- United States

- /

- Energy Services

- /

- NYSE:HAL

Will Shell’s New ROCS Deal Mark a Turning Point for Halliburton’s (HAL) Offshore Margin Story?

Reviewed by Sasha Jovanovic

- In October 2025, Shell announced it had signed a framework agreement for Halliburton to provide umbilical-less tubing hanger installation and retrieval services using ROCS technology, following successful implementation in Gulf of America deepwater wells.

- This move highlights Halliburton's ability to deliver technology-driven efficiency gains and safety improvements for complex offshore operations, potentially positioning its services for broader international adoption.

- We'll explore how Halliburton's ROCS agreement with Shell could influence the company's margins and outlook for global offshore growth.

We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Halliburton Investment Narrative Recap

To invest in Halliburton, you need to believe the company’s deepwater technology, like ROCS, can drive international growth and improve margins, even as pressures mount from global decarbonization and the transition away from fossil fuels. This Shell agreement showcases Halliburton’s edge in delivering operational efficiency and safety, supporting near-term differentiation for its service portfolio, but it does not meaningfully offset the prevailing risks around slower oil demand and regulatory headwinds.

Among recent developments, Halliburton’s multi-year contracts with Petrobras to deploy advanced production optimization technologies in Brazil stand out. Such wins build on its global presence and technology leadership, tying directly to the catalysts surrounding international expansion and the company’s ability to maintain earnings resilience outside North America.

However, investors should also be aware that, in contrast, persistent regulatory pressures and decarbonization efforts could erode oilfield service demand and...

Read the full narrative on Halliburton (it's free!)

Halliburton's outlook anticipates $22.1 billion in revenue and $2.0 billion in earnings by 2028. This scenario assumes a 0.2% annual revenue decline and a $0.1 billion increase in earnings from the current $1.9 billion.

Uncover how Halliburton's forecasts yield a $29.46 fair value, a 9% upside to its current price.

Exploring Other Perspectives

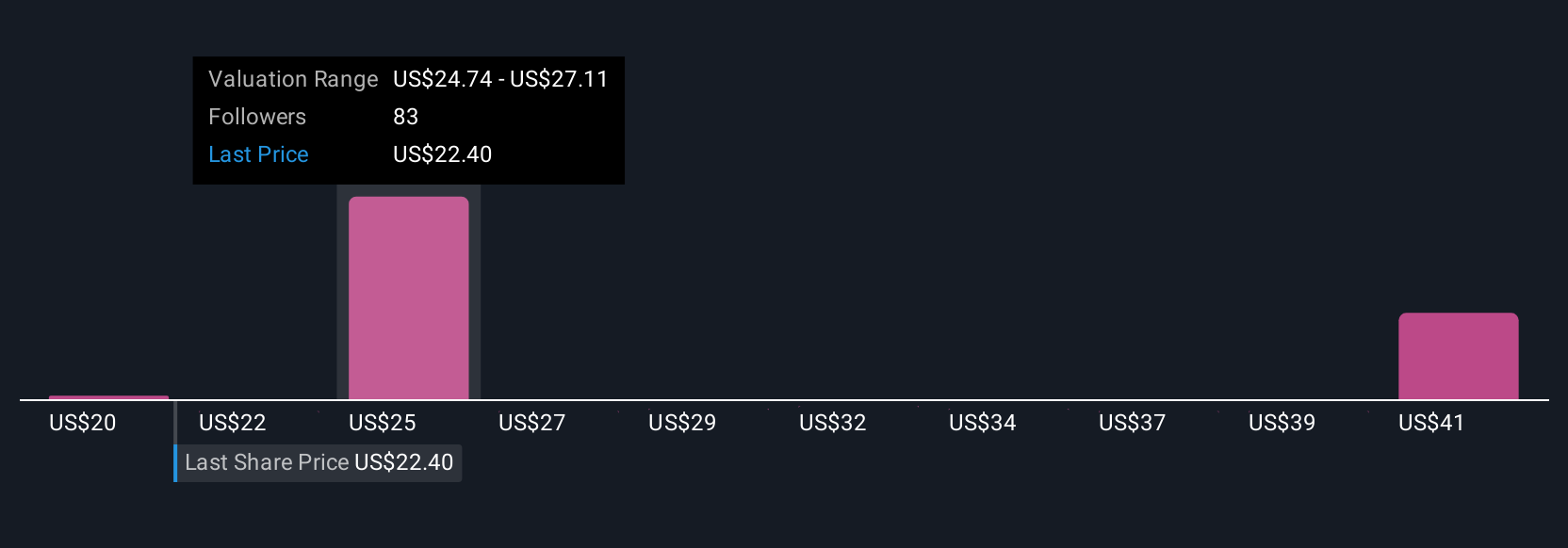

Fair value estimates in the Simply Wall St Community range from US$20.00 to US$43.56, based on 11 different analyses. Nevertheless, rising global decarbonization initiatives continue to challenge traditional assumptions about Halliburton’s core oilfield markets, pointing to a wide variety of views you can explore.

Explore 11 other fair value estimates on Halliburton - why the stock might be worth as much as 62% more than the current price!

Build Your Own Halliburton Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Halliburton research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Halliburton research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Halliburton's overall financial health at a glance.

No Opportunity In Halliburton?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Halliburton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HAL

Halliburton

Provides products and services to the energy industry worldwide.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives