- United States

- /

- Oil and Gas

- /

- NYSE:GPOR

Gulfport Energy (GPOR): Assessing Valuation Ahead of Highly Anticipated Earnings and Strong Analyst Sentiment

Reviewed by Simply Wall St

Gulfport Energy (GPOR) is drawing attention ahead of its upcoming earnings report, with expectations pointing to a 36% jump in revenue and healthy earnings per share for the recent quarter. Investors are watching closely as sentiment around the company has turned positive, which is highlighted by a consensus 'buy' rating among analysts.

See our latest analysis for Gulfport Energy.

Gulfport Energy's momentum has been steadily building over the past year, with a one-year total shareholder return of 34.05% and a three-year total return that more than doubled investors’ money. After some recent volatility, the stock is holding firm at $186.01. This suggests that the positive sentiment around its upcoming results is being reflected in price action and overall risk appetite.

If you’re tracking energy sector standouts, it could be a strong time to expand your search and discover fast growing stocks with high insider ownership

With the stock trading well below the average analyst price target, and double-digit revenue and earnings growth forecasted, does Gulfport Energy remain undervalued or is the market already pricing in its future potential gains?

Most Popular Narrative: 13.9% Undervalued

With Gulfport Energy's fair value estimate at $216.08, its last close price near $186 signals that market pricing still lags behind analyst consensus. This creates a narrative focused on structural shifts and forward-looking industry catalysts.

Gulfport's direct access to premium Gulf Coast markets, exposure to the LNG export corridor, and ongoing negotiations to supply emerging large-scale power projects (driven by AI/data center growth and US/EU LNG infrastructure buildout) position the company to benefit from rising natural gas demand, translating into improved realized prices, cash flows, and long-term revenues.

Curious why this valuation goes beyond a simple discount? Underneath it all lies an ambitious play on future earnings strength and margin expansion, tied to pivotal demand shifts. What key growth levers and bold assumptions really drive this target? Tap into the full narrative to see the underlying math and strategic bets powering this price.

Result: Fair Value of $216.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in natural gas prices and execution risks around Gulfport's asset transition could quickly challenge the bullish fair value narrative.

Find out about the key risks to this Gulfport Energy narrative.

Another View: What Do the Multiples Say?

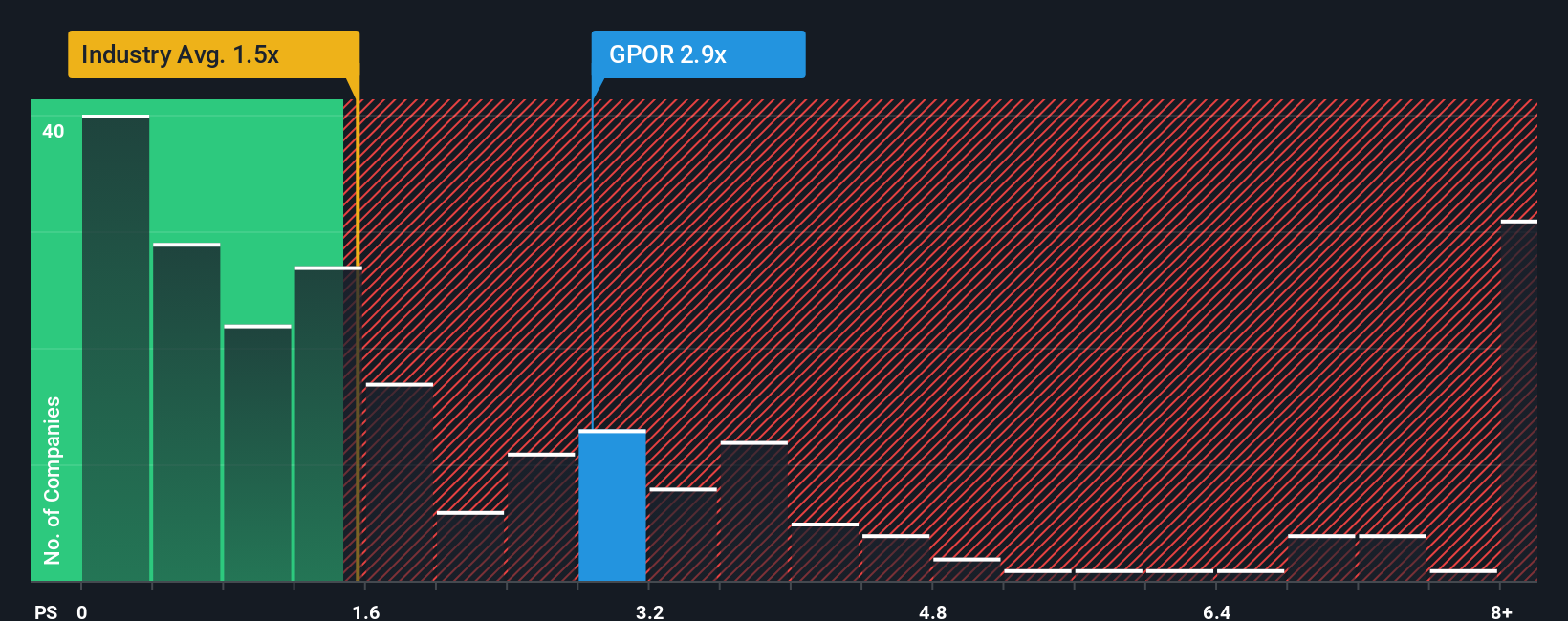

While the fair value estimate paints Gulfport Energy as undervalued, its price-to-sales ratio stands at 2.9x, higher than both the industry average of 1.5x and the company's fair ratio of 2.4x. This suggests the market is already optimistic compared to peers and where the ratio could settle. Could upside still remain, or is some optimism already reflected in the price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Gulfport Energy Narrative

If you see a different story in the numbers or want to dig deeper using your own insights, it only takes a couple of minutes to create your own perspective. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Gulfport Energy.

Looking for More Investment Opportunities?

Open the door to your next standout stock by checking out these carefully curated lists, designed to help you spot what others might miss.

- Unlock new growth potential by tapping into these 27 AI penny stocks, which are reshaping industries with machine learning, automation, and next-level data insights.

- Boost your portfolio’s income stream with these 20 dividend stocks with yields > 3%, offering handsome yields above 3% from established, reliable businesses.

- Capitalize on overlooked value and strengthen your long-term strategy by targeting these 843 undervalued stocks based on cash flows, which the market may be underpricing right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GPOR

Gulfport Energy

Engages in the acquisition, exploration, and production of natural gas, crude oil, and natural gas liquids in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives