- United States

- /

- Oil and Gas

- /

- NYSE:GPOR

Gulfport Energy (GPOR): Evaluating Valuation After Boosted Share Buybacks and Strategic Share Count Reduction

Reviewed by Simply Wall St

Gulfport Energy (GPOR) has caught investors’ attention by stepping up its share repurchase plans for the next two years and reducing its overall share count. These moves boost financial stability and support shareholder returns.

See our latest analysis for Gulfport Energy.

Following these shareholder-focused moves, Gulfport Energy’s momentum has been on the upswing. The 30-day share price return of 14.58% and year-to-date gain of 15.31% point to renewed optimism in the stock. Looking at the bigger picture, investors have seen a robust 21.4% total shareholder return over the past year, with a standout 160% return over three years. Recent management discipline and repurchase activity are clearly resonating with the market and helping to sustain that positive trajectory.

If you’re scanning for more energy names with similar momentum, it is worth checking out fast growing stocks with high insider ownership.

But with Gulfport’s shares rallying, along with a firm focus on buybacks and disciplined growth, is the stock still undervalued at current levels or are markets already pricing in these drivers of future growth?

Most Popular Narrative: 1.9% Undervalued

Gulfport Energy’s most widely tracked narrative suggests a fair value only slightly above the recent close, pointing to a market nearly in balance but with a modest edge for buyers. The narrative’s analysis weighs catalysts such as operational flexibility and rapid capital deployment, teeing up the quote below.

Gulfport's direct access to premium Gulf Coast markets, exposure to the LNG export corridor, and ongoing negotiations to supply emerging large-scale power projects (driven by AI/data center growth and US/EU LNG infrastructure buildout) position the company to benefit from rising natural gas demand, translating into improved realized prices, cash flows, and long-term revenues.

What is the engine behind this verdict? The narrative is betting on transformative changes in Gulfport’s customer base and future earnings power. Want to uncover which bold forecasts make this narrative tick? See which hidden growth triggers and assumptions could send the stock higher or not by reading the complete breakdown.

Result: Fair Value of $216.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected declines in natural gas prices or setbacks in Gulfport’s liquids diversification strategy could quickly challenge this narrative and stall future returns.

Find out about the key risks to this Gulfport Energy narrative.

Another View: Are Price Ratios Sending a Warning?

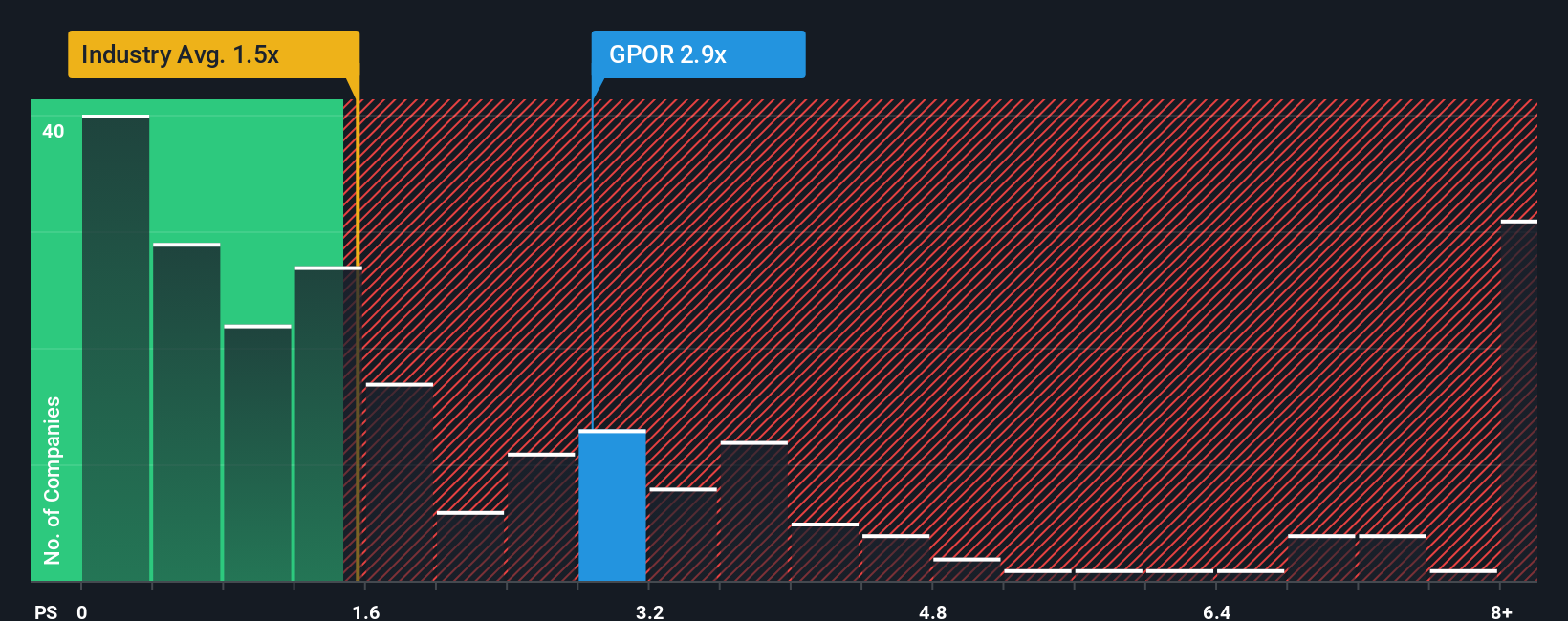

While the fair value narrative leans optimistic, a look at Gulfport’s price-to-sales ratio reveals a different story. The company trades at 3.3 times sales, making it much pricier than the industry average of 1.5 times and above its fair ratio of 2.5 times. Such a premium suggests investors expect strong outperformance, but it also raises the stakes. If growth disappoints or margins fall short, the downside risk may grow. Are the current fundamentals enough to justify this higher valuation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Gulfport Energy Narrative

If you’re looking to dive deeper or want to analyze the data using your own approach, you can craft your personalized take in just a few minutes, all with Do it your way.

A great starting point for your Gulfport Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Get ahead of the crowd and put your money to work where innovation meets opportunity. The best investors know when to seize fresh ideas before everyone else catches on.

- Spot high yields and let steady income build your wealth by reviewing these 15 dividend stocks with yields > 3%, which offers payouts over 3%.

- Tap into companies fueling the healthcare revolution powered by AI and find tomorrow’s winners among these 30 healthcare AI stocks.

- Capitalize on overlooked value with these 898 undervalued stocks based on cash flows, which highlights stocks with cash flows that outshine their share prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GPOR

Gulfport Energy

Engages in the acquisition, exploration, and production of natural gas, crude oil, and natural gas liquids in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives