- United States

- /

- Oil and Gas

- /

- NYSE:HESM

Hess Midstream (HESM) Margin Gains Reinforce Bullish Profit Narratives Despite Modest Revenue Growth

Reviewed by Simply Wall St

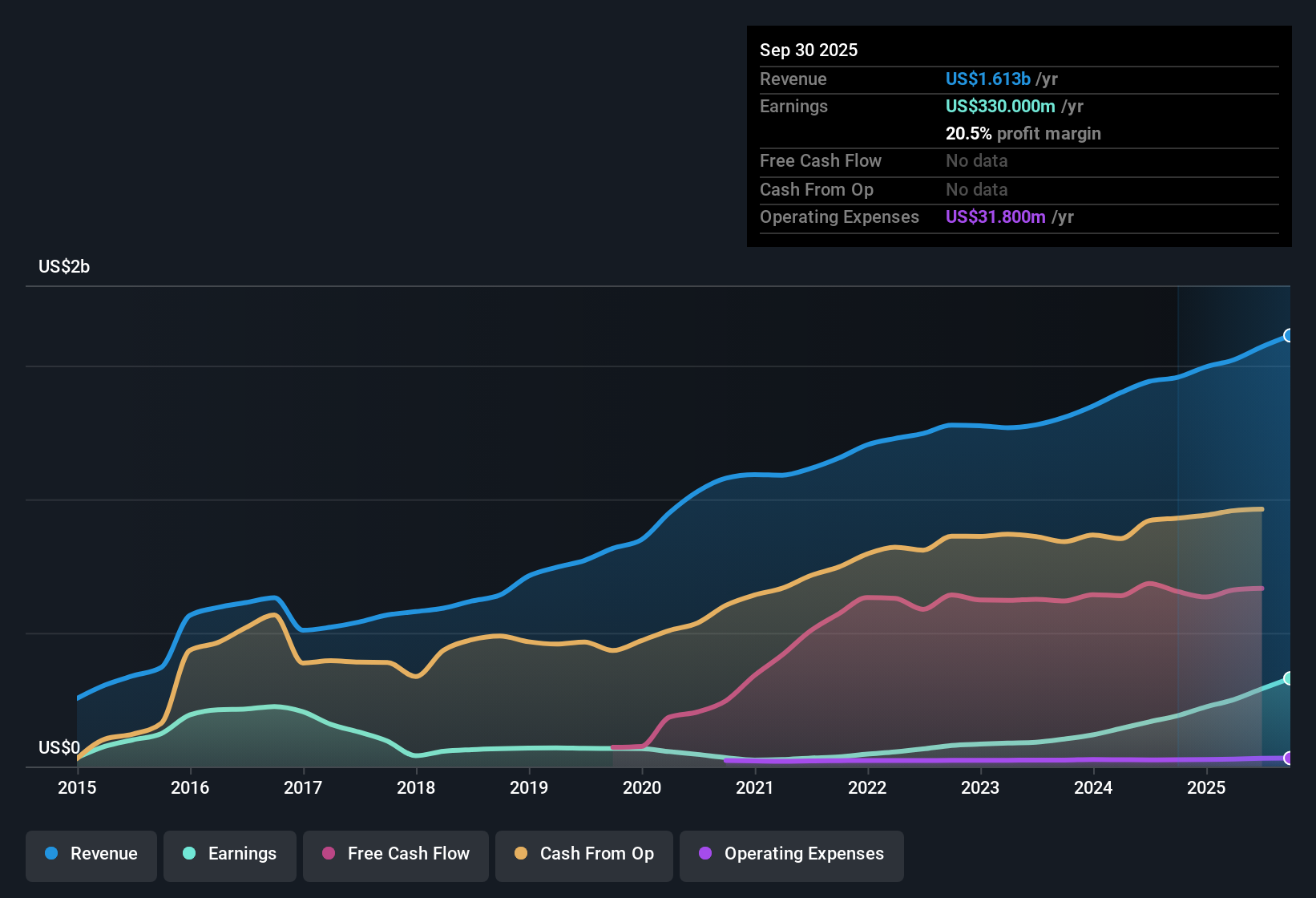

Hess Midstream (NYSE:HESM) turned in a strong year, with net profit margins rising to 20.5% from last year’s 13.1% and a standout 73.5% earnings growth, far outpacing its five-year compound annual rate of 46.7%. The company’s forward-looking projections keep that momentum going, forecasting 21.3% annual earnings growth, ahead of the broader US market’s expected 16%. With consistent profitability and expanding margins, investors are likely to focus on Hess Midstream’s resilient earnings track record and compelling value, even as revenue growth expectations sit below the US average.

See our full analysis for Hess Midstream.Now, let’s see how these headline numbers stack up against the most widely followed narratives around Hess Midstream. Some might get reinforced, while others could face new questions.

See what the community is saying about Hess Midstream

Margins Projected to Nearly Double

- Analysts forecast profit margins to rise from 18.5% today to 37.0% over the next three years, a significant expansion that stands out even among strong peers.

- Analysts' consensus view highlights this large margin increase as evidence of high operating leverage and ongoing demand for Hess Midstream's fee-based services.

- Multi-year minimum volume contracts through the late 2030s and inflation-linked revenues are cited as reasons the company may sustain this margin advantage.

- Robust upstream production and energy export demand are projected to keep the infrastructure operating at elevated utilization rates, directly benefiting margins.

- To see what is driving the consensus view and whether these margin gains appear sustainable, read the full analyst narrative. 📊 Read the full Hess Midstream Consensus Narrative.

DCF Fair Value Signals Deep Discount

- The current share price of $33.91 trades at less than half the DCF fair value estimate of $73.81, highlighting a significant gap between market price and intrinsic value.

- According to analysts' consensus perspective, this discount attracts value-focused investors but is balanced by slower revenue growth forecasts.

- While DCF-based fair value is compelling, the projected annual revenue growth of just 2.1% lags behind the broader US market’s 10.5% rate.

- Analyst price target of $37.00 indicates some market skepticism around growth sustaining at these levels, despite the calculated valuation potential.

Ownership and Regional Dependency Risks

- Hess Midstream depends heavily on the Bakken region and contracts with Hess Corporation (now Chevron), exposing the company to volume and strategic risks if drilling activity or Chevron’s priorities change.

- Consensus narrative notes this regional concentration and single-customer risk as legitimate concerns for long-term stability and valuation.

- Potential changes in Chevron’s capital allocation or strategy could materially impact throughput volumes and EBITDA, presenting a challenge to the generally stable outlook.

- Regulatory shifts or production declines specific to the Bakken region could further pressure margins and operational performance over time.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Hess Midstream on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the figures from another angle? In just a few minutes, you can build and share your personal take on Hess Midstream’s outlook. Do it your way

A great starting point for your Hess Midstream research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Hess Midstream’s limited revenue growth and exposure to single-region, single-customer risk could challenge its ability to deliver consistent outperformance over time.

If you want steadier growth and less concentration risk, check out stable growth stocks screener (2077 results) to find companies delivering reliable gains year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hess Midstream might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HESM

Hess Midstream

Owns, operates, develops, and acquires midstream assets and provide fee-based services to Hess and third-party customers in the United States.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives