- United States

- /

- Energy Services

- /

- NYSE:HAL

What Halliburton (HAL)'s Shell Automation Deal Reveals About Its Deepwater Technology Strategy

Reviewed by Sasha Jovanovic

- Shell recently announced a framework agreement with Halliburton to deploy umbilical-less tubing hanger installation and retrieval services using ROCS technology, following a successful phase in the Gulf of America that showcased its efficiency and safety in deepwater operations.

- This move underscores how advanced automation and remote-operated control systems are increasingly redefining well-completion standards and operational safety in complex offshore environments.

- We'll take a look at how Halliburton's Shell agreement and ROCS technology adoption could reshape its investment narrative and sector positioning.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Halliburton Investment Narrative Recap

To be a Halliburton shareholder, you need to believe that global energy demand, project wins in deepwater markets, and the adoption of advanced oilfield technology will outpace the shift to renewables and margin pressures from North American drilling slowdowns. The Shell agreement and ROCS deployment show the company’s capability to address deepwater efficiency and safety needs, but do not materially shift the biggest short-term catalyst: increased international market share, and the main risk remains ongoing weakness in US drilling activity.

Among recent announcements, Michael Burry’s Scion Asset Management’s sizable position in Halliburton stands out. This large call option purchase came despite Halliburton’s declining Q3 earnings, and points to ongoing investor interest as the company executes cost reductions and sees sustained demand for drilling technology, both directly connected to the catalysts highlighted by the Shell ROCS collaboration.

But unlike the headlines suggest, investors should be aware of ongoing exposure to North American drilling cycles and how sudden downturns can...

Read the full narrative on Halliburton (it's free!)

Halliburton's outlook points to $22.1 billion in revenue and $2.0 billion in earnings by 2028. This is based on a 0.2% annual decline in revenue and a $0.1 billion increase in earnings from the current $1.9 billion.

Uncover how Halliburton's forecasts yield a $29.46 fair value, a 8% upside to its current price.

Exploring Other Perspectives

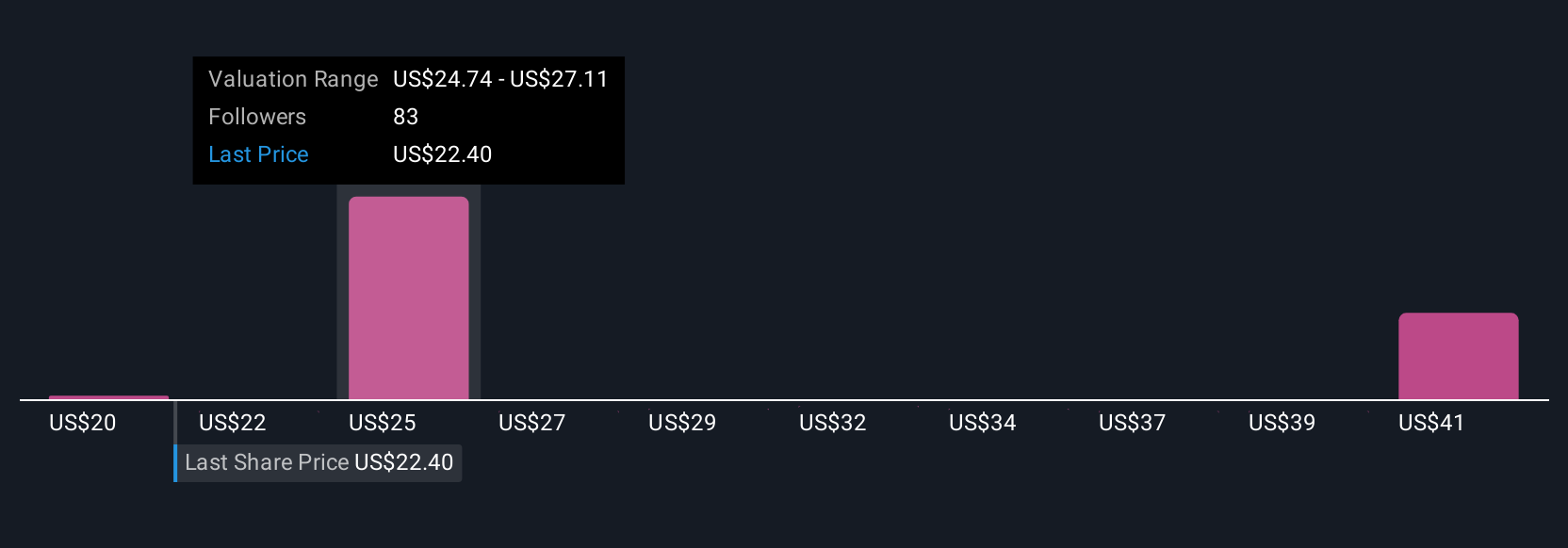

Simply Wall St Community members provided 11 fair value estimates for Halliburton, from US$20 to over US$50 per share. Against this wide opinion range, continuing weakness in US shale activity is a risk that could affect both revenues and investor confidence, so it pays to explore other viewpoints.

Explore 11 other fair value estimates on Halliburton - why the stock might be worth as much as 83% more than the current price!

Build Your Own Halliburton Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Halliburton research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Halliburton research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Halliburton's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Halliburton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HAL

Halliburton

Provides products and services to the energy industry worldwide.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives