- United States

- /

- Oil and Gas

- /

- NYSE:GPOR

Gulfport Energy (GPOR) Losses Narrow 54.8% Annually, Eyes Profitability Within Three Years

Reviewed by Simply Wall St

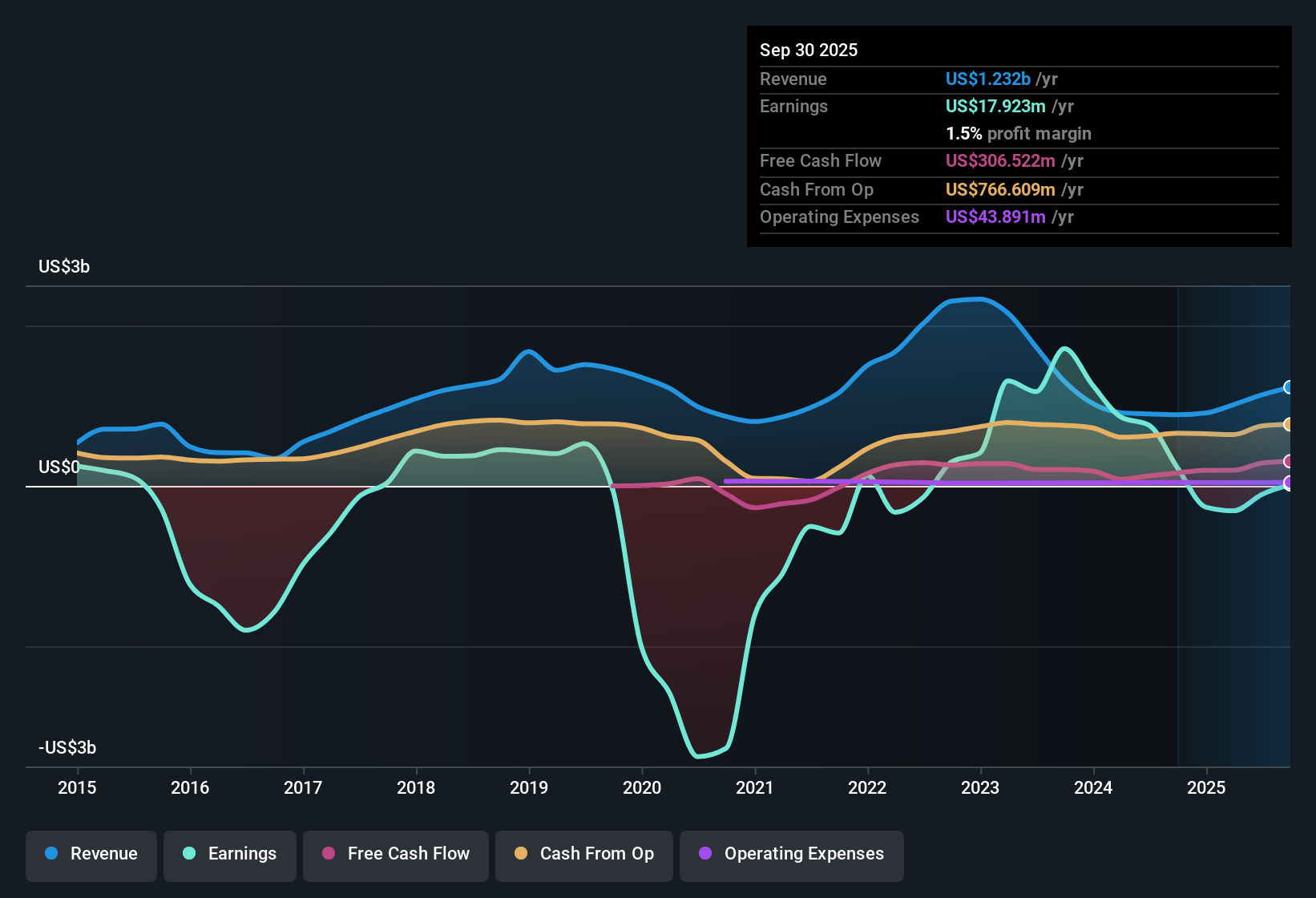

Gulfport Energy (GPOR) remains unprofitable but has steadily narrowed its losses over the past five years by an average of 54.8% each year. Looking ahead, analysts project earnings growth of 16.3% annually, and the company is expected to reach profitability within three years. Revenue is forecast to grow at 8.4% per year, which trails the US market average of 10.5%. With no significant risk factors flagged and a discounted valuation based on the discounted cash flow model, investors have reasons to watch closely this earnings season.

See our full analysis for Gulfport Energy.Next up, we will see how these financial trends line up with the most widely followed narratives for Gulfport Energy and where those stories might get challenged or reinforced.

See what the community is saying about Gulfport Energy

Margin Expansion Aims: Profit Margin Set to Lift From -10.9% to 34.0%

- Analysts forecast Gulfport's profit margin will swing dramatically over the next three years, rising from a negative 10.9% today to a robust 34.0% by around September 2028, underscoring the scale of expected operational turnaround.

- Analysts' consensus view highlights several key factors supporting the path to higher margins and earnings:

- Recent step-changes in well performance along with optimized flowback strategies are credited for lowering breakeven costs, enabling Gulfport to benefit even in choppy commodity markets.

- Capital structure simplification, including redeeming all outstanding preferred stock and an 18% share count reduction, is set to further amplify per-share earnings and cash flow, bolstering long-term shareholder value.

- For investors following the consensus narrative, the steep projected climb in profit margins will be crucial to watch against energy price swings and any operational hiccups.

- To see how the consensus narrative translates into specific upside scenarios for Gulfport's turnaround, check out the full consensus narrative below. 📊 Read the full Gulfport Energy Consensus Narrative.

Aggressive Share Buybacks: 18% Reduction at Below-Market Prices

- Gulfport has reduced its outstanding share count by a notable 18% at prices well below today's $196.90 market value, signaling management's strong confidence in intrinsic value and strategic capital deployment.

- Analysts' consensus view points to several possible outcomes tied to share repurchases:

- This buyback activity, paired with low net leverage of roughly 0.85x, serves to boost per-share performance metrics but also raises questions about market liquidity and future flexibility if capital needs change.

- Ongoing buybacks cut public float, potentially making the stock more volatile and less attractive for large institutions, adding a layer of risk even as reported earnings per share increase.

Valuation Gap: Trading Far Below DCF Fair Value, But Price-to-Sales Remains Elevated

- Despite a share price of $196.90, Gulfport is trading at a substantial discount to its DCF fair value of $707.18, while its price-to-sales ratio of 3.4x looks expensive relative to the broader US industry average of 1.5x but slightly attractive compared to its direct peers at 3.8x.

- Analysts' consensus view argues this valuation set-up brings both opportunity and caution:

- The large DCF discount could offer upside if profitability targets and revenue projections materialize. However, slower forecasted revenue growth (8.4% per year vs. the US market's 10.5%) suggests investors should moderate expectations for a big catch-up rally.

- Consensus price target stands at $220.69, about 12% above current levels, indicating analysts see some further room to run but expect more measured gains rather than a dramatic re-rating in the short term.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Gulfport Energy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you have a unique angle on the numbers? Craft your own narrative and share your view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Gulfport Energy.

Explore Alternatives

Despite Gulfport Energy’s projected profit margin improvements and buyback activity, its slower-than-average revenue growth and premium price-to-sales ratio may limit near-term upside.

If you’re seeking stocks with more reliable revenue growth and steadier performance, consider our stable growth stocks screener (2073 results) to spot companies delivering consistent expansion year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GPOR

Gulfport Energy

Engages in the acquisition, exploration, and production of natural gas, crude oil, and natural gas liquids in the United States.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives