- United States

- /

- Oil and Gas

- /

- NYSE:INR

A Fresh Look at Infinity Natural Resources (INR) Valuation Following Q3 Earnings, Buyback, and Production Guidance Update

Reviewed by Simply Wall St

Infinity Natural Resources (NYSE:INR) just rolled out a series of key updates, including its third-quarter 2025 earnings results, a tightened full-year production outlook, and a newly authorized $75 million share buyback program.

See our latest analysis for Infinity Natural Resources.

It’s been a dramatic stretch for Infinity Natural Resources, with the share price soaring 15.25% in a single day and 19.03% over the past week, following the company’s upbeat Q3 earnings, tightened production guidance, and new buyback plan. However, this comes after a challenging first half of the year and a year-to-date share price return of -36.17%. While the short-term momentum is turning positive, longer-term performance still has room to recover.

If these sharp price swings have you curious about wider opportunities, this is a great moment to broaden your search and discover fast growing stocks with high insider ownership

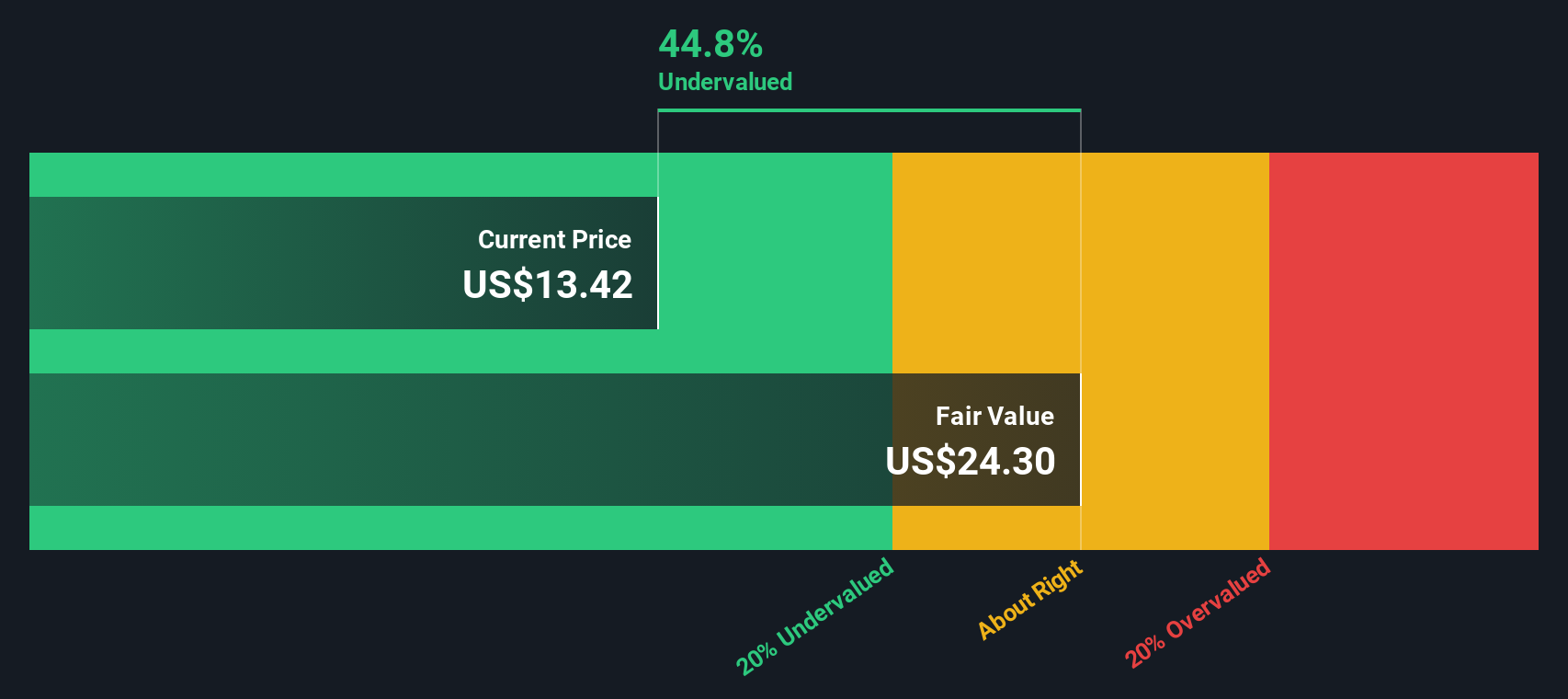

So with shares trading well below analyst targets, recent buyback news, and Q3 momentum, is Infinity Natural Resources now undervalued, or has the market already factored in its future growth potential and recovery?

Price-to-Sales Ratio of 0.7x: Is it justified?

Infinity Natural Resources is currently trading at a price-to-sales (P/S) ratio of 0.7x, which is sharply below both its own industry peers and its estimated fair P/S level. At a closing price of $13.45, the market is assigning a steep discount compared to benchmarks across the sector.

The price-to-sales ratio shows how much investors are paying for each dollar of revenue. It is particularly relevant for companies like Infinity Natural Resources that are not yet profitable, as it sidesteps sometimes volatile or negative earnings numbers and instead focuses on the top line.

With a P/S multiple of 0.7x versus the peer average of 1.2x and the US Oil and Gas industry average of 1.5x, Infinity Natural Resources is being valued at a major discount. The estimated fair price-to-sales ratio is 2.9x. The market could move toward this level if strong growth projections materialize and investor sentiment shifts.

Explore the SWS fair ratio for Infinity Natural Resources

Result: Price-to-Sales Ratio of 0.7x (UNDERVALUED)

However, lingering net losses and broader energy market volatility still pose risks that could limit short-term gains, even though fundamentals are improving.

Find out about the key risks to this Infinity Natural Resources narrative.

Another View: Our DCF Model Signals Even Deeper Value

While the price-to-sales ratio paints Infinity Natural Resources as undervalued compared to industry norms, our SWS DCF model goes further and estimates a fair value of $55 per share. With the stock at $13.45, that suggests even greater upside. But do both approaches tell the full story, or is the market wary for a reason?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Infinity Natural Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Infinity Natural Resources Narrative

If you see things differently or want to build your own perspective, you can easily dig into the numbers and shape your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Infinity Natural Resources.

Looking for more investment ideas?

Get ahead of the market by accessing hand-picked opportunities across growth, innovation, and income. These unique lists can help you capture the next big trend. Do not let them pass you by.

- Tap into future breakthroughs by checking out these 26 AI penny stocks that are transforming entire industries with artificial intelligence.

- Boost your long-term returns when you hunt for value in these 870 undervalued stocks based on cash flows where strong fundamentals meet attractive pricing.

- Secure regular cash flow by exploring these 15 dividend stocks with yields > 3% featuring companies offering reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INR

Infinity Natural Resources

Engages in the acquisition, exploration, and development of properties to produce oil, natural gas, and natural gas liquids from underground reservoirs in the United States.

Very undervalued with exceptional growth potential.

Similar Companies

Market Insights

Community Narratives