinder Morgan.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Kinder Morgan Investment Narrative Recap

Owning shares of Kinder Morgan means believing in the long-term resilience of U.S. natural gas infrastructure and stable, fee-based cash flow, despite the sector's shift toward renewables, aging assets, and persistent high leverage. The recent insider purchase by a board director is unlikely to materially affect short-term catalysts or address the ongoing risks tied to debt levels or energy transition headwinds, though it does underscore internal confidence at a time of ongoing market underperformance.

The most relevant company update to this insider transaction is Kinder Morgan’s Q3 2025 earnings announcement, which showed steady revenue growth but flat profitability and continued dividend increases. These results provide some support for longer-term bullish narratives but do not directly change the outlook for near-term challenges, such as debt management and the pace of the energy transition.

However, what may catch some off guard is the ongoing pressure from debt obligations and the potential for this to limit future investments or affect earnings, especially if interest rates or market competition shift...

Read the full narrative on Kinder Morgan (it's free!)

Kinder Morgan's outlook anticipates $20.2 billion in revenue and $3.7 billion in earnings by 2028. This scenario is based on annual revenue growth of 8.2% and an earnings increase of $1.0 billion from current earnings of $2.7 billion.

Uncover how Kinder Morgan's forecasts yield a $31.06 fair value, a 20% upside to its current price.

Exploring Other Perspectives

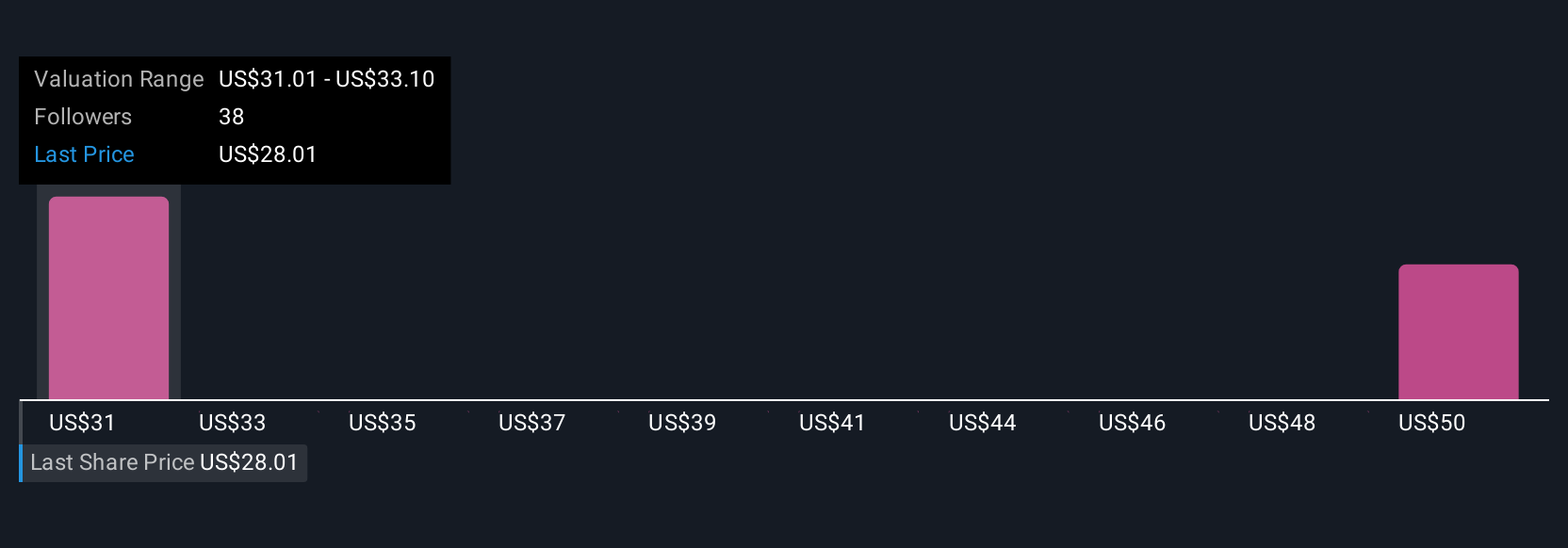

Simply Wall St Community members shared 3 fair value estimates for Kinder Morgan ranging from US$31.05 to US$44.06 per share. With earnings growth expected to lag the broader market, it is important to weigh how differing growth forecasts could shape longer-term returns, especially as opinions across the community can differ widely.

Explore 3 other fair value estimates on Kinder Morgan - why the stock might be worth as much as 70% more than the current price!

Build Your Own Kinder Morgan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kinder Morgan research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kinder Morgan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kinder Morgan's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinder Morgan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMI

Kinder Morgan

Operates as an energy infrastructure company primarily in North America.

Acceptable track record and slightly overvalued.

Similar Companies

Market Insights

Community Narratives