Stock Analysis

- United States

- /

- Oil and Gas

- /

- NYSE:GPRK

Introducing GeoPark (NYSE:GPRK), The Stock That Soared 382% In The Last Five Years

GeoPark Limited (NYSE:GPRK) shareholders have seen the share price descend 14% over the month. But over five years returns have been remarkably great. Indeed, the share price is up a whopping 382% in that time. Arguably, the recent fall is to be expected after such a strong rise. But the real question is whether the business fundamentals can improve over the long term.

See our latest analysis for GeoPark

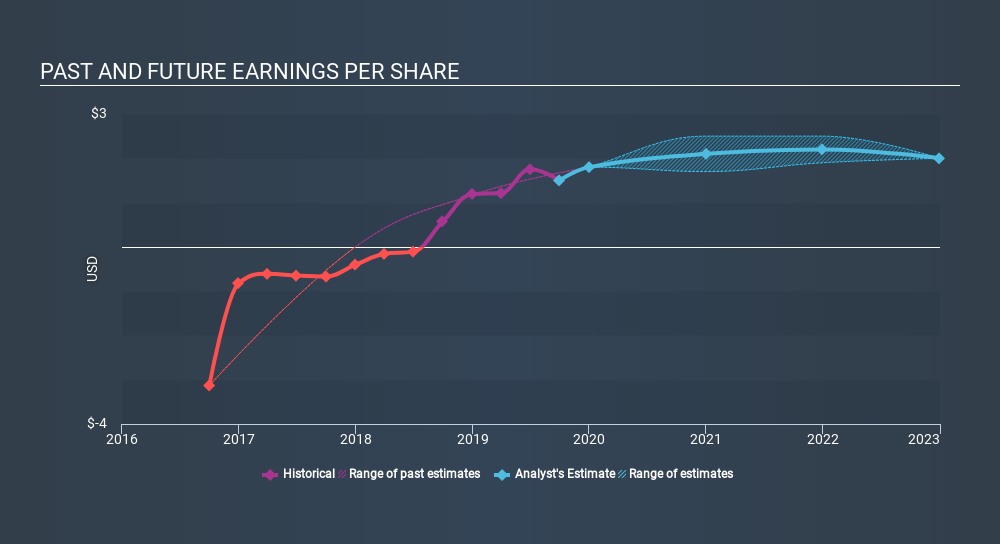

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last half decade, GeoPark became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how GeoPark has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling GeoPark stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

GeoPark shareholders gained a total return of 12% during the year. Unfortunately this falls short of the market return. If we look back over five years, the returns are even better, coming in at 37% per year for five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for GeoPark that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:GPRK

GeoPark

Operates as an oil and natural gas exploration and production company primarily in Chile, Colombia, Brazil, Argentina, Ecuador, and other Latin American countries.

Undervalued with adequate balance sheet and pays a dividend.